SmileDirectClub Investor Presentation Deck

Balance sheet highlights.

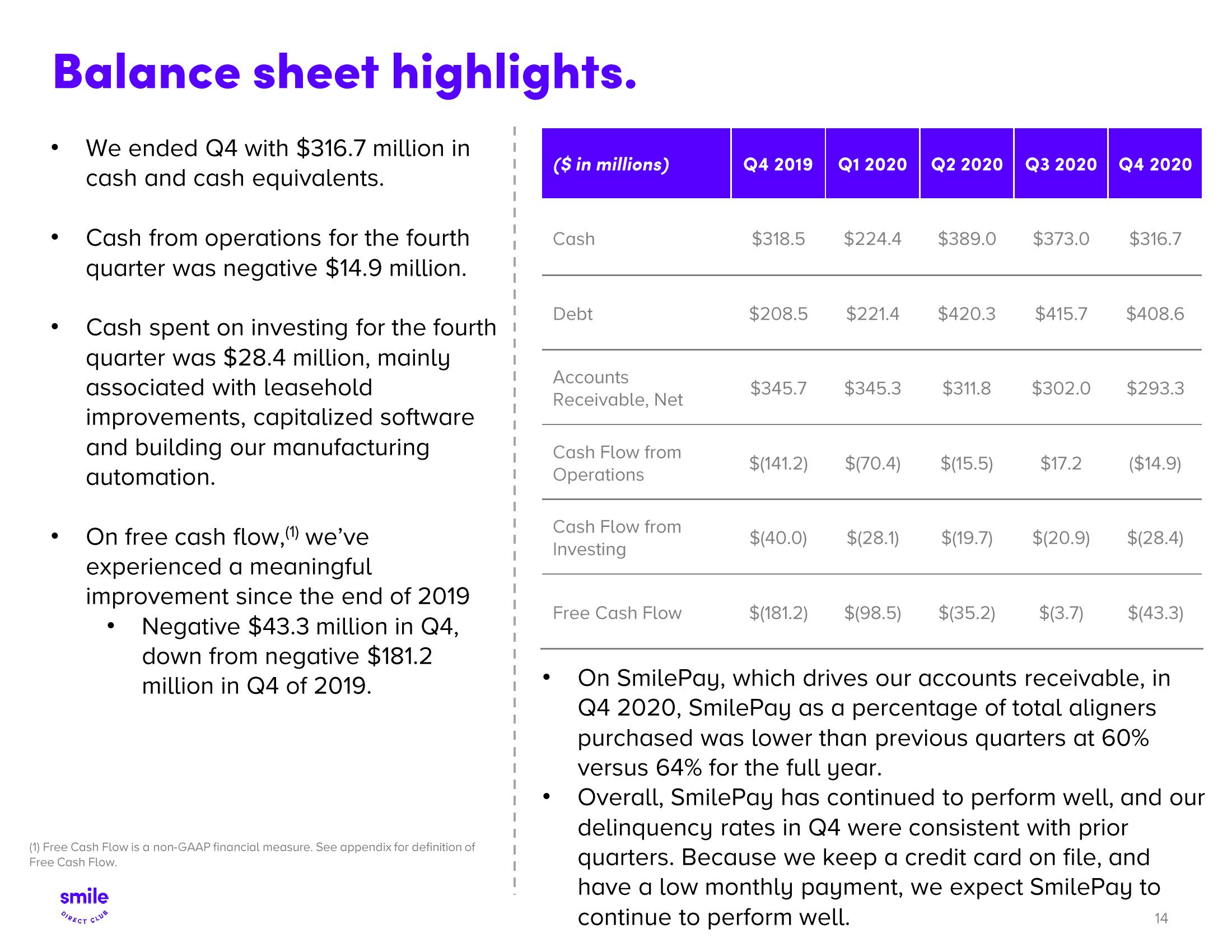

We ended Q4 with $316.7 million in

cash and cash equivalents.

●

Cash from operations for the fourth

quarter was negative $14.9 million.

Cash spent on investing for the fourth

quarter was $28.4 million, mainly

associated with leasehold

improvements, capitalized software

and building our manufacturing

automation.

On free cash flow,(1) we've

experienced a meaningful

improvement since the end of 2019

Negative $43.3 million in Q4,

down from negative $181.2

million in Q4 of 2019.

(1) Free Cash Flow is a non-GAAP financial measure. See appendix for definition of

Free Cash Flow.

smile

DIRECT CLUB

($ in millions)

Cash

Debt

Accounts

Receivable, Net

Cash Flow from

Operations

Cash Flow from

Investing

Free Cash Flow

Q4 2019

$318.5

$208.5

Q1 2020

$224.4

Q2 2020 Q3 2020 Q4 2020

$389.0

$(141.2) $(70.4)

$221.4 $420.3 $415.7

$373.0

$(15.5)

$345.7 $345.3 $311.8 $302.0 $293.3

$17.2

$316.7

$(40.0) $(28.1) $(19.7) $(20.9)

$408.6

($14.9)

$(28.4)

$(181.2) $(98.5) $(35.2) $(3.7) $(43.3)

On SmilePay, which drives our accounts receivable, in

Q4 2020, SmilePay as a percentage of total aligners

purchased was lower than previous quarters at 60%

versus 64% for the full year.

Overall, SmilePay has continued to perform well, and our

delinquency rates in Q4 were consistent with prior

quarters. Because we keep a credit card on file, and

have a low monthly payment, we expect SmilePay to

continue to perform well.

14View entire presentation