Ready Capital Investor Presentation Deck

A Successful & Proven Asset Manager

WATERFALL

Asset Management

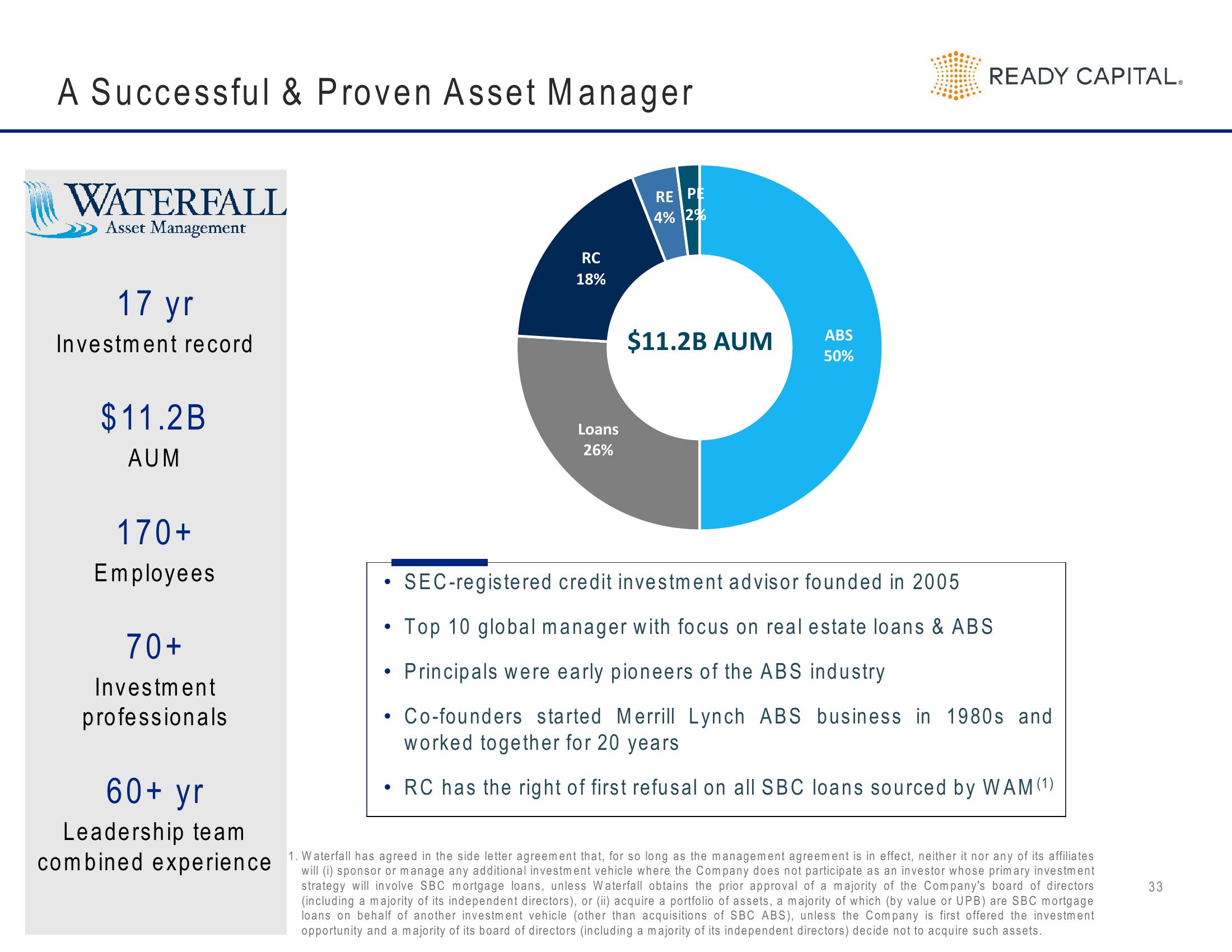

17 yr

Investment record

$11.2B

AUM

170+

Employees

70+

Investment

professionals

60+ yr

Leadership team

combined experience

RC

18%

Loans

26%

RE PE

4% 2%

$11.2B AUM

ABS

50%

READY CAPITAL.

SEC-registered credit investment advisor founded in 2005

Top 10 global manager with focus on real estate loans & ABS

• Principals were early pioneers of the ABS industry

• Co-founders started Merrill Lynch ABS business in 1980s and

worked together for 20 years

RC has the right of first refusal on all SBC loans sourced by WAM (¹)

1. Waterfall has agreed in the side letter agreement that, for so long as the management agreement is in effect, neither it nor any of its affiliates

will (i) sponsor or manage any additional investment vehicle where the Company does not participate as an investor whose primary investment

strategy will involve SBC mortgage loans, unless Waterfall obtains the prior approval of a majority of the Company's board of directors

(including a majority of its independent directors), or (ii) acquire a portfolio of assets, a majority of which (by value or UPB) are SBC mortgage

loans on behalf of another investment vehicle (other than acquisitions of SBC ABS), unless the Company is first offered the investment

opportunity and a majority of its board of directors (including a majority of its independent directors) decide not to acquire such assets.

33View entire presentation