Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

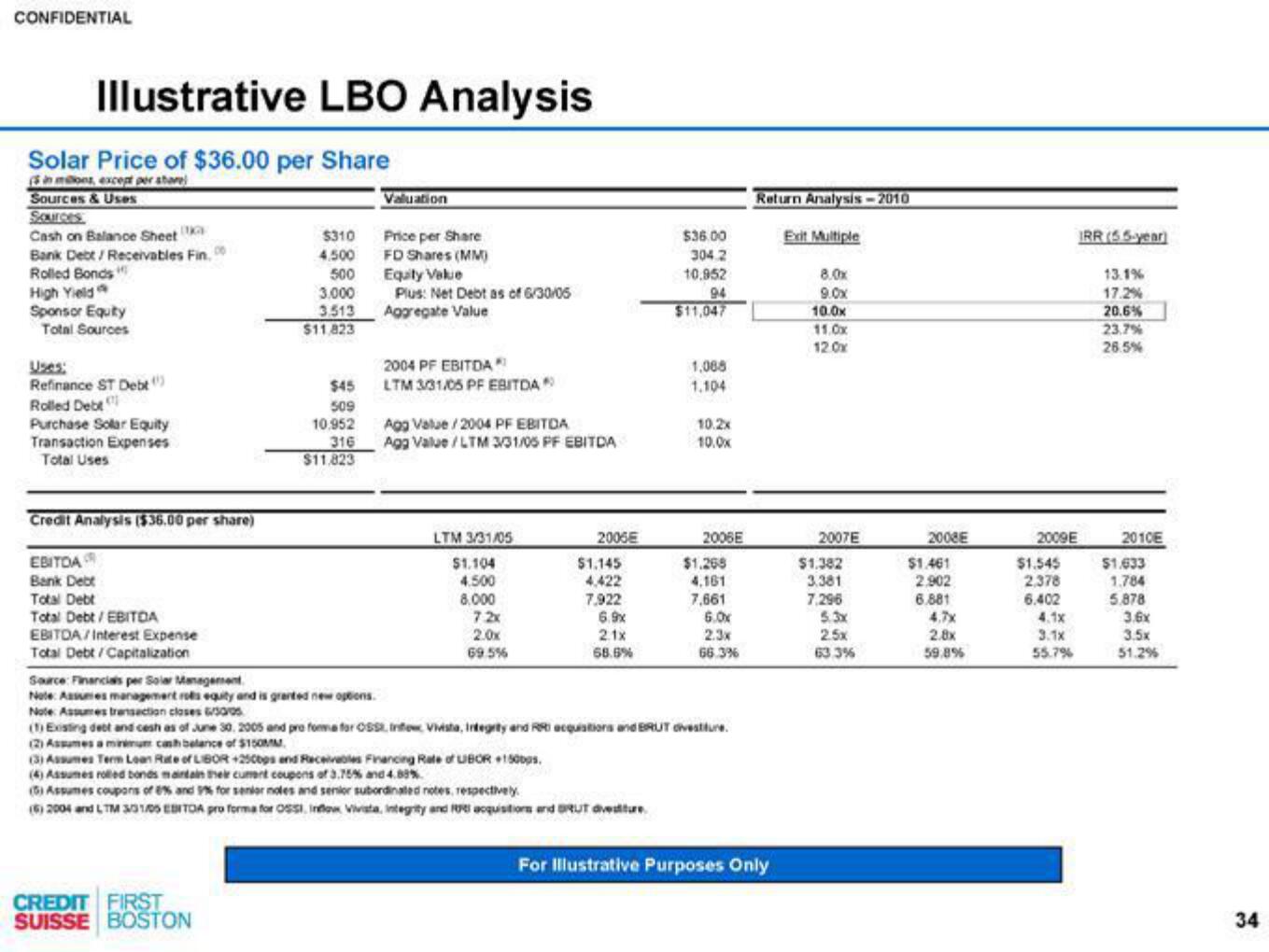

Illustrative LBO Analysis

Solar Price of $36.00 per Share

in mor, except per store

Sources & Uses

Sources

Cash on Balance Sheet

Bank Debt/Receivables Fin.00

Rolled Bonds

High Yield

Sponsor Equity

Total Sources

Uses:

Refinance ST Debt

Rolled Debt

Purchase Solar Equity

Transaction Expenses

Total Uses

Credit Analysis ($36.00 per share)

EBITDA

Bank Debt

Total Debt

Total Debt / EBITDA

EBITDA/Interest Expense

$310

4.500

500

3,000

3.513

$11.823

$45

509

10.952

316

$11.823

Total Debt/Capitalization

Source: Financials per Solar Management.

Note: Assumes management ros equity and is granted new options.

Note: Assumes transaction closes Gros

CREDIT FIRST

SUISSE BOSTON

Valuation

Price per Share

FD Shares (MM)

Equity Value

Plus: Net Debt as of 6/30/05

Aggregate Value

2004 PF EBITDA*

LTM 3/31/05 PF EBITDA

Agg Value/2004 PF EBITDA

Agg Value/LTM 3/31/05 PF EBITDA

LTM 3/31/05

$1.104

4.500

8,000

7:2x

2.0x

69.5%

2006E

$1.145

4,422

7,922

6.9x

2.1x

68.6%

(3) Assumes Term Loan Rate of LIBOR +250bps and Receivables Financing Rate of UIBOR +150bps.

(4) Assumes rolled bonds maintain their cument coupons of 3.75% and 4.89%

(5) Assumes coupons of 8% and 9% for senior notes and senior subordinated notes, respectively.

(6) 2004 and LTM 3/31/05 EBITOA pro forma for OSSI, Inflow Vivista, Integrity and acquisitions and BRUT divestiture

$36.00

304.2

10,952

94

$11,047

1,068

1.104

10.2x

10.0x

2006E

$1.269

4,161

7,661

(1) Existing debt and cesh as of June 30, 2005 and pro forma for OSS, Info Vivista, Integrity and RR acquisitions and BRUT dvesture.

(2) Assumes a minimum cash belance of $150MM

6.0x

2.3x

66.3%

Return Analysis-2010

For Illustrative Purposes Only

Exit Multiple

8.0x

9.0x

10.0x

11.0x

12.0x

2007E

$1.382

3.381

7,296

5.3x

2.5x

63.3%

2008E

$1.461

2.902

6.881

2.8x

59.8%

2009E

$1.545

2,378

6.402

IRR (5.5-year)

4.1x

3.1x

55.7%

13.1%

17.2%

20.6%

23.7%

26.5%

2010E

$1,633

1.784

5.878

3.6x

3.5x

51.2%

34View entire presentation