Investor Deep Dive Corporate Bank

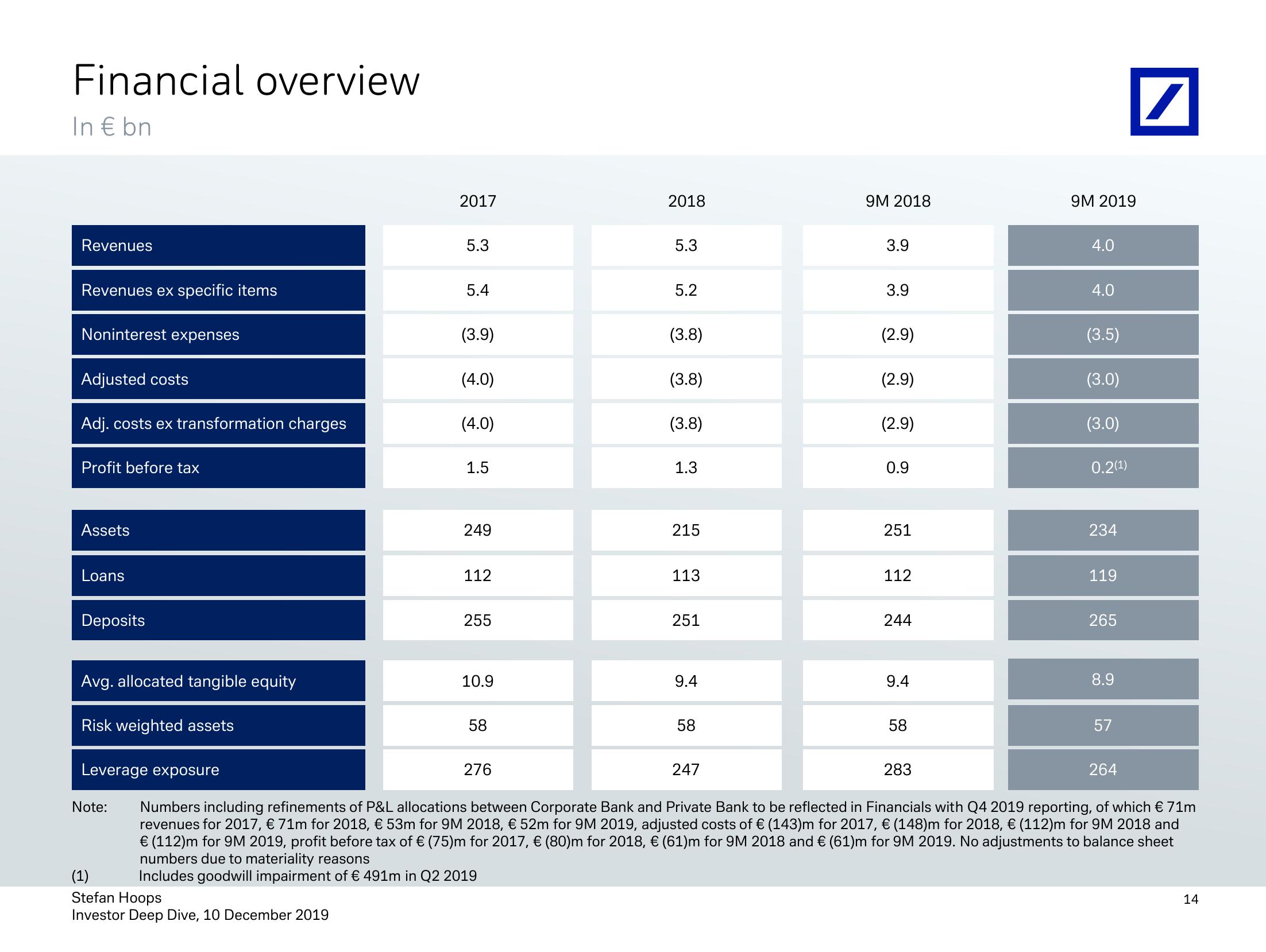

Financial overview

In € bn

2017

2018

9M 2018

9M 2019

Revenues

5.3

5.3

3.9

4.0

Revenues ex specific items

5.4

5.2

3.9

4.0

Noninterest expenses

(3.9)

(3.8)

(2.9)

(3.5)

Adjusted costs

(4.0)

(3.8)

(2.9)

(3.0)

Adj. costs ex transformation charges

(4.0)

(3.8)

(2.9)

(3.0)

Profit before tax

1.5

1.3

0.9

0.2(1)

Assets

Loans

Deposits

249

215

251

234

112

113

112

119

255

251

244

265

Avg. allocated tangible equity

10.9

9.4

9.4

8.9

Risk weighted assets

58

58

58

57

Leverage exposure

276

247

283

264

Note:

(1)

Numbers including refinements of P&L allocations between Corporate Bank and Private Bank to be reflected in Financials with Q4 2019 reporting, of which € 71m

revenues for 2017, € 71m for 2018, € 53m for 9M 2018, € 52m for 9M 2019, adjusted costs of € (143)m for 2017, € (148)m for 2018, € (112)m for 9M 2018 and

€ (112)m for 9M 2019, profit before tax of € (75)m for 2017, € (80)m for 2018, € (61)m for 9M 2018 and € (61)m for 9M 2019. No adjustments to balance sheet

numbers due to materiality reasons

Includes goodwill impairment of € 491m in Q2 2019

Stefan Hoops

Investor Deep Dive, 10 December 2019

14View entire presentation