Antofagasta Results Presentation Deck

12345

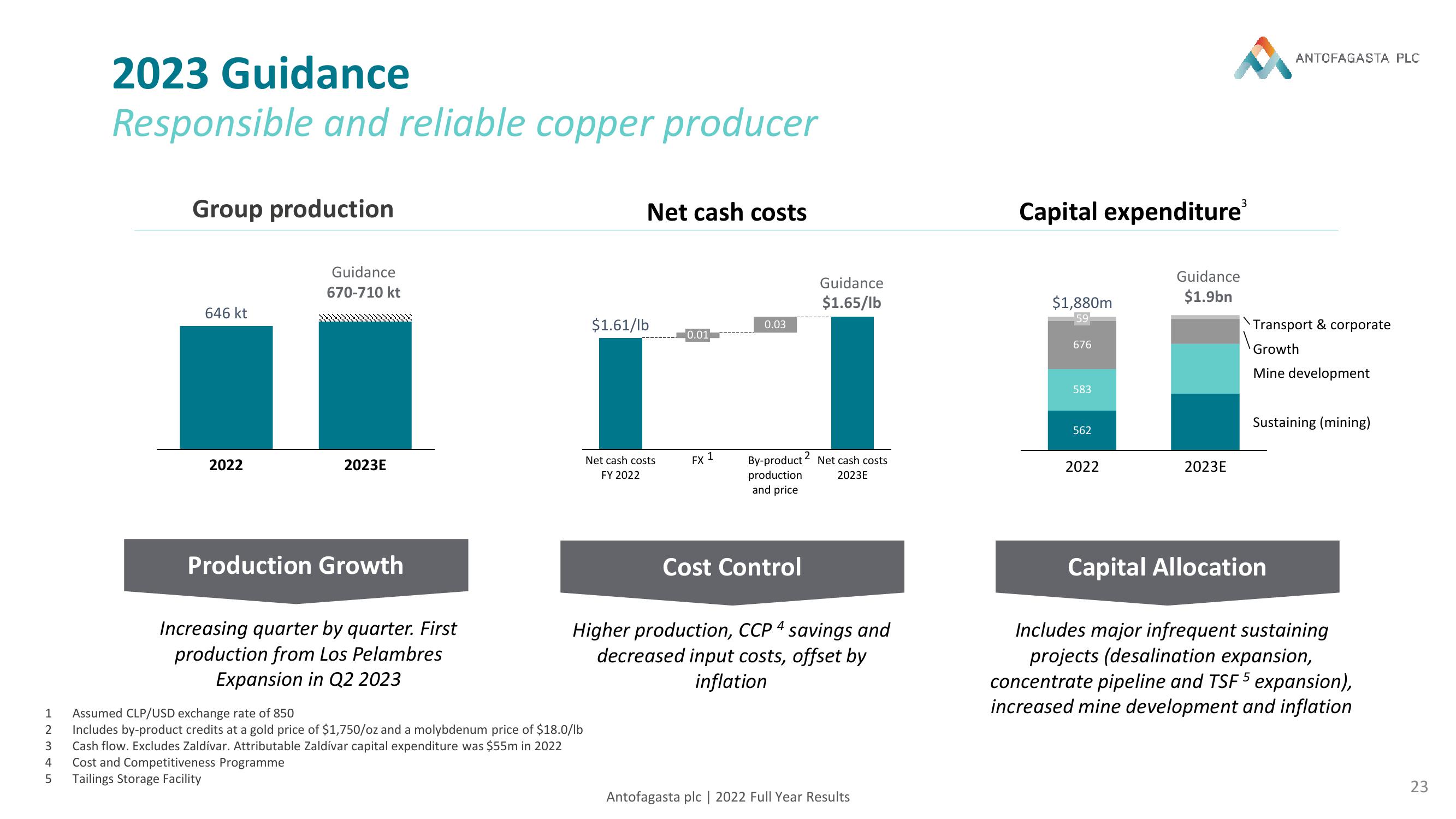

2023 Guidance

Responsible and reliable copper producer

Group production

646 kt

2022

Guidance

670-710 kt

2023E

Production Growth

Increasing quarter by quarter. First

production from Los Pelambres

Expansion in Q2 2023

Net cash costs

Assumed CLP/USD exchange rate of 850

Includes by-product credits at a gold price of $1,750/oz and a molybdenum price of $18.0/lb

Cash flow. Excludes Zaldívar. Attributable Zaldívar capital expenditure was $55m in 2022

Cost and Competitiveness Programme

Tailings Storage Facility

$1.61/lb

Net cash costs

FY 2022

0.01

FX

0.03

Guidance

$1.65/lb

By-product Net cash costs

production 2023E

and price

Cost Control

Higher production, CCP 4 savings and

decreased input costs, offset by

inflation

Antofagasta plc | 2022 Full Year Results

Capital expenditure³

$1,880m

59

676

583

562

2022

Guidance

$1.9bn

2023E

b

ANTOFAGASTA PLC

Transport & corporate

Growth

Mine development

Sustaining (mining)

Capital Allocation

Includes major infrequent sustaining

projects (desalination expansion,

concentrate pipeline and TSF 5 expansion),

increased mine development and inflation

23View entire presentation