AngloAmerican Investor Update

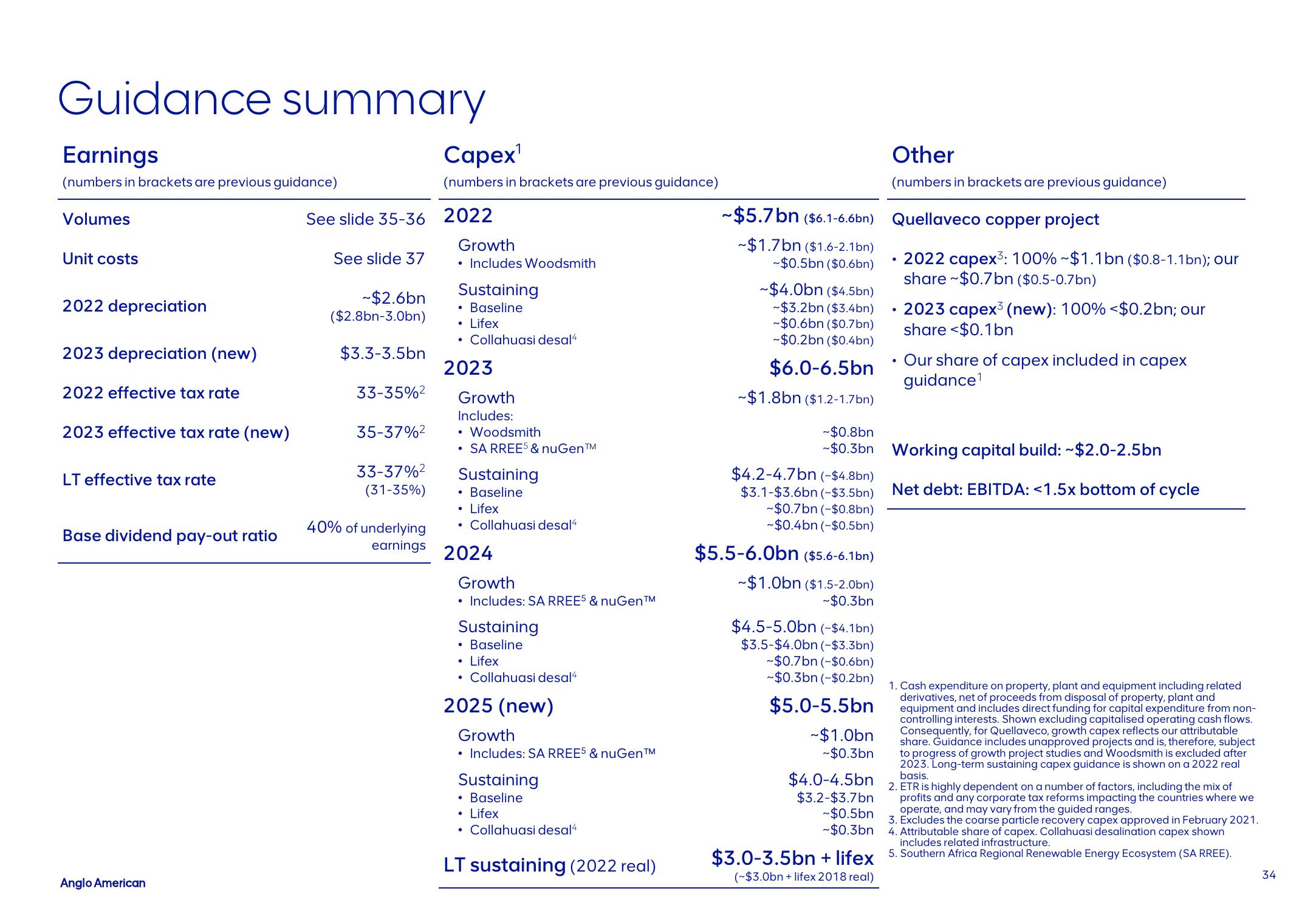

Guidance summary

Earnings

(numbers in brackets are previous guidance)

Volumes

Unit costs

2022 depreciation

2023 depreciation (new)

2022 effective tax rate

2023 effective tax rate (new)

LT effective tax rate

Base dividend pay-out ratio

Anglo American

See slide 35-36 2022

See slide 37

~$2.6bn

($2.8bn-3.0bn)

$3.3-3.5bn

33-35%²

35-37%²

33-37%²

(31-35%)

Capex¹

(numbers in brackets are previous guidance)

40% of underlying

earnings

Growth

• Includes Woodsmith

Sustaining

Baseline

Lifex

. Collahuasi desal4

●

2023

Growth

Includes:

• Woodsmith

• SA RREE5 & nuGen™

Sustaining

Baseline

●

• Lifex

• Collahuasi desal4

2024

Growth

• Includes: SA RREE5 & nuGen™

Sustaining

• Baseline

• Lifex

. Collahuasi desal4

2025 (new)

Growth

• Includes: SA RREE5 & nuGen™

Sustaining

Baseline

.

• Lifex

• Collahuasi desal4

LT sustaining (2022 real)

~$5.7bn ($6.1-6.6bn)

~$1.7bn ($1.6-2.1bn)

~$0.5bn ($0.6bn)

~$4.0bn ($4.5bn)

-$3.2bn ($3.4bn)

~$0.6bn ($0.7bn)

~$0.2bn ($0.4bn)

$6.0-6.5bn

-$1.8bn ($1.2-1.7bn)

~$0.8bn

~$0.3bn

$4.2-4.7bn (-$4.8bn)

$3.1-$3.6bn (~$3.5bn)

~$0.7bn (~$0.8bn)

-$0.4bn (~$0.5bn)

$5.5-6.0bn ($5.6-6.1bn)

~$1.0bn ($1.5-2.0bn)

~$0.3bn

$4.5-5.0bn (~$4.1bn)

$3.5-$4.0bn (~$3.3bn)

-$0.7bn (~$0.6bn)

~$0.3bn (~$0.2bn)

$5.0-5.5bn

~$1.0bn

~$0.3bn

$4.0-4.5bn

$3.2-$3.7bn

Other

(numbers in brackets are previous guidance)

Quellaveco copper project

~$0.5bn

~$0.3bn

●

●

•

2022 capex³: 100% ~$1.1bn ($0.8-1.1bn); our

share $0.7bn ($0.5-0.7bn)

2023 capex³ (new): 100% <$0.2bn; our

share <$0.1bn

Our share of capex included in capex

guidance¹

Working capital build: ~$2.0-2.5bn

Net debt: EBITDA: <1.5x bottom of cycle

1. Cash expenditure on property, plant and equipment including related

derivatives, net of proceeds from disposal of property, plant and

equipment and includes direct funding for capital expenditure from non-

controlling interests. Shown excluding capitalised operating cash flows.

Consequently, for Quellaveco, growth capex reflects our attributable

share. Guidance includes unapproved projects and is, therefore, subject

to progress of growth project studies and Woodsmith is excluded after

2023. Long-term sustaining capex guidance is shown on a 2022 real

basis.

2. ETR is highly dependent on a number of factors, including the mix of

profits and any corporate tax reforms impacting the countries where we

operate, and may vary from the guided ranges.

3. Excludes the coarse particle recovery capex approved in February 2021.

4. Attributable share of capex. Collahuasi desalination capex shown

includes related infrastructure.

$3.0-3.5bn + lifex 5. Southern Africa Regional Renewable Energy Ecosystem (SA RREE).

(~$3.0bn + lifex 2018 real)

34View entire presentation