Credit Suisse Results Presentation Deck

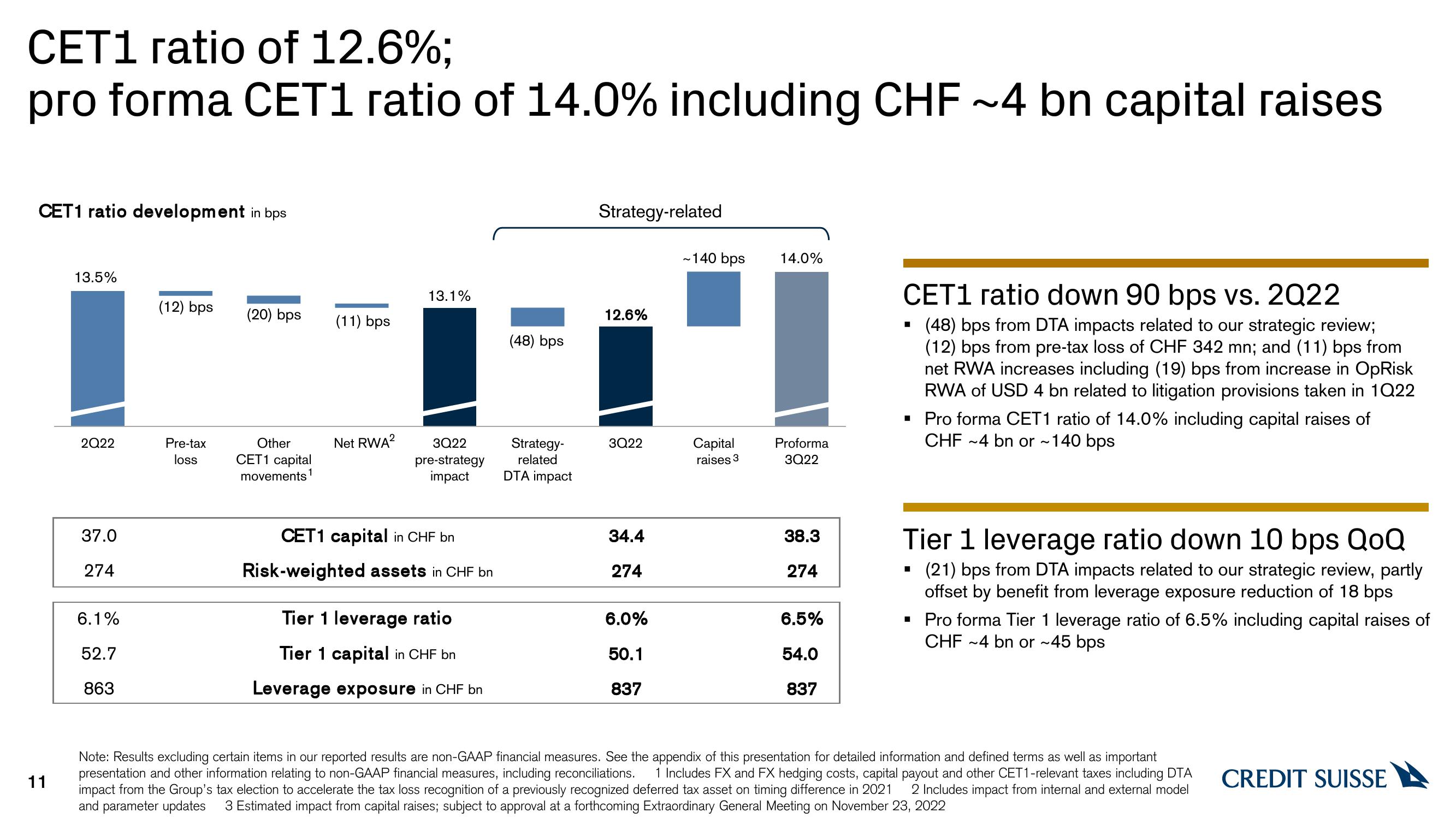

CET1 ratio of 12.6%;

pro forma CET1 ratio of 14.0% including CHF ~4 bn capital raises

CET1 ratio development in bps

11

13.5%

2Q22

37.0

274

6.1%

52.7

863

(12) bps

Pre-tax

loss

(20) bps

Other

CET1 capital

1

movements

(11) bps

Net RWA²

13.1%

3Q22

pre-strategy

impact

CET1 capital in CHF bn

Risk-weighted assets in CHF bn

Tier 1 leverage ratio

Tier 1 capital in CHF bn

Leverage exposure in CHF bn

(48) bps

Strategy-

related

DTA impact

Strategy-related

12.6%

3Q22

34.4

274

6.0%

50.1

837

~140 bps

14.0%

Capital Proforma

raises 3

3Q22

38.3

274

6.5%

54.0

837

CET1 ratio down 90 bps vs. 2Q22

(48) bps from DTA impacts related to our strategic review;

(12) bps from pre-tax loss of CHF 342 mn; and (11) bps from

net RWA increases including (19) bps from increase in OpRisk

RWA of USD 4 bn related to litigation provisions taken in 1Q22

▪ Pro forma CET1 ratio of 14.0% including capital raises of

CHF-4 bn or ~140 bps

Tier 1 leverage ratio down 10 bps QoQ

(21) bps from DTA impacts related to our strategic review, partly

offset by benefit from leverage exposure reduction of 18 bps

▪ Pro forma Tier 1 leverage ratio of 6.5% including capital raises of

CHF ~4 bn or ~45 bps

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Includes FX and FX hedging costs, capital payout and other CET1-relevant taxes including DTA

impact from the Group's tax election to accelerate the tax loss recognition of a previously recognized deferred tax asset on timing difference in 2021 2 Includes impact from internal and external model

and parameter updates 3 Estimated impact from capital raises; subject to approval at a forthcoming Extraordinary General Meeting on November 23, 2022

CREDIT SUISSEView entire presentation