Antero Midstream Partners Mergers and Acquisitions Presentation Deck

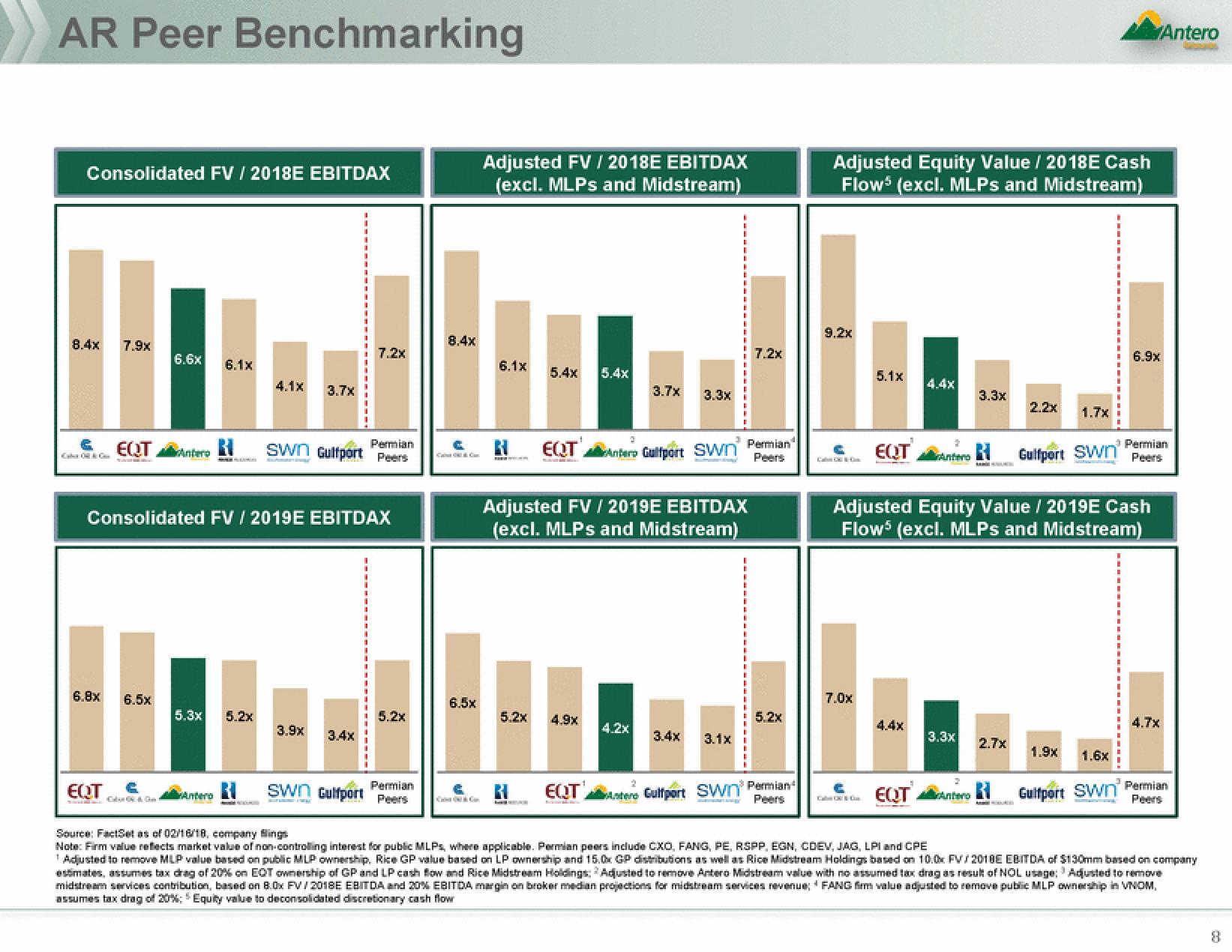

AR Peer Benchmarking

Consolidated FV / 2018E EBITDAX

8.4x

2

đam m

7.9x

EQT

EQT

6.8x 6.5x

6.6x

intero

6.1x

5.3x 5.2x

Antero

4.1x

Consolidated FV / 2019E EBITDAX

3.7x

Permian

swn Gulfport Peers

3.9x

7.2x

3.4x

5.2x

Permian

swn Gulfport Pers

8.4x

6.5x

Adjusted FV / 2018E EBITDAX

(excl. MLPs and Midstream)

6.1x

5.2x

5.4x 5.4x

RI

EQT

Adjusted FV / 2019E EBITDAX

(excl. MLPs and Midstream)

4.9x

3.7x 3.3x

Antero Gulfport Swn

4.2x

3.4x 3.1x

7.2x

Permian

Peers

5.2x

2

EQT Antero Gulfport Swn Permian

Peers

Adjusted Equity Value / 2018E Cash

Flows (excl. MLPs and Midstream)

Cam

5.1x

7.0x

EQT

4.4x

4.4x

S

counterno

3.3x

KARE ZA S

EQT Ant

3.3x 2.7x

2.2x

Adjusted Equity Value / 2019E Cash

Flows (excl. MLPs and Midstream)

RI

1.7x

Gulfport Swn'

1.9x 1.6x

Gulfport Swn'

Antero

6.9x

Permian

Peers

4.7x

Permian

Peers

Source: FactSet as of 02/16/18, company Slings

Note: Firm value reflects market value of non-controlling interest for public MLPs, where applicable. Permian peers include CXO, FANG, PE, RSPP, EGN, CDEV, JAG, LPI and CPE

¹ Adjusted to remove MLP value based on public MLP ownership, Rice GP value based on LP ownership and 15.0x GP distributions as well as Rice Midstream Holdings based on 10.0x FV/2010E EBITDA of $130mm based on company

estimates, assumes tax drag of 20% on EQT ownership of GP and LP cash flow and Rice Midstream Holdings: Adjusted to remove Antero Midstream value with no assumed tax drag as result of NOL usage: Adjusted to remove

midstream services contribution, based on 8.0x FV/2018E EBITDA and 20% EBITDA margin on broker median projections for midstream services revenue; FANG firm value adjusted to remove public MLP ownership in VNOM,

assumes tax drag of 20%; Equity value to deconsolidated discretionary cash flow

3

8View entire presentation