Paysafe SPAC Presentation Deck

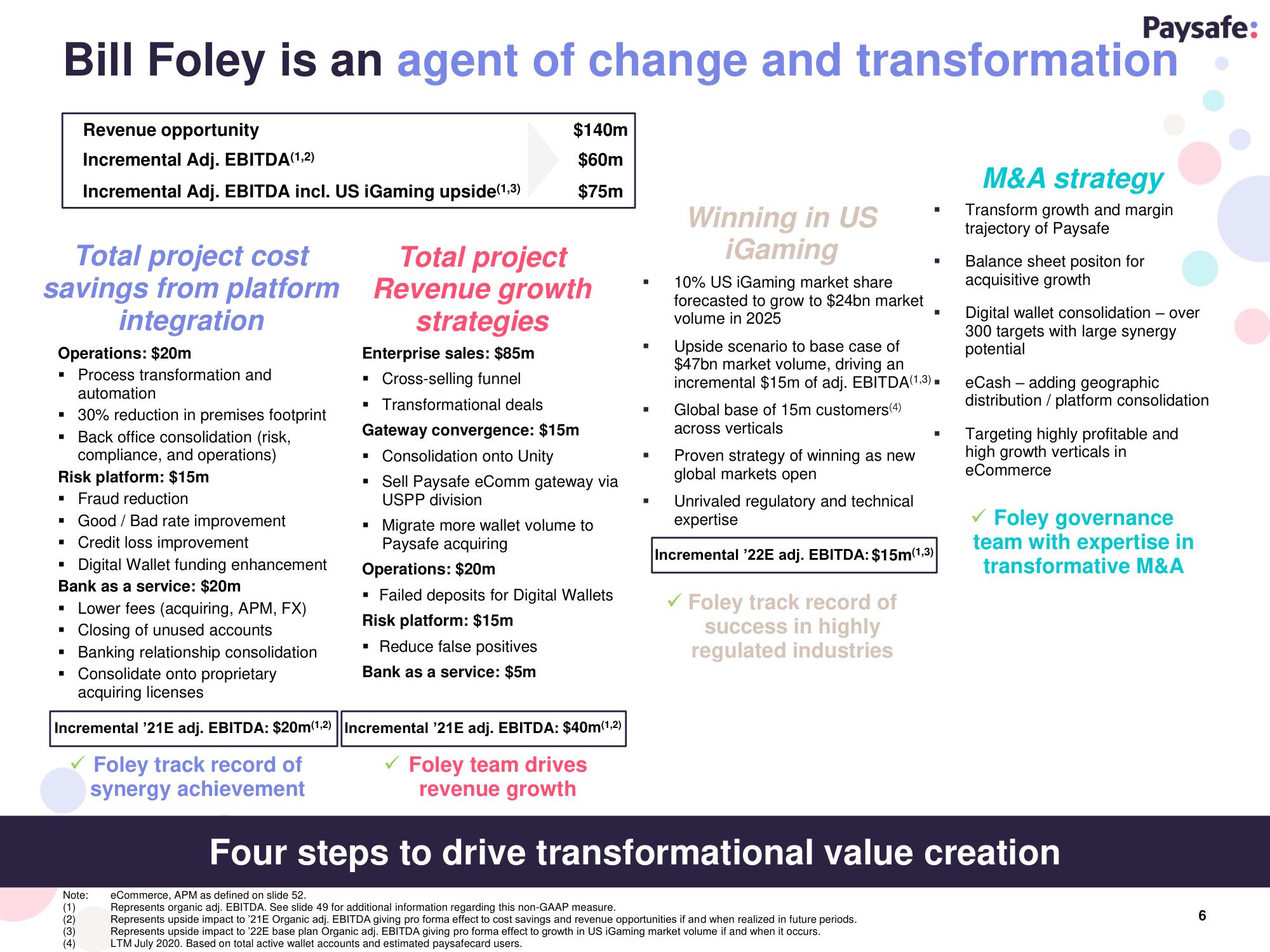

Bill Foley is an agent of change and transformation

Revenue opportunity

Incremental Adj. EBITDA(1,2)

Incremental Adj. EBITDA incl. US iGaming upside (1,3)

Total project cost

savings from platform

integration

Operations: $20m

▪ Process transformation and

automation

▪ 30% reduction in premises footprint

Back office consolidation (risk,

Risk platform: $15m

compliance, and operations)

Fraud reduction

Good / Bad rate improvement

Credit loss improvement

Digital Wallet funding enhancement

Bank as a service: $20m

Lower fees (acquiring, APM, FX)

Closing of unused accounts

■

■

Banking relationship consolidation

▪ Consolidate onto proprietary

acquiring licenses

Note:

(1)

(2)

(3)

(4)

Total project

Revenue growth

strategies

Enterprise sales: $85m

Cross-selling funnel

■ Transformational deals

Gateway convergence: $15m

Consolidation onto Unity

Sell Paysafe eComm gateway via

USPP division

■

$140m

$60m

$75m

■

■

Migrate more wallet volume to

Paysafe acquiring

Operations: $20m

▪ Failed deposits for Digital Wallets

Risk platform: $15m

▪ Reduce false positives

Bank as a service: $5m

Incremental '21E adj. EBITDA: $20m(1,2)| Incremental '21E adj. EBITDA: $40m(1,2)

✓ Foley team drives

Foley track record of

synergy achievement

revenue growth

■

■

Winning in US

iGaming

10% US iGaming market share

forecasted to grow to $24bn market

volume in 2025

Upside scenario to base case of

$47bn market volume, driving an

incremental $15m of adj. EBITDA(1,3) ▪

Global base of 15m customers(4)

across verticals

Proven strategy of winning as new

global markets open

■

Unrivaled regulatory and technical

expertise

Incremental '22E adj. EBITDA: $15m(1,3)

✓ Foley track record of

success in highly

regulated industries

eCommerce, APM as defined on slide 52.

Represents organic adj. EBITDA. See slide 49 for additional information regarding this non-GAAP measure.

Represents upside impact to '21E Organic adj. EBITDA giving pro forma effect to cost savings and revenue opportunities if and when realized in future periods.

Represents upside impact to '22E base plan Organic adj. EBITDA giving pro forma effect to growth in US iGaming market volume if and when it occurs.

LTM July 2020. Based on total active wallet accounts and estimated paysafecard users.

Paysafe:

M&A strategy

Transform growth and margin

trajectory of Paysafe

Balance sheet positon for

acquisitive growth

Digital wallet consolidation - over

300 targets with large synergy

potential

eCash adding geographic

distribution / platform consolidation

Targeting highly profitable and

high growth verticals in

eCommerce

Four steps to drive transformational value creation

✓ Foley governance

team with expertise in

transformative M&A

6View entire presentation