UBS Results Presentation Deck

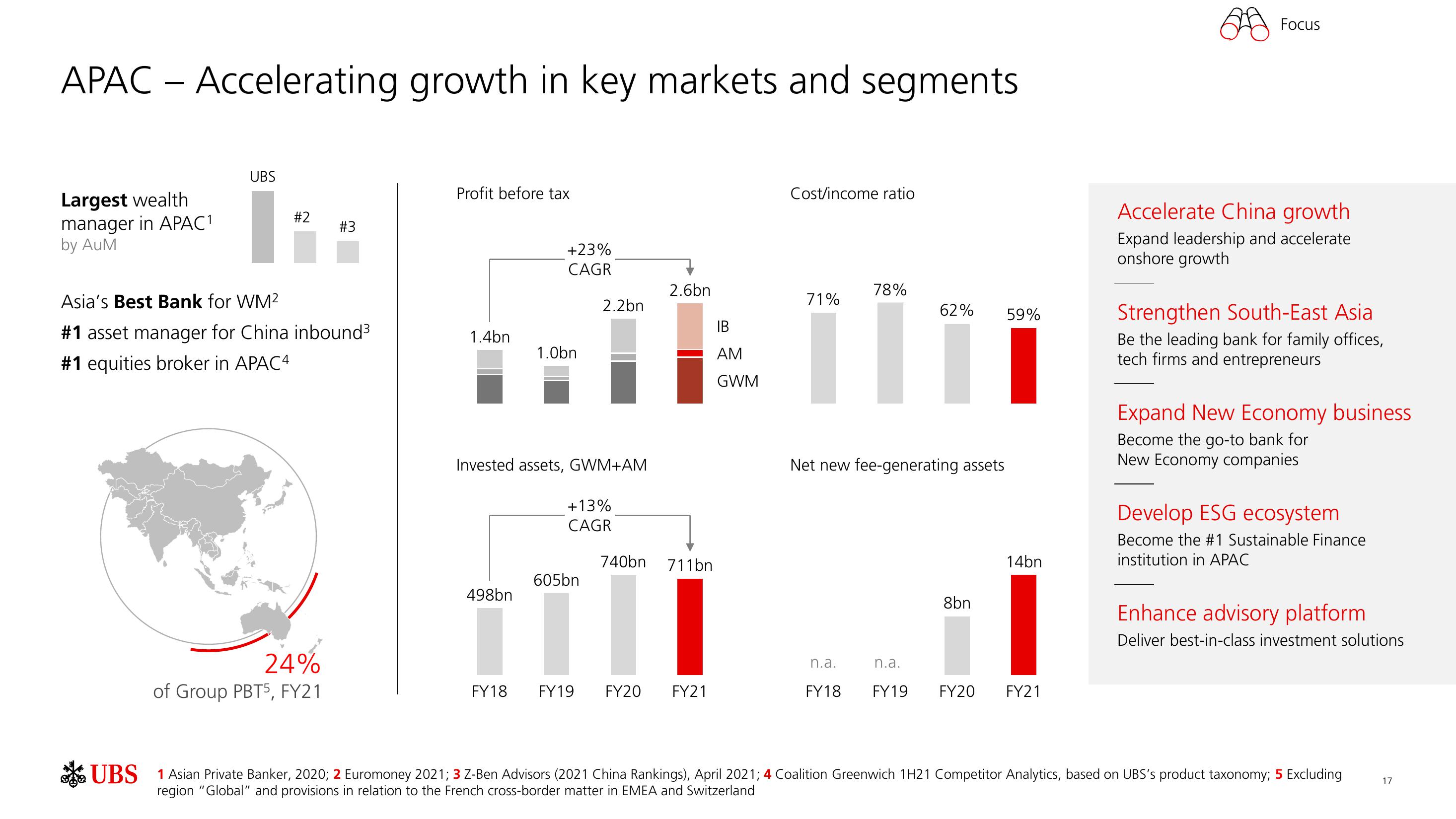

APAC - Accelerating growth in key markets and segments

Largest wealth

manager in APAC ¹

by AuM

UBS

#2

#3

Asia's Best Bank for WM²

#1 asset manager for China inbound³

#1 equities broker in APAC4

24%

of Group PBT5, FY21

Profit before tax

1.4bn

+23%

CAGR

498bn

1.0bn

Invested assets, GWM+AM

2.2bn

+13%

CAGR

605bn

2.6bn

740bn 711bn

FY18 FY19 FY20 FY21

IB

AM

GWM

Cost/income ratio

71%

78%

62% 59%

Net new fee-generating assets

n.a.

8bn

14bn

n.a.

FY18 FY19 FY20 FY21

2

Focus

Accelerate China growth

Expand leadership and accelerate

onshore growth

Strengthen South-East Asia

Be the leading bank for family offices,

tech firms and entrepreneurs

Expand New Economy business

Become the go-to bank for

New Economy companies

Develop ESG ecosystem

Become the #1 Sustainable Finance

institution in APAC

Enhance advisory platform

Deliver best-in-class investment solutions

UBS 1 Asian Private Banker, 2020; 2 Euromoney 2021; 3 Z-Ben Advisors (2021 China Rankings), April 2021; 4 Coalition Greenwich 1H21 Competitor Analytics, based on UBS's product taxonomy; 5 Excluding

region "Global" and provisions in relation to the French cross-border matter in EMEA and Switzerland

17View entire presentation