Cyxtera Results Presentation Deck

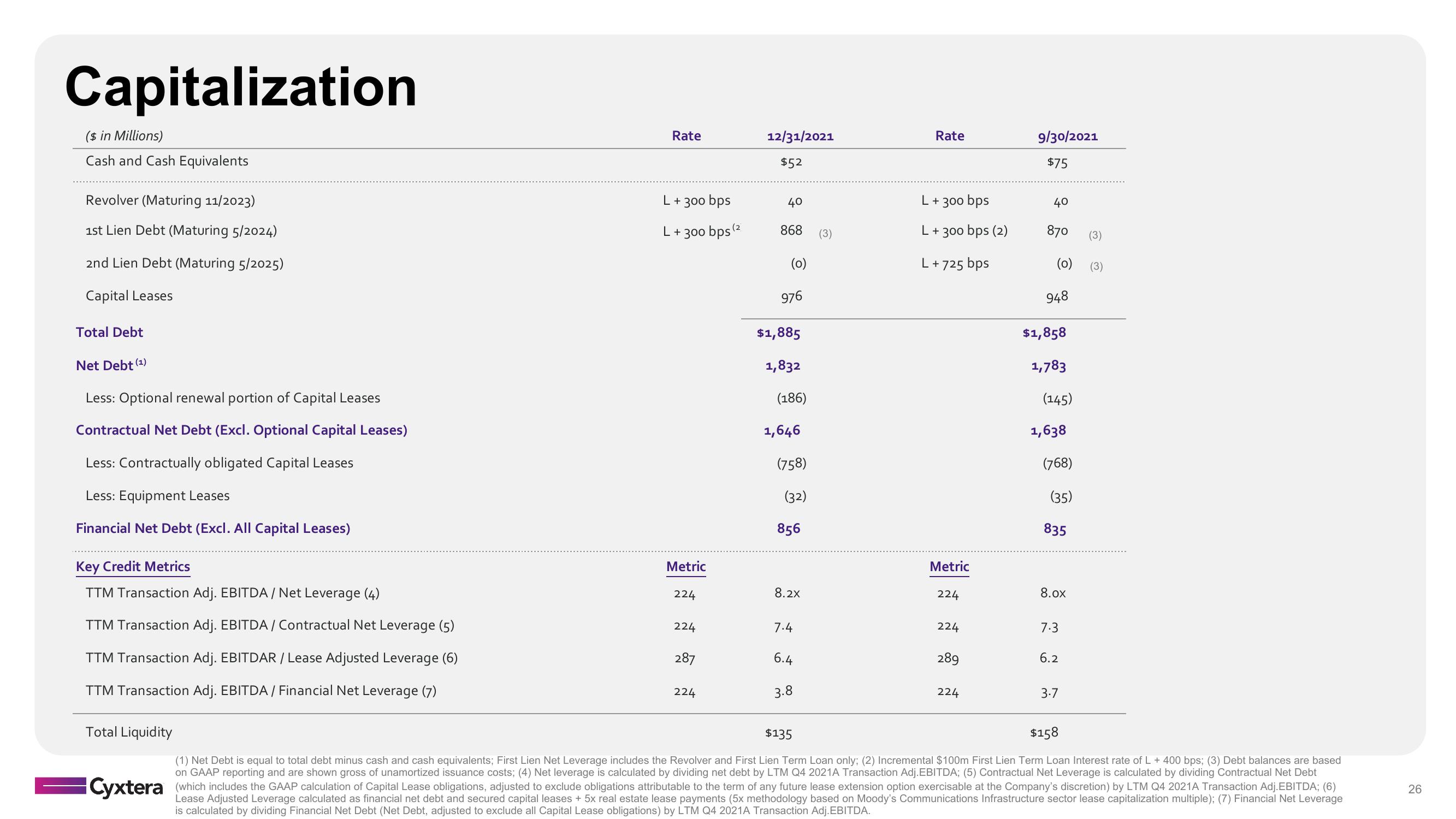

Capitalization

($ in Millions)

Cash and Cash Equivalents

Revolver (Maturing 11/2023)

1st Lien Debt (Maturing 5/2024)

2nd Lien Debt (Maturing 5/2025)

Capital Leases

Total Debt

Net Debt (¹)

Less: Optional renewal portion of Capital Leases

Contractual Net Debt (Excl. Optional Capital Leases)

Less: Contractually obligated Capital Leases

Less: Equipment Leases

Financial Net Debt (Excl. All Capital Leases)

Key Credit Metrics

TTM Transaction Adj. EBITDA/Net Leverage (4)

TTM Transaction Adj. EBITDA/ Contractual Net Leverage (5)

TTM Transaction Adj. EBITDAR / Lease Adjusted Leverage (6)

TTM Transaction Adj. EBITDA / Financial Net Leverage (7)

Total Liquidity

Rate

L + 300 bps

L + 300 bps (²

Metric

224

224

287

224

12/31/2021

$52

40

868

(0)

976

$1,885

1,832

(186)

1,646

(758)

(32)

856

8.2x

7.4

6.4

3.8

(3)

Rate

L + 300 bps

L + 300 bps (2)

L + 725 bps

Metric

224

224

289

224

9/30/2021

$75

40

870 (3)

(0)

(3)

948

$1,858

1,783

(145)

1,638

(768)

(35)

835

8.ox

7.3

6.2

3.7

$135

$158

Cyxtera

(1) Net Debt is equal to total debt minus cash and cash equivalents; First Lien Net Leverage includes the Revolver and First Lien Term Loan only; (2) Incremental $100m First Lien Term Loan Interest rate of L + 400 bps; (3) Debt balances are based

on GAAP reporting and are shown gross of unamortized issuance costs; (4) Net leverage is calculated by dividing net debt by LTM Q4 2021A Transaction Adj.EBITDA; (5) Contractual Net Leverage is calculated by dividing Contractual Net Debt

(which includes the GAAP calculation of Capital Lease obligations, adjusted to exclude obligations attributable to the term of any future lease extension option exercisable at the Company's discretion) by LTM Q4 2021A Transaction Adj. EBITDA; (6)

Lease Adjusted Leverage calculated as financial net debt and secured capital leases + 5x real estate lease payments (5x methodology based on Moody's Communications Infrastructure sector lease capitalization multiple); (7) Financial Net Leverage

is calculated by dividing Financial Net Debt (Net Debt, adjusted to exclude all Capital Lease obligations) by LTM Q4 2021A Transaction Adj.EBITDA.

26View entire presentation