Bank of America Results Presentation Deck

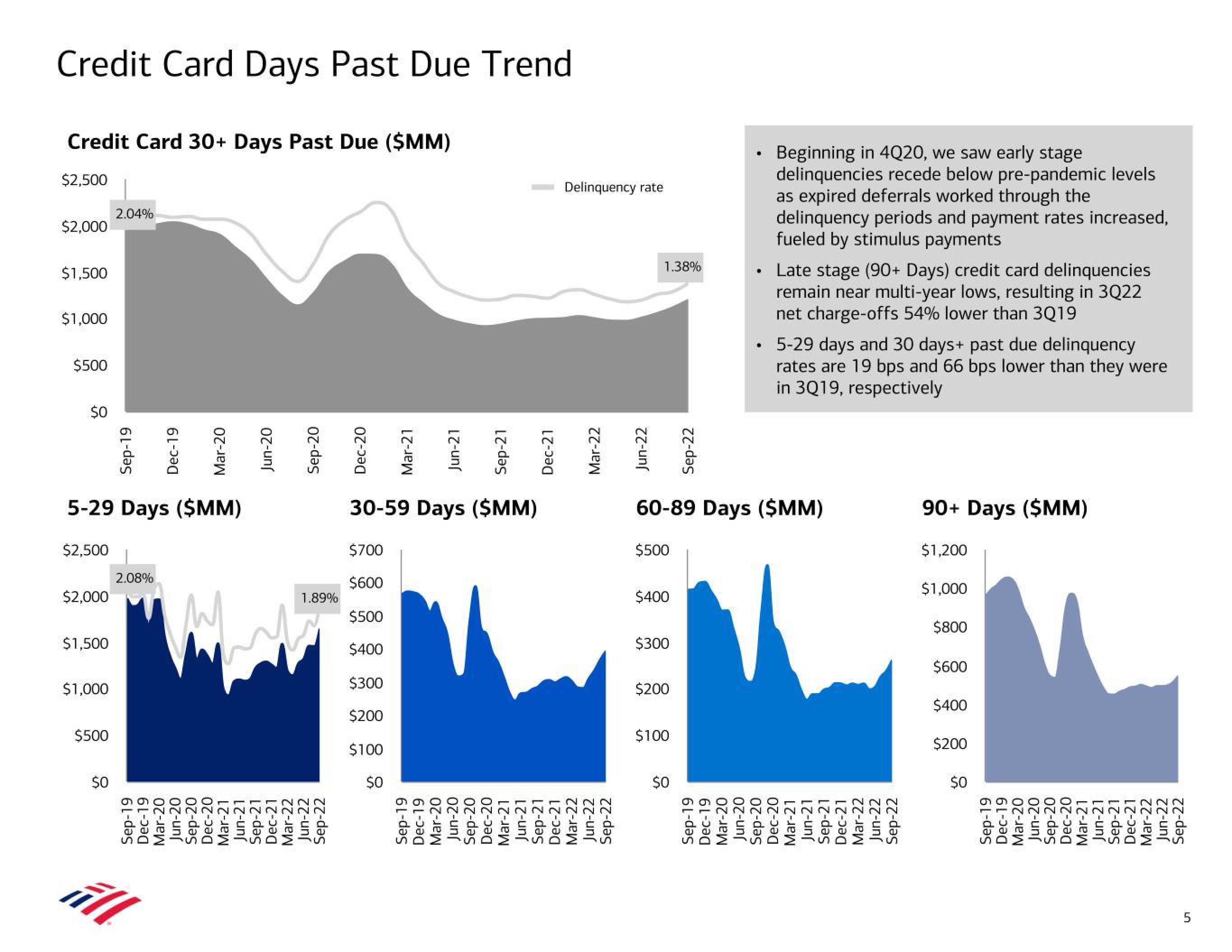

Credit Card Days Past Due Trend

Credit Card 30+ Days Past Due ($MM)

$2,500

$2,000

$1,500

$1,000

$500

$0

$2,000

$1,500

$1,000

5-29 Days ($MM)

$2,500

$500

2.04%

$0

Sep-19

2.08%

Dec-19

ill

Mar-20

w

Jun-20

Sep-20

1.89%

Dec-20

Mar-21

$700

$600

$500

$400

$300

$200

$100

$0

Jun-21

30-59 Days ($MM)

Sep-19

Dec-19

Mar-20

Sep-21

Jun-20

Sep-20

Dec-20

Dec-21

Mar-21

Jun-21

Sep-21

Dec-21

Delinquency rate

Mar-22

Mar-22

Jun-22

Sep-22

Jun-22

1.38%

$500

$400

$300

60-89 Days ($MM)

$200

$100

Sep-22

$0

Beginning in 4Q20, we saw early stage

delinquencies recede below pre-pandemic levels

as expired deferrals worked through the

delinquency periods and payment rates increased,

fueled by stimulus payments

Sep-19

Dec-19

Late stage (90+ Days) credit card delinquencies

remain near multi-year lows, resulting in 3Q22

net charge-offs 54% lower than 3Q19

• 5-29 days and 30 days+ past due delinquency

rates are 19 bps and 66 bps lower than they were

in 3Q19, respectively

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Mar-22

Jun-22

Sep-22

90+ Days ($MM)

$1,200

$1,000

$800

$600

$400

$200

$0

Jun-22

Sep-22

5View entire presentation