AMC Mergers and Acquisitions Presentation Deck

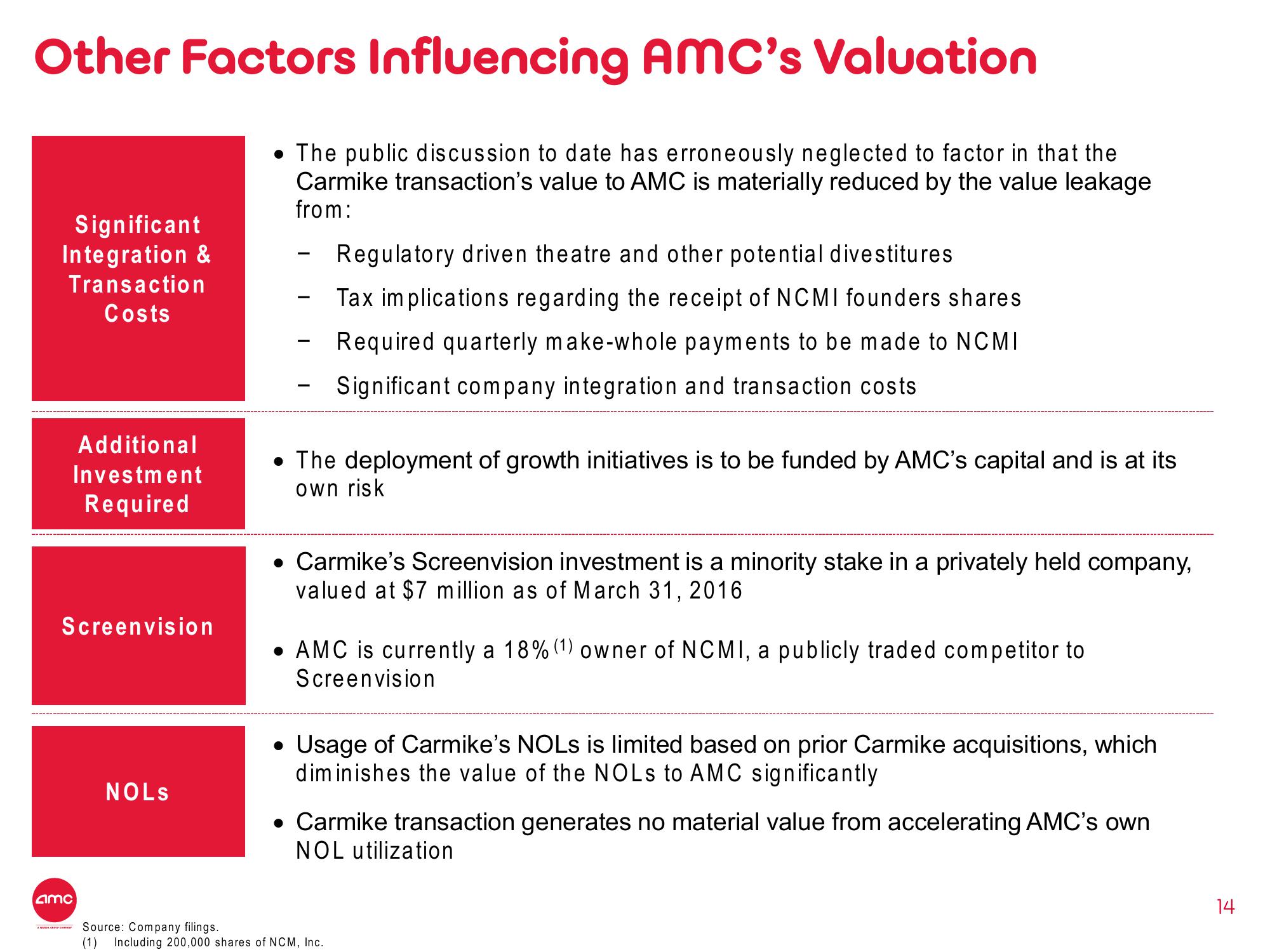

Other Factors Influencing AMC's Valuation

Significant

Integration &

Transaction

Costs

Additional

Investment

Required

Screenvision

amc

NOLS

• The public discussion to date has erroneously neglected to factor in that the

Carmike transaction's value to AMC is materially reduced by the value leakage

from:

-

• The deployment of growth initiatives is to be funded by AMC's capital and is at its

own risk

●

Regulatory driven theatre and other potential divestitures

Tax implications regarding the receipt of NCMI founders shares

Required quarterly make-whole payments to be made to NCMI

Significant company integration and transaction costs

• Carmike's Screenvision investment is a minority stake in a privately held company,

valued at $7 million as of March 31, 2016

AMC is currently a 18% (1) owner of NCMI, a publicly traded competitor to

Screenvision

Usage of Carmike's NOLs is limited based on prior Carmike acquisitions, which

diminishes the value of the NOLs to AMC significantly

• Carmike transaction generates no material value from accelerating AMC's own

NOL utilization

Source: Company filings.

(1) Including 200,000 shares of NCM, Inc.

14View entire presentation