Aston Martin Results Presentation Deck

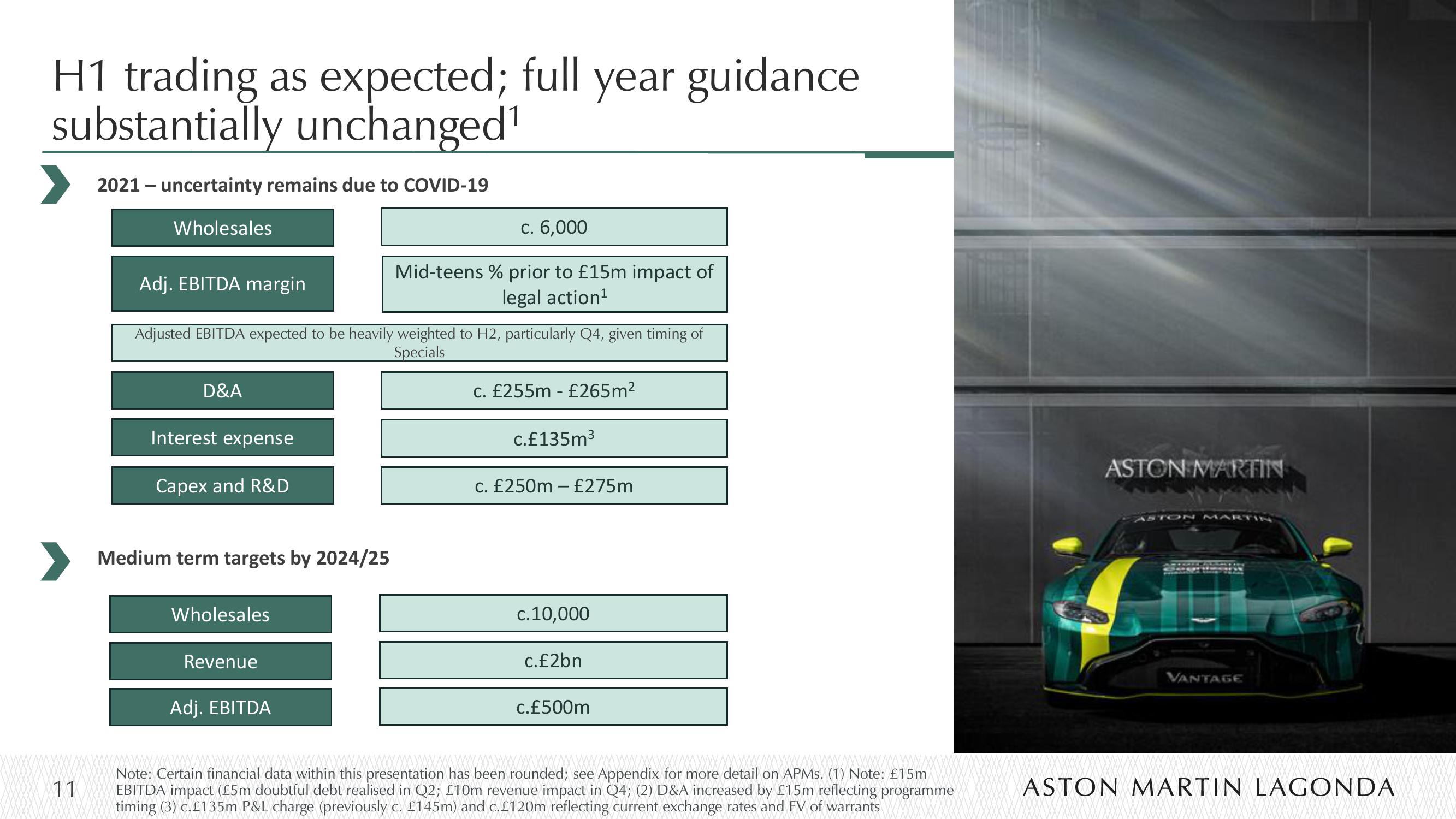

H1 trading as expected; full year guidance

substantially unchanged¹

2021 - uncertainty remains due to COVID-19

Wholesales

11

Adj. EBITDA margin

Adjusted EBITDA expected to be heavily weighted to H2, particularly Q4, given timing of

Specials

D&A

Interest expense

Capex and R&D

Medium term targets by 2024/25

Wholesales

Revenue

c. 6,000

Mid-teens % prior to £15m impact of

legal action¹

Adj. EBITDA

c. £255m - £265m²

c.£135m³

c. £250m - £275m

c. 10,000

c.£2bn

c.£500m

Note: Certain financial data within this presentation has been rounded; see Appendix for more detail on APMs. (1) Note: £15m

EBITDA impact (£5m doubtful debt realised in Q2; £10m revenue impact in Q4; (2) D&A increased by £15m reflecting programme

timing (3) c.£135m P&L charge (previously c. £145m) and c.£120m reflecting current exchange rates and FV of warrants

ASTON MARTIN

VANTAGE

ASTON MARTIN LAGONDAView entire presentation