Dave Investor Presentation Deck

Expanding variable

margin

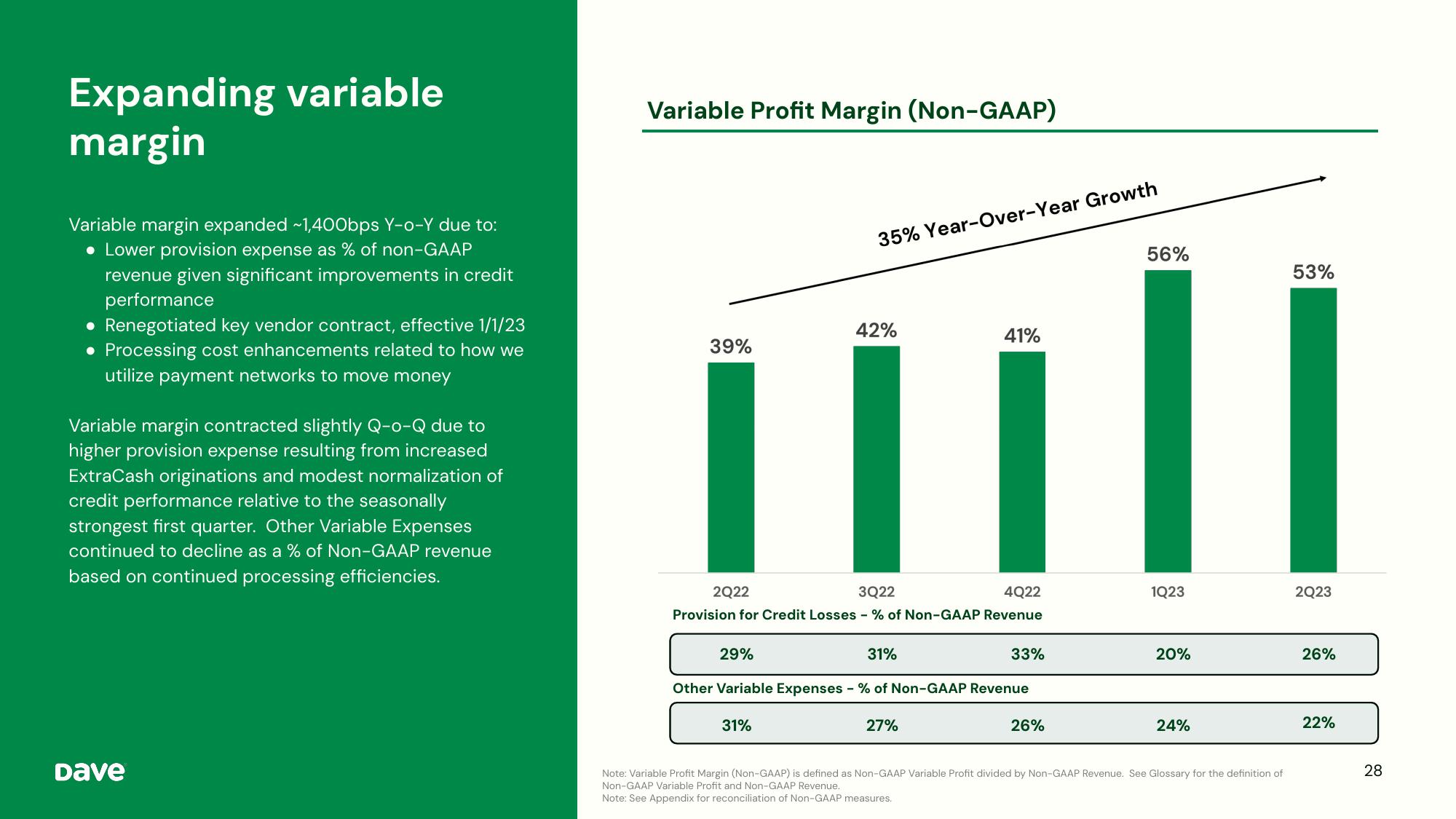

Variable margin expanded ~1,400bps Y-o-Y due to:

• Lower provision expense as % of non-GAAP

revenue given significant improvements in credit

performance

• Renegotiated key vendor contract, effective 1/1/23

• Processing cost enhancements related to how we

utilize payment networks to move money

Variable margin contracted slightly Q-o-Q due to

higher provision expense resulting from increased

ExtraCash originations and modest normalization of

credit performance relative to the seasonally

strongest first quarter. Other Variable Expenses

continued to decline as a % of Non-GAAP revenue

based on continued processing efficiencies.

Dave

Variable Profit Margin (Non-GAAP)

39%

29%

35% Year-Over-Year Growth

42%

31%

2Q22

3Q22

4Q22

Provision for Credit Losses - % of Non-GAAP Revenue

||

41%

31%

Other Variable Expenses - % of Non-GAAP Revenue

27%

33%

26%

56%

1Q23

20%

24%

Note: Variable Profit Margin (Non-GAAP) is defined as Non-GAAP Variable Profit divided by Non-GAAP Revenue. See Glossary for the definition of

Non-GAAP Variable Profit and Non-GAAP Revenue.

Note: See Appendix for reconciliation of Non-GAAP measures.

53%

2Q23

26%

22%

28View entire presentation