Kinnevik Results Presentation Deck

Intro

Net Asset Value

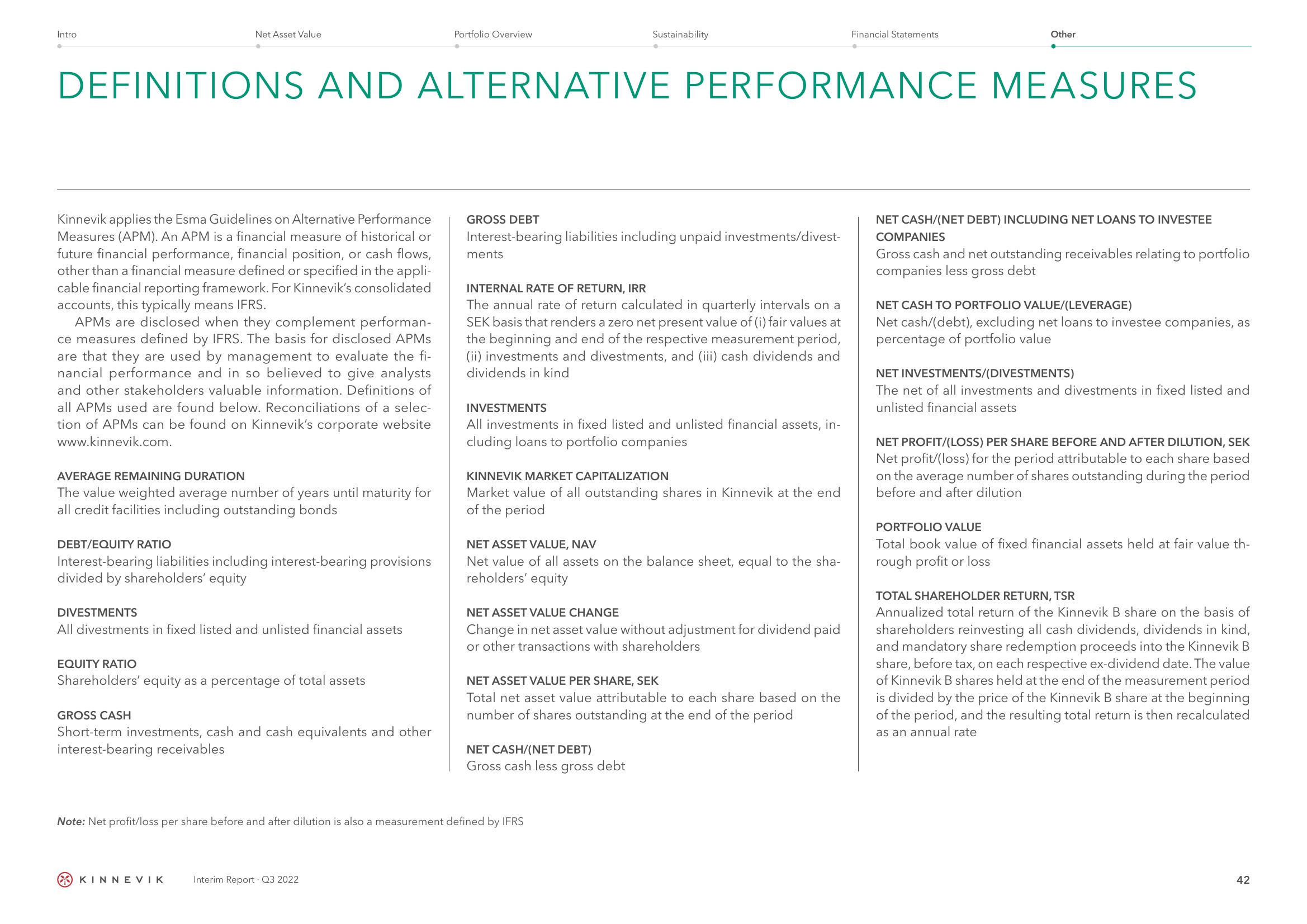

Kinnevik applies the Esma Guidelines on Alternative Performance

Measures (APM). An APM is a financial measure of historical or

future financial performance, financial position, or cash flows,

other than a financial measure defined or specified in the appli-

cable financial reporting framework. For Kinnevik's consolidated

accounts, this typically means IFRS.

APMs are disclosed when they complement performan-

ce measures defined by IFRS. The basis for disclosed APMs

are that they are used by management to evaluate the fi-

nancial performance and in so believed to give analysts

and other stakeholders valuable information. Definitions of

all APMs used are found below. Reconciliations of a selec-

tion of APMs can be found on Kinnevik's corporate website

www.kinnevik.com.

AVERAGE REMAINING DURATION

The value weighted average number of years until maturity for

all credit facilities including outstanding bonds

DEBT/EQUITY RATIO

Interest-bearing liabilities including interest-bearing provisions

divided by shareholders' equity

DEFINITIONS AND ALTERNATIVE PERFORMANCE MEASURES

DIVESTMENTS

All divestments in fixed listed and unlisted financial assets

EQUITY RATIO

Shareholders' equity as a percentage of total assets

GROSS CASH

Short-term investments, cash and cash equivalents and other

interest-bearing receivables

KINNEVIK

Portfolio Overview

Interim Report Q3 2022

GROSS DEBT

Interest-bearing liabilities including unpaid investments/divest-

ments

Sustainability

INTERNAL RATE OF RETURN, IRR

The annual rate of return calculated in quarterly intervals on a

SEK basis that renders a zero net present value of (i) fair values at

the beginning and end of the respective measurement period,

(ii) investments and divestments, and (iii) cash dividends and

dividends in kind

INVESTMENTS

All investments in fixed listed and unlisted financial assets, in-

cluding loans to portfolio companies

KINNEVIK MARKET CAPITALIZATION

Market value of all outstanding shares in Kinnevik at the end

of the period

NET ASSET VALUE, NAV

Net value of all assets on the balance sheet, equal to the sha-

reholders' equity

NET ASSET VALUE CHANGE

Change in net asset value without adjustment for dividend paid

or other transactions with shareholders

Note: Net profit/loss per share before and after dilution is also a measurement defined by IFRS

NET ASSET VALUE PER SHARE, SEK

Total net asset value attributable to each share based on the

number of shares outstanding at the end of the period

NET CASH/(NET DEBT)

Gross cash less gross debt

Financial Statements

Other

NET CASH/(NET DEBT) INCLUDING NET LOANS TO INVESTEE

COMPANIES

Gross cash and net outstanding receivables relating to portfolio

companies less gross debt

NET CASH TO PORTFOLIO VALUE/(LEVERAGE)

Net cash/(debt), excluding net loans to investee companies, as

percentage of portfolio value

NET INVESTMENTS/(DIVESTMENTS)

The net of all investments and divestments in fixed listed and

unlisted financial assets

NET PROFIT/(LOSS) PER SHARE BEFORE AND AFTER DILUTION, SEK

Net profit/(loss) for the period attributable to each share based

on the average number of shares outstanding during the period

before and after dilution

PORTFOLIO VALUE

Total book value of fixed financial assets held at fair value th-

rough profit or loss

TOTAL SHAREHOLDER RETURN, TSR

Annualized total return of the Kinnevik B share on the basis of

shareholders reinvesting all cash dividends, dividends in kind,

and mandatory share redemption proceeds into the Kinnevik B

share, before tax, on each respective ex-dividend date. The value

of Kinnevik B shares held at the end of the measurement period

is divided by the price of the Kinnevik B share at the beginning

of the period, and the resulting total return is then recalculated

as an annual rate

42View entire presentation