First Merchants Results Presentation Deck

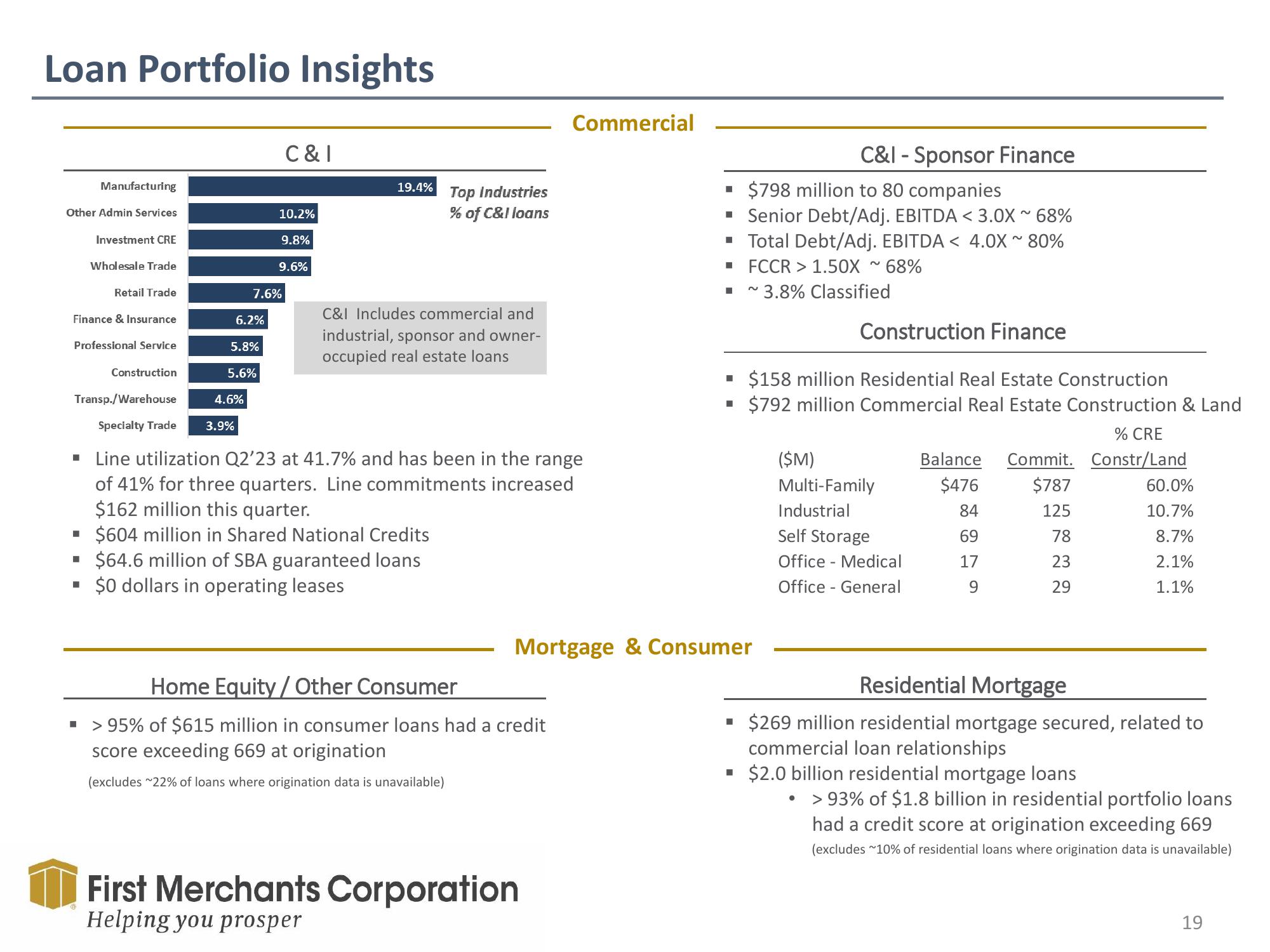

Loan Portfolio Insights

Manufacturing

Other Admin Services

Investment CRE

■

Wholesale Trade

Retail Trade

Finance & Insurance

Professional Service

Construction

Transp./Warehouse

Specialty Trade

6.2%

5.8%

5.6%

4.6%

3.9%

C&I

10.2%

9.8%

9.6%

6%

19.4%

Top Industries

% of C&I loans

C&I Includes commercial and

industrial, sponsor and owner-

occupied real estate loans

▪ $604 million in Shared National Credits

■

$64.6 million of SBA guaranteed loans

$0 dollars in operating leases

Line utilization Q2'23 at 41.7% and has been in the range

of 41% for three quarters. Line commitments increased

$162 million this quarter.

Commercial

Home Equity / Other Consumer

▪ >95% of $615 million in consumer loans had a credit

score exceeding 669 at origination

(excludes ~22% of loans where origination data is unavailable)

First Merchants Corporation

Helping you prosper

■

$798 million to 80 companies

▪ Senior Debt/Adj. EBITDA <3.0X ~ 68%

Total Debt/Adj. EBITDA < 4.0X ~ 80%

■ FCCR > 1.50X ~ 68%

~3.8% Classified

■

■

Mortgage & Consumer

C&I - Sponsor Finance

Construction Finance

■ $158 million Residential Real Estate Construction

$792 million Commercial Real Estate Construction & Land

% CRE

Balance Commit. Constr/Land

$476

$787

84

125

69

17

9

■

($M)

Multi-Family

Industrial

Self Storage

Office - Medical

Office General

78

23

29

60.0%

10.7%

8.7%

2.1%

1.1%

Residential Mortgage

$269 million residential mortgage secured, related to

commercial loan relationships

$2.0 billion residential mortgage loans

> 93% of $1.8 billion in residential portfolio loans

had a credit score at origination exceeding 669

(excludes ~10% of residential loans where origination data is unavailable)

19View entire presentation