J.P.Morgan Results Presentation Deck

Asset & Wealth Management¹

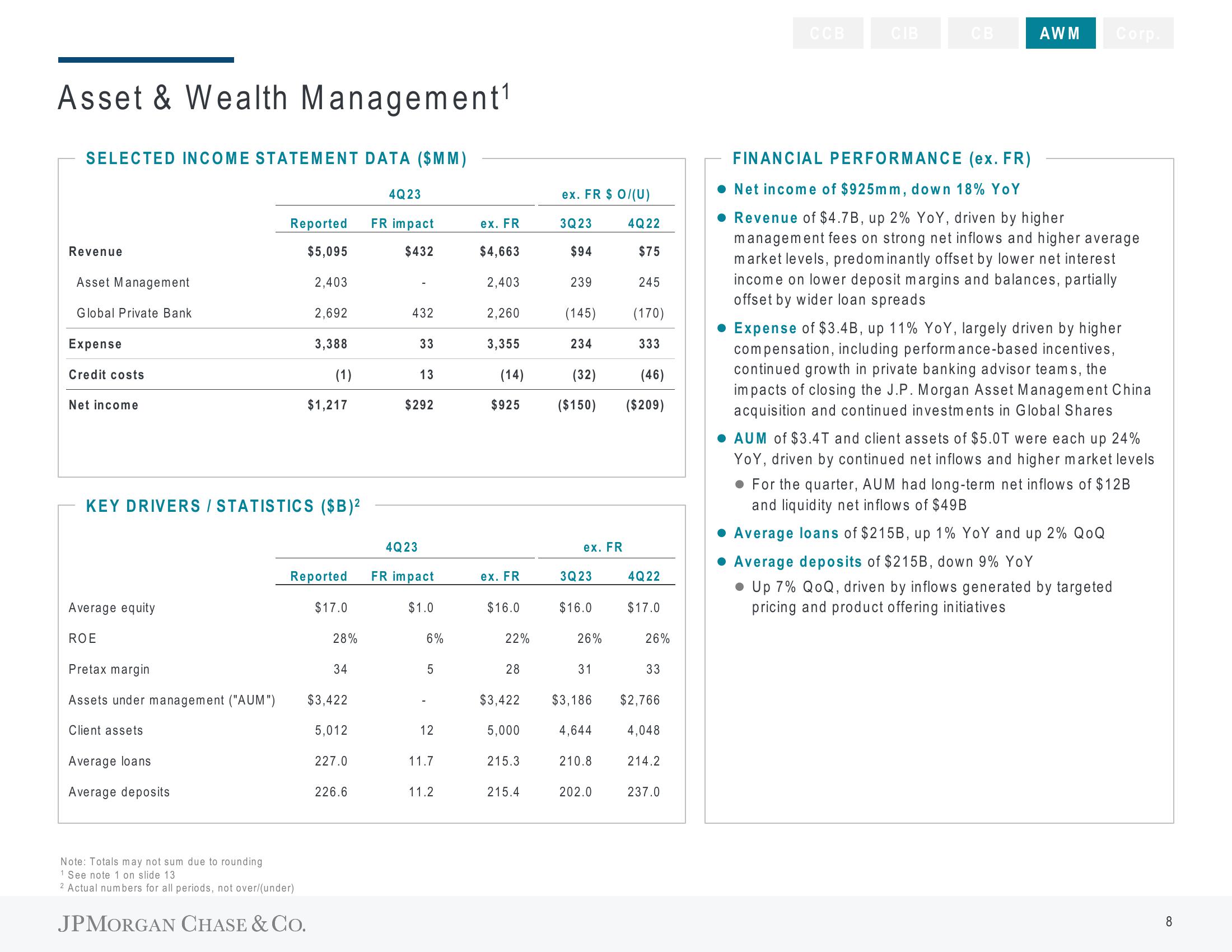

SELECTED INCOME STATEMENT DATA ($MM)

Revenue

Asset Management

Global Private Bank

Expense

Credit costs

Net income

Average equity

ROE

Pretax margin

Assets under management ("AUM")

KEY DRIVERS / STATISTICS ($B)²

Client assets

Reported

$5,095

2,403

Average loans

Average deposits

2,692

3,388

(1)

$1,217

Note: Totals may not sum due to rounding

1 See note 1 on slide 13

2 Actual numbers for all periods, not over/(under)

JPMORGAN CHASE & CO.

Reported

$17.0

28%

34

$3,422

5,012

227.0

226.6

4Q23

FR impact

$432

432

33

4Q23

13

$292

FR impact

$1.0

6%

5

12

11.7

11.2

ex. FR

$4,663

2,403

2,260

3,355

(14)

$925

ex. FR

$16.0

22%

28

$3,422

5,000

215.3

215.4

ex. FR $ 0/(U)

3Q23

$94

239

ex. FR

(145) (170)

234

3Q23

$16.0

(32) (46)

($150) ($209)

26%

31

$3,186

4,644

4Q22

210.8

$75

202.0

245

333

4Q22

$17.0

26%

33

$2,766

4,048

214.2

237.0

CCB

CIB

AWM Corp.

FINANCIAL PERFORMANCE (ex. FR)

Net income of $925mm, down 18% YoY

Revenue of $4.7B, up 2% YoY, driven by higher

management fees on strong net inflows and higher average

market levels, predominantly offset by lower net interest

income on lower deposit margins and balances, partially

offset by wider loan spreads

Expense of $3.4B, up 11% YoY, largely driven by higher

compensation, including performance-based incentives,

continued growth in private banking advisor teams, the

impacts of closing the J.P. Morgan Asset Management China

acquisition and continued investments in Global Shares

AUM of $3.4T and client assets of $5.0T were each up 24%

YoY, driven by continued net inflows and higher market levels

. For the quarter, AUM had long-term net inflows of $12B

and liquidity net inflows of $49B

Average loans of $215B, up 1% YoY and up 2% QOQ

Average deposits of $215B, down 9% YoY

Up 7% QoQ, driven by inflows generated by targeted

pricing and product offering initiatives

8View entire presentation