J.P. Morgan 2016 Auto Conference

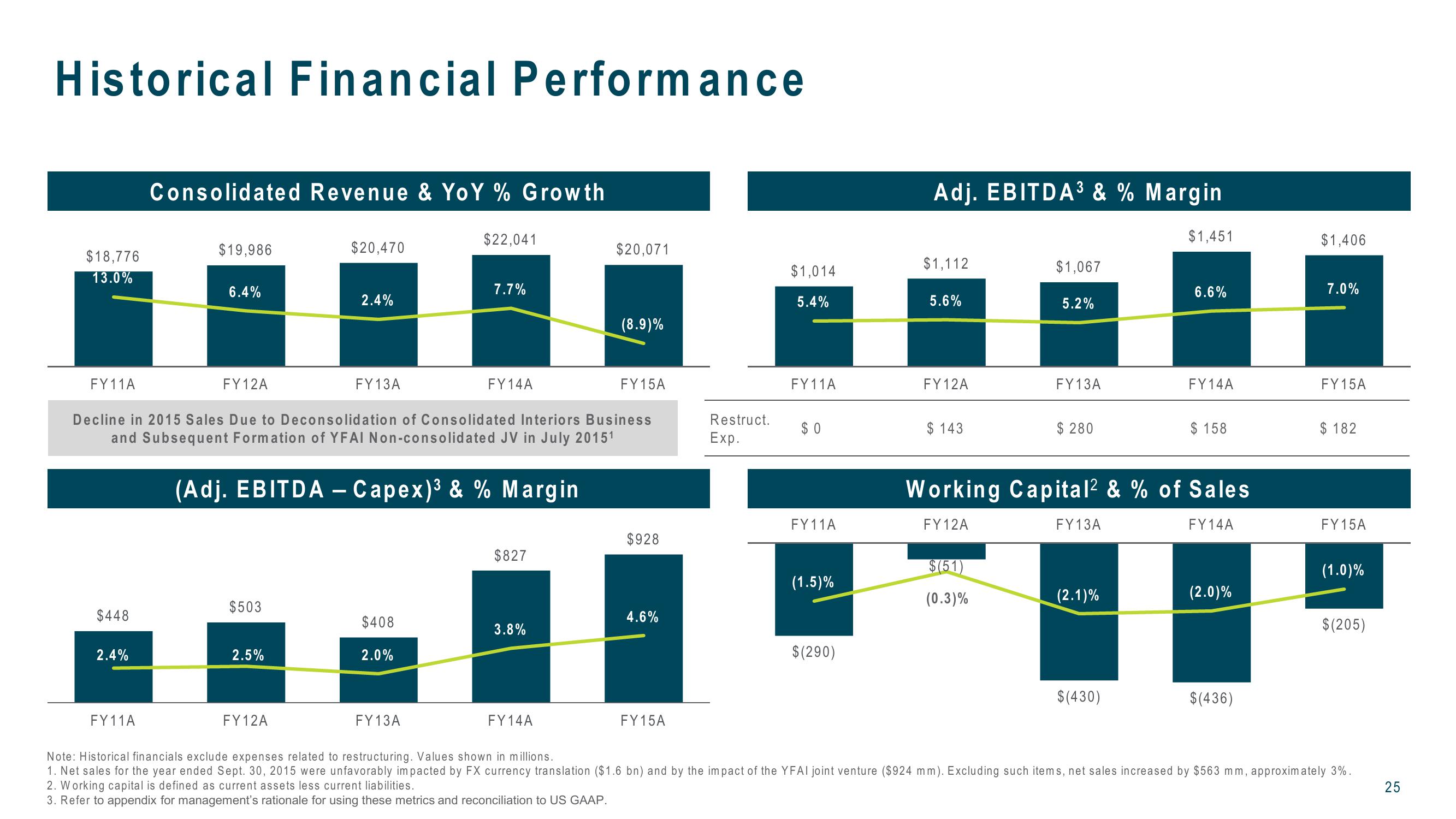

Historical Financial Performance

Consolidated Revenue & YoY % Growth

Adj. EBITDA³ & % Margin

$1,451

$1,406

$22,041

$19,986

$20,470

$20,071

$18,776

13.0%

$1,112

$1,067

$1,014

7.7%

6.6%

7.0%

6.4%

2.4%

5.4%

5.6%

5.2%

(8.9)%

FY11A

FY12A

FY13A

FY14A

FY15A

Decline in 2015 Sales Due to Deconsolidation of Consolidated Interiors Business

and Subsequent Formation of YFAI Non-consolidated JV in July 20151

FY11A

FY12A

FY13A

FY14A

FY15A

Restruct.

Exp.

$ 0

$ 143

$ 280

$ 158

$ 182

(Adj. EBITDA - Capex)³ & % Margin

Working Capital² & % of Sales

FY11A

FY12A

FY13A

FY14A

FY15A

$928

$827

$(51)

(1.0)%

(1.5)%

(0.3)%

(2.1)%

(2.0)%

$503

$448

4.6%

$408

$(205)

3.8%

2.4%

2.5%

2.0%

$(290)

FY11A

FY12A

FY13A

FY14A

FY15A

$(430)

$(436)

Note: Historical financials exclude expenses related to restructuring. Values shown in millions.

1. Net sales for the year ended Sept. 30, 2015 were unfavorably impacted by FX currency translation ($1.6 bn) and by the impact of the YFAI joint venture ($924 mm). Excluding such items, net sales increased by $563 mm, approximately 3%.

2. Working capital is defined as current assets less current liabilities.

3. Refer to appendix for management's rationale for using these metrics and reconciliation to US GAAP.

25View entire presentation