Apollo Global Management Investor Day Presentation Deck

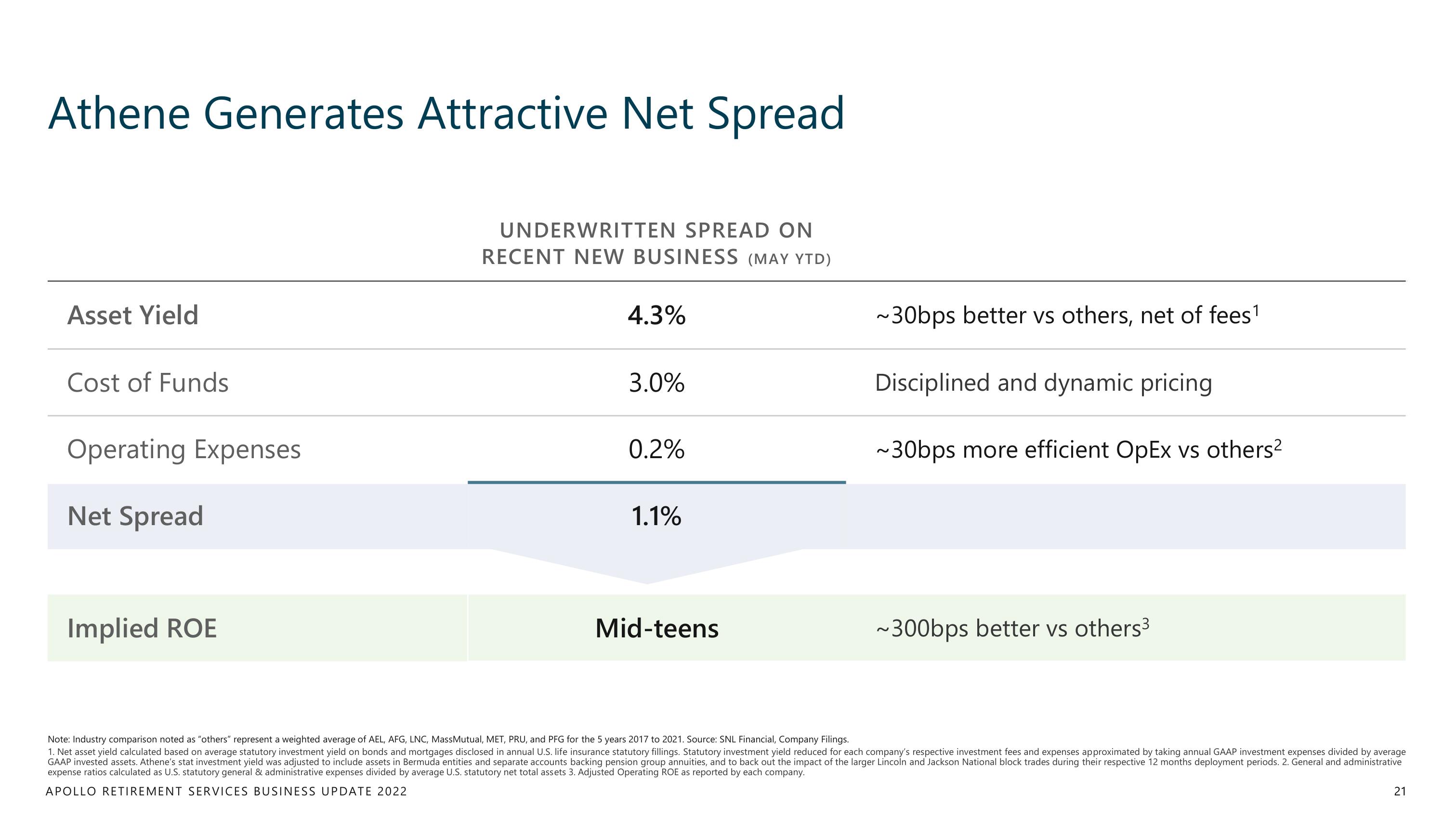

Athene Generates Attractive Net Spread

UNDERWRITTEN SPREAD ON

RECENT NEW BUSINESS (MAY YTD)

Asset Yield

Cost of Funds

Operating Expenses

Net Spread

Implied ROE

4.3%

3.0%

0.2%

1.1%

Mid-teens

~30bps better vs others, net of fees¹

Disciplined and dynamic pricing

~30bps more efficient OpEx vs others²

~300bps better vs others³

Note: Industry comparison noted as "others" represent a weighted average of AEL, AFG, LNC, MassMutual, MET, PRU, and PFG for the 5 years 2017 to 2021. Source: SNL Financial, Company Filings.

1. Net asset yield calculated based on average statutory investment yield on bonds and mortgages disclosed in annual U.S. life insurance statutory fillings. Statutory investment yield reduced for each company's respective investment fees and expenses approximated by taking annual GAAP investment expenses divided by average

GAAP invested assets. Athene's stat investment yield was adjusted to include assets in Bermuda entities and separate accounts backing pension group annuities, and to back out the impact of the larger Lincoln and Jackson National block trades during their respective 12 months deployment periods. 2. General and administrative

expense ratios calculated as U.S. statutory general & administrative expenses divided by average U.S. statutory net total assets 3. Adjusted Operating ROE as reported by each company.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

21View entire presentation