Allwyn SPAC

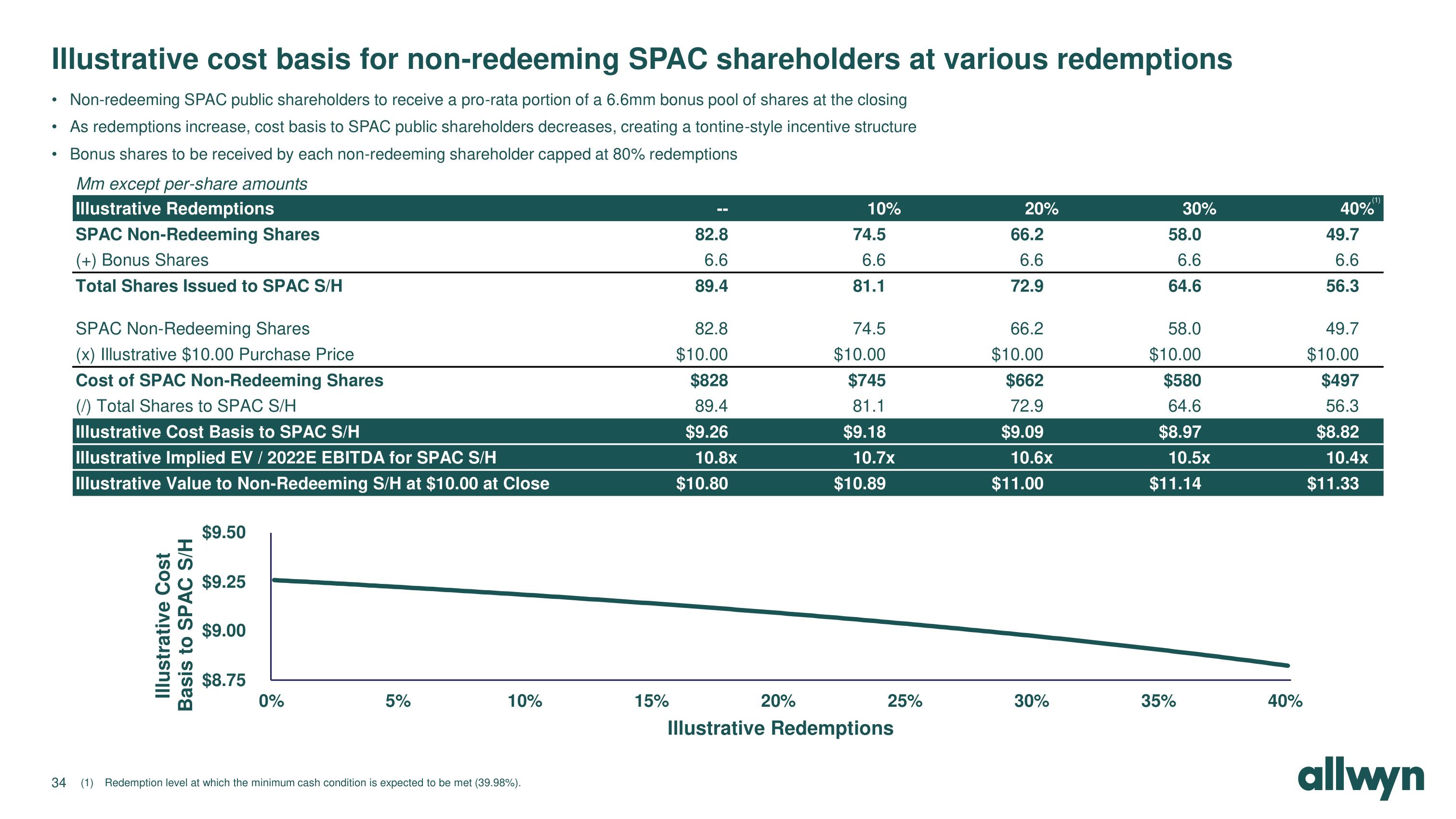

Illustrative cost basis for non-redeeming SPAC shareholders at various redemptions

Non-redeeming SPAC public shareholders to receive a pro-rata portion of a 6.6mm bonus pool of shares at the closing

As redemptions increase, cost basis to SPAC public shareholders decreases, creating a tontine-style incentive structure

Bonus shares to be received by each non-redeeming shareholder capped at 80% redemptions

Mm except per-share amounts

Illustrative Redemptions

●

●

SPAC Non-Redeeming Shares

(+) Bonus Shares

Total Shares Issued to SPAC S/H

SPAC Non-Redeeming Shares

(x) Illustrative $10.00 Purchase Price

Cost of SPAC Non-Redeeming Shares

(/) Total Shares to SPAC S/H

Illustrative Cost Basis to SPAC S/H

Illustrative Implied EV / 2022E EBITDA for SPAC S/H

Illustrative

Value to Non-Redeeming S/H at $10.00 at Close

Illustrative Cost

Basis to SPAC S/H

$9.50

$9.25

$9.00

$8.75

0%

5%

10%

34 (1) Redemption level at which the minimum cash condition is expected to be met (39.98%).

15%

82.8

6.6

89.4

82.8

$10.00

$828

89.4

$9.26

10.8x

$10.80

20%

10%

74.5

6.6

81.1

74.5

$10.00

$745

81.1

$9.18

10.7x

$10.89

25%

Illustrative Redemptions

20%

66.2

6.6

72.9

66.2

$10.00

$662

72.9

$9.09

10.6x

$11.00

30%

30%

58.0

6.6

64.6

58.0

$10.00

$580

64.6

$8.97

10.5x

$11.14

35%

40%

40%

49.7

6.6

56.3

49.7

$10.00

$497

56.3

$8.82

10.4x

(1)

$11.33

allwynView entire presentation