Informatica Investor Presentation Deck

49

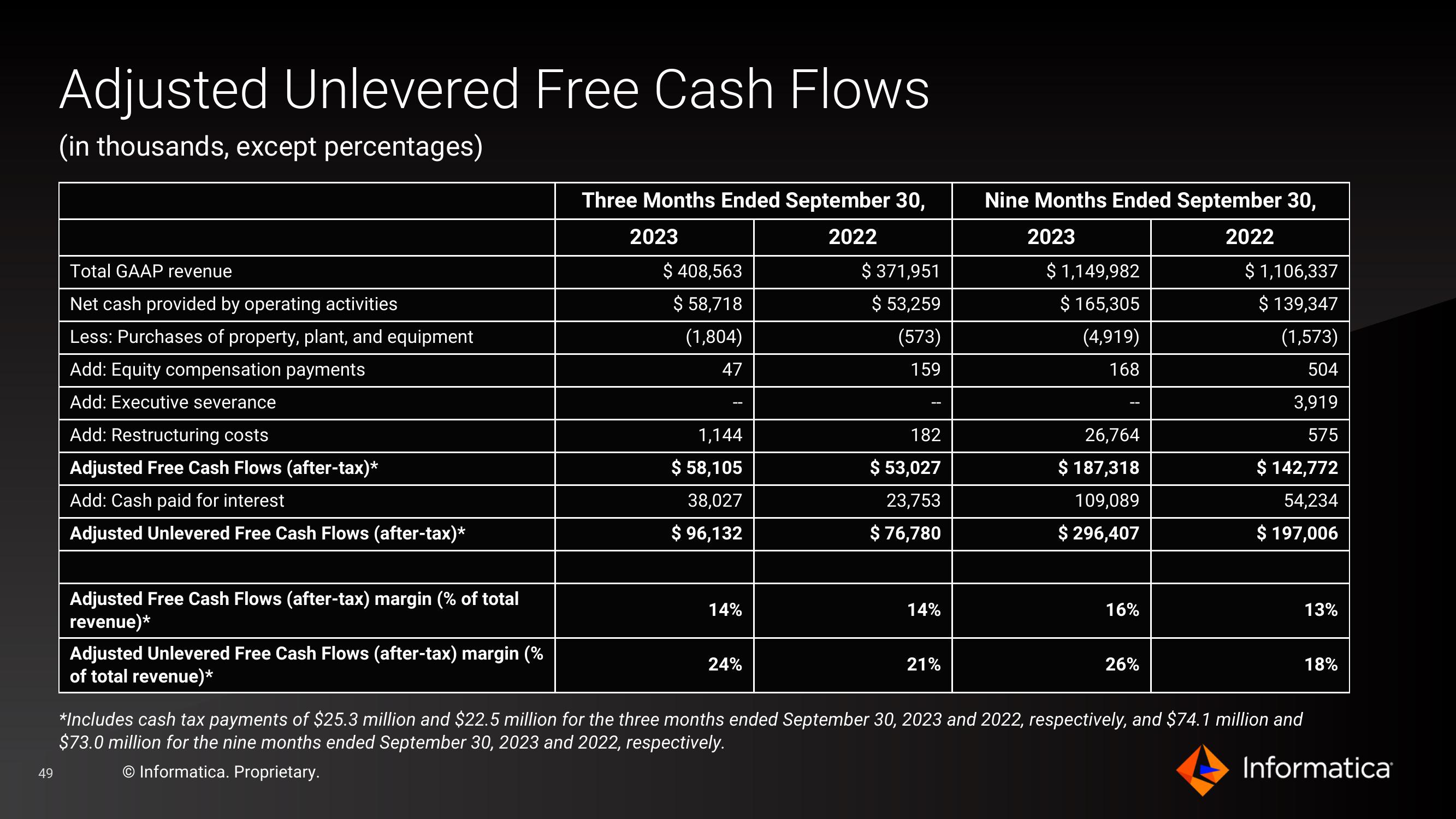

Adjusted Unlevered Free Cash Flows

(in thousands, except percentages)

Total GAAP revenue

Net cash provided by operating activities

Less: Purchases of property, plant, and equipment

Add: Equity compensation payments

Add: Executive severance

Add: Restructuring costs

Adjusted Free Cash Flows (after-tax)*

Add: Cash paid for interest

Adjusted Unlevered Free Cash Flows (after-tax)*

Adjusted Free Cash Flows (after-tax) margin (% of total

revenue)*

Adjusted Unlevered Free Cash Flows (after-tax) margin (%

of total revenue)*

Three Months Ended September 30,

2023

2022

$ 408,563

$ 58,718

(1,804)

47

1,144

$ 58,105

38,027

$ 96,132

14%

24%

$ 371,951

$ 53,259

(573)

159

182

$ 53,027

23,753

$ 76,780

14%

21%

Nine Months Ended September 30,

2023

2022

$ 1,149,982

$ 165,305

(4,919)

168

26,764

$ 187,318

109,089

$ 296,407

16%

26%

$ 1,106,337

$ 139,347

(1,573)

504

3,919

575

$ 142,772

54,234

$ 197,006

13%

18%

*Includes cash tax payments of $25.3 million and $22.5 million for the three months ended September 30, 2023 and 2022, respectively, and $74.1 million and

$73.0 million for the nine months ended September 30, 2023 and 2022, respectively.

Informatica

O Informatica. Proprietary.View entire presentation