Paysafe Results Presentation Deck

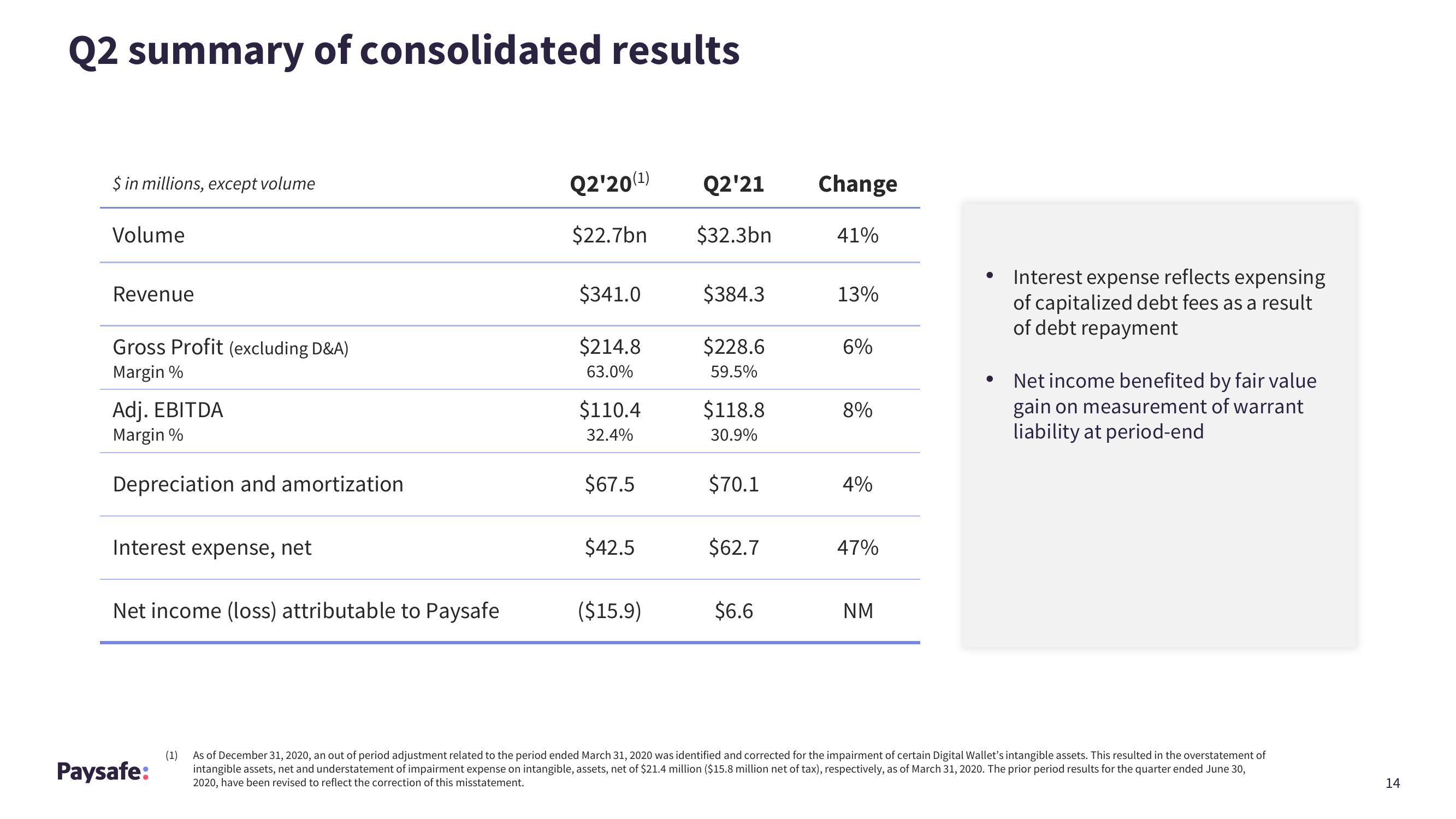

Q2 summary of consolidated results

$ in millions, except volume

Volume

Revenue

Gross Profit (excluding D&A)

Margin %

Adj. EBITDA

Margin %

Depreciation and amortization

Interest expense, net

Net income (loss) attributable to Paysafe

Paysafe:

Q2'20(¹)

Q2¹21

$22.7bn $32.3bn

$341.0

$214.8

63.0%

$110.4

32.4%

$67.5

$42.5

($15.9)

$384.3

$228.6

59.5%

$118.8

30.9%

$70.1

$62.7

$6.6

Change

41%

13%

6%

8%

4%

47%

NM

●

Interest expense reflects expensing

of capitalized debt fees as a result

of debt repayment

Net income benefited by fair value

gain on measurement of warrant

liability at period-end

(1) As of December 31, 2020, an out of period adjustment related to the period ended March 31, 2020 was identified and corrected for the impairment of certain Digital Wallet's intangible assets. This resulted in the overstatement of

intangible assets, net and understatement of impairment expense on intangible, assets, net of $21.4 million ($15.8 million net of tax), respectively, as of March 31, 2020. The prior period results for the quarter ended June 30,

2020, have been revised to reflect the correction of this misstatement.

14View entire presentation