Q2 Quarter 2023

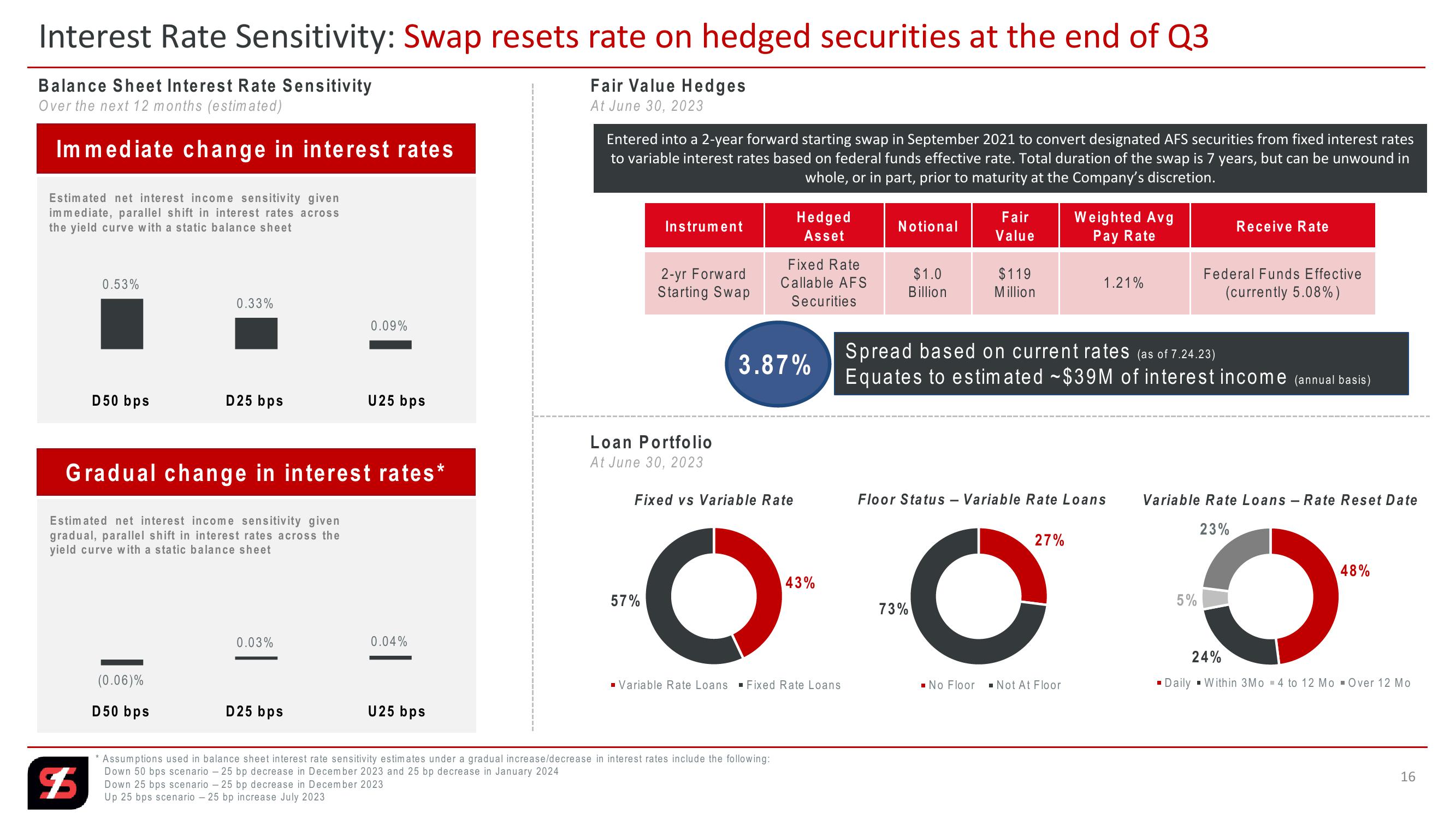

Interest Rate Sensitivity: Swap resets rate on hedged securities at the end of Q3

Balance Sheet Interest Rate Sensitivity

Over the next 12 months (estimated)

Immediate change in interest rates

Estimated net interest income sensitivity given

immediate, parallel shift in interest rates across

the yield curve with a static balance sheet

0.53%

Fair Value Hedges

At June 30, 2023

Entered into a 2-year forward starting swap in September 2021 to convert designated AFS securities from fixed interest rates

to variable interest rates based on federal funds effective rate. Total duration of the swap is 7 years, but can be unwound in

whole, or in part, prior to maturity at the Company's discretion.

Instrument

Hedged

Asset

Notional

Fair

Value

Weighted Avg

Pay Rate

Receive Rate

2-yr Forward

Starting Swap

Fixed Rate

Callable AFS

Securities

$1.0

Billion

$119

Million

1.21%

Federal Funds Effective

(currently 5.08%)

0.33%

0.09%

U25 bps

D50 bps

D25 bps

3.87%

Spread based on current rates (as of 7.24.23)

Equates to estimated ~$39M of interest income (annual basis)

Loan Portfolio

At June 30, 2023

Gradual change in interest rates*

Fixed vs Variable Rate

Floor Status - Variable Rate Loans

Estimated net interest income sensitivity given

gradual, parallel shift in interest rates across the

yield curve with a static balance sheet

Variable Rate Loans

23%

-

Rate Reset Date

27%

(0.06)%

D50 bps

0.03%

0.04%

D25 bps

U25 bps

43%

57%

73%

O

■ Variable Rate Loans ■Fixed Rate Loans

■ No Floor ■Not At Floor

* Assumptions used in balance sheet interest rate sensitivity estimates under a gradual increase/decrease in interest rates include the following:

Down 50 bps scenario -25 bp decrease in December 2023 and 25 bp decrease in January 2024

$5

Down 25 bps scenario - 25 bp decrease in December 2023

Up 25 bps scenario - 25 bp increase July 2023

5%

48%

24%

■Daily Within 3Mo 4 to 12 Mo - Over 12 Mo

16View entire presentation