Liberty Global Results Presentation Deck

RECONCILIATIONS

CENTRALLY-HELD P&E

LESS P&E ADDITIONS

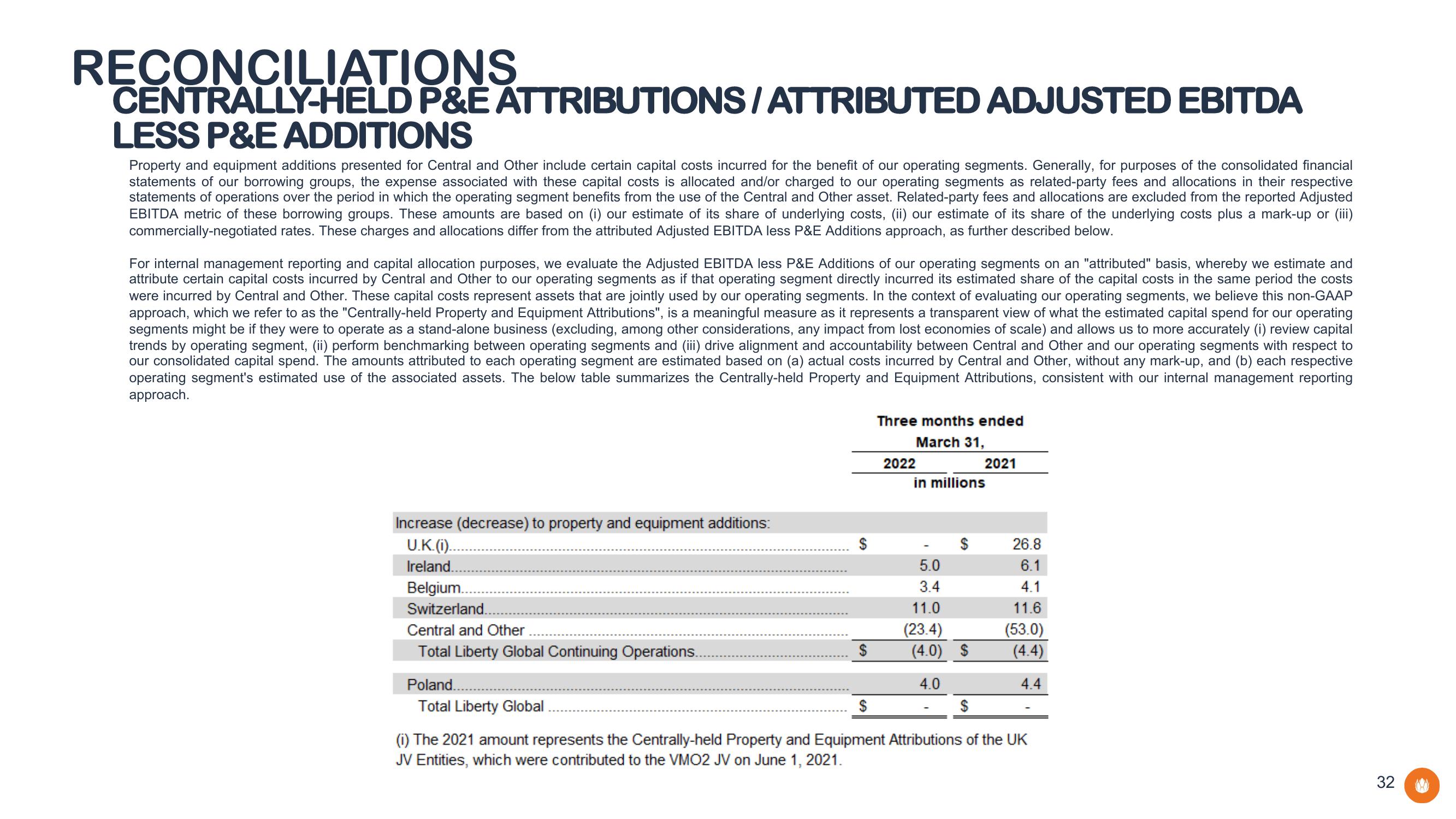

Property and equipment additions presented for Central and Other include certain capital costs incurred for the benefit of our operating segments. Generally, for purposes of the consolidated financial

statements of our borrowing groups, the expense associated with these capital costs is allocated and/or charged to our operating segments as related-party fees and allocations in their respective

statements of operations over the period in which the operating segment benefits from the use of the Central and Other asset. Related-party fees and allocations are excluded from the reported Adjusted

EBITDA metric of these borrowing groups. These amounts are based on (i) our estimate of its share of underlying costs, (ii) our estimate of its share of the underlying costs plus a mark-up or (iii)

commercially-negotiated rates. These charges and allocations differ from the attributed Adjusted EBITDA less P&E Additions approach, as further described below.

ATTRIBUTIONS/ATTRIBUTED ADJUSTED EBITDA

UTION

For internal management reporting and capital allocation purposes, we evaluate the Adjusted EBITDA less P&E Additions of our operating segments on an "attributed" basis, whereby we estimate and

attribute certain capital costs incurred by Central and Other to our operating segments as if that operating segment directly incurred its estimated share of the capital costs in the same period the costs

were incurred by Central and Other. These capital costs represent assets that are jointly used by our operating segments. In the context of evaluating our operating segments, we believe this non-GAAP

approach, which we refer to as the "Centrally-held Property and Equipment Attributions", is a meaningful measure as it represents a transparent view of what the estimated capital spend for our operating

segments might be if they were to operate as a stand-alone business (excluding, among other considerations, any impact from lost economies of scale) and allows us to more accurately (i) review capital

trends by operating segment, (ii) perform benchmarking between operating segments and (iii) drive alignment and accountability between Central and Other and our operating segments with respect to

our consolidated capital spend. The amounts attributed to each operating segment are estimated based on (a) actual costs incurred by Central and Other, without any mark-up, and (b) each respective

operating segment's estimated use of the associated assets. The below table summarizes the Centrally-held Property and Equipment Attributions, consistent with our internal management reporting

approach.

Increase (decrease) to property and equipment additions:

U.K.(1)..

Ireland.

Belgium...

Switzerland.

Central and Other

Total Liberty Global Continuing Operations..

Poland..

Total Liberty Global

$

Three months ended

March 31,

2022

in millions

5.0

3.4

11.0

(23.4)

2021

(4.0) $

4.0

26.8

6.1

4.1

11.6

(53.0)

(4.4)

4.4

$

(i) The 2021 amount represents the Centrally-held Property and Equipment Attributions of the UK

JV Entities, which were contributed to the VMO2 JV on June 1, 2021.

32View entire presentation