Playboy Mergers and Acquisitions Presentation Deck

ACQUISITION OF HONEY BIRDETTE

10

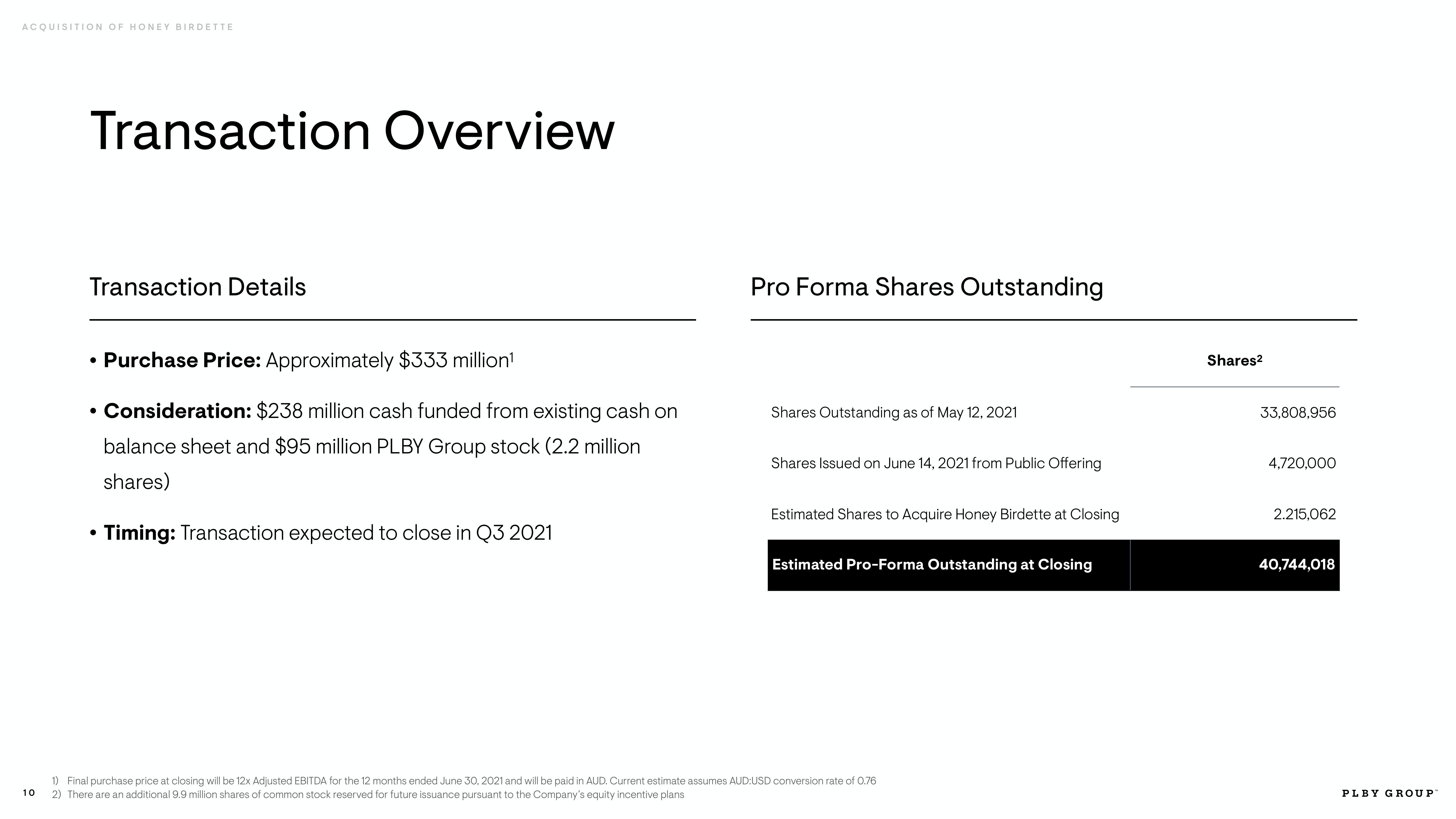

Transaction Overview

Transaction Details

• Purchase Price: Approximately $333 million¹

• Consideration: $238 million cash funded from existing cash on

balance sheet and $95 million PLBY Group stock (2.2 million

shares)

Timing: Transaction expected to close in Q3 2021

●

Pro Forma Shares Outstanding

Shares Outstanding as of May 12, 2021

Shares Issued on June 14, 2021 from Public Offering

Estimated Shares to Acquire Honey Birdette at Closing

Estimated Pro-Forma Outstanding at Closing

1) Final purchase price at closing will be 12x Adjusted EBITDA for the 12 months ended June 30, 2021 and will be paid in AUD. Current estimate assumes AUD:USD conversion rate of 0.76

2) There are an additional 9.9 million shares of common stock reserved for future issuance pursuant to the Company's equity incentive plans

Shares²

33,808,956

4,720,000

2.215,062

40,744,018

PLBY GROUPView entire presentation