Baird Investment Banking Pitch Book

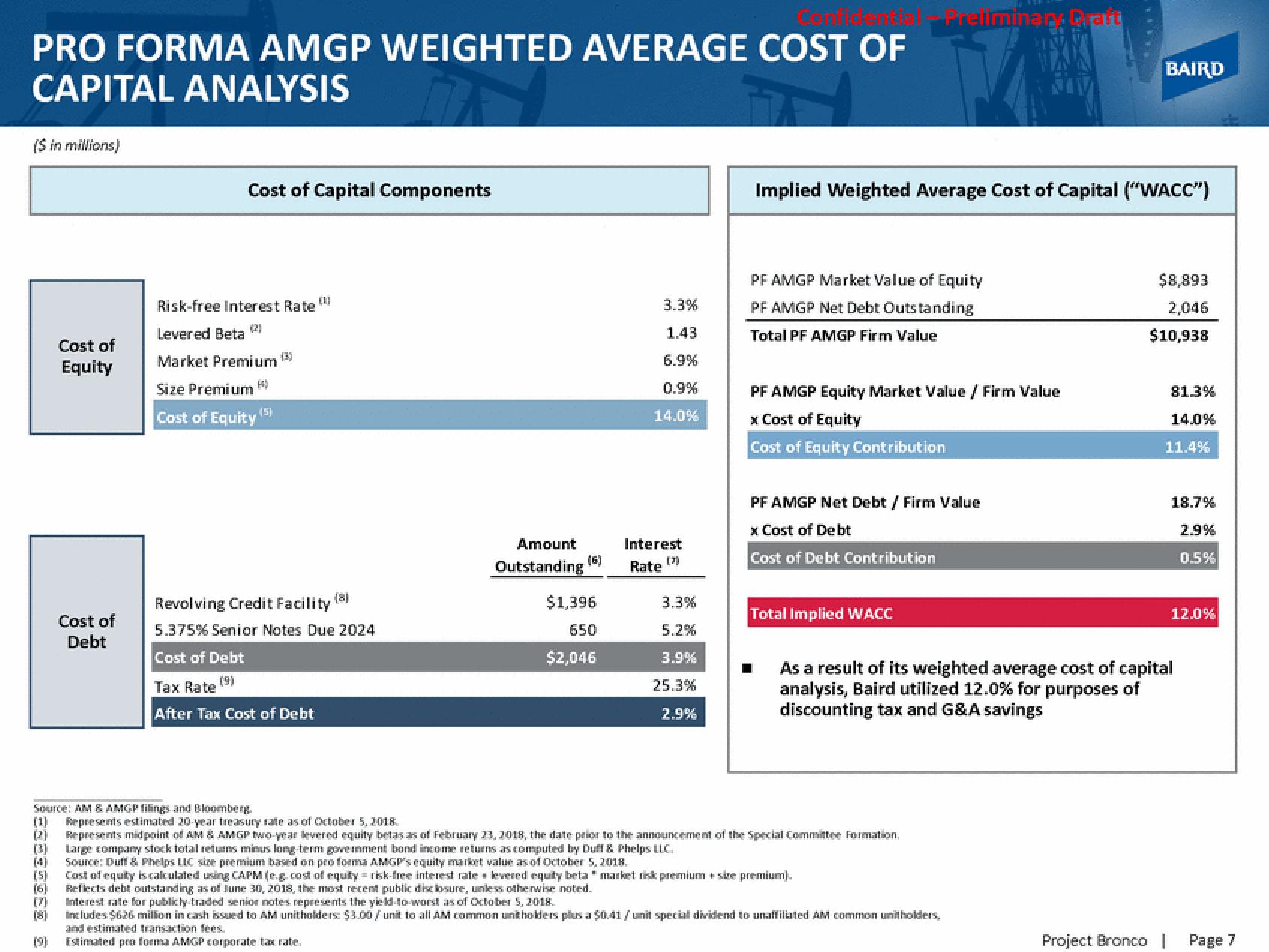

PRO FORMA AMGP WEIGHTED AVERAGE COST OF

CAPITAL ANALYSIS

H

($ in millions)

3西西安市西西园 室

(1)

[2]

(3)

(4)

Cost of

Equity

(6)

Cost of

Debt

(7)

Cost of Capital Components

Risk-free Interest Rate

Levered Beta (2)

Market Premium

Size Premium

Cost of Equity

Cost of Debt

(9)

(5)

(3)

Revolving Credit Facility

5.375% Senior Notes Due 2024

(8)

Tax Rate

After Tax Cost of Debt

Amount

Outstanding

(6)

$1,396

650

$2,046

3.3%

1.43

6.9%

0.9%

14.0%

Interest

(2)

Rate

3.3%

5.2%

3.9%

25.3%

2.9%

Source: AM & AMGP filings and Bloomberg.

Represents estimated 20-year treasury rate as of October 5, 2018

Represents midpoint of AM & AMGP two-year levered equity betas as of February 23, 2018, the date prior to the announcement of the Special Committee Formation,

Large company stock total returns minus long-term government bond income returns as computed by Duff & Phelps LLC.

Source: Duff & Phelps LLC size premium based on pro forma AMGP's equity market value as of October 5, 2018.

PF AMGP Market Value of Equity

PF AMGP Net Debt Outstanding

Total PF AMGP Firm Value

Implied Weighted Average Cost of Capital ("WACC")

PF AMGP Equity Market Value / Firm Value

x Cost of Equity

Cost of Equity Contribution

Preliminary Graft

PF AMGP Net Debt / Firm Value

x Cost of Debt

Cost of Debt Contribution

Total Implied WACC

■

(5) Cost of equity is calculated using CAPM (e.g. cost of equity risk-free interest rate levered equity beta" market risk premium size premium).

Reflects debt outstanding as of June 30, 2018, the most recent public disclosure, unless otherwise noted.

BAIRD

Interest rate for publicly traded senior notes represents the yield-to-worst as of October 5, 2018.

Includes $626 million in cash issued to AM unitholders: $3.00/unit to all AM common unitholders plus a $0.41 / unit special dividend to unaffiliated AM common unitholders,

and estimated transaction fees.

Estimated pro forma AMGP corporate tax rate.

Project Bronco

$8,893

2,046

$10,938

81.3%

14.0%

As a result of its weighted average cost of capital

analysis, Baird utilized 12.0% for purposes of

discounting tax and G&A savings

11.4%

18.7%

2.9%

0.5%

12.0%

Page 7View entire presentation