Third Quarter Fiscal 2023

CASH FLOW AND METRICS

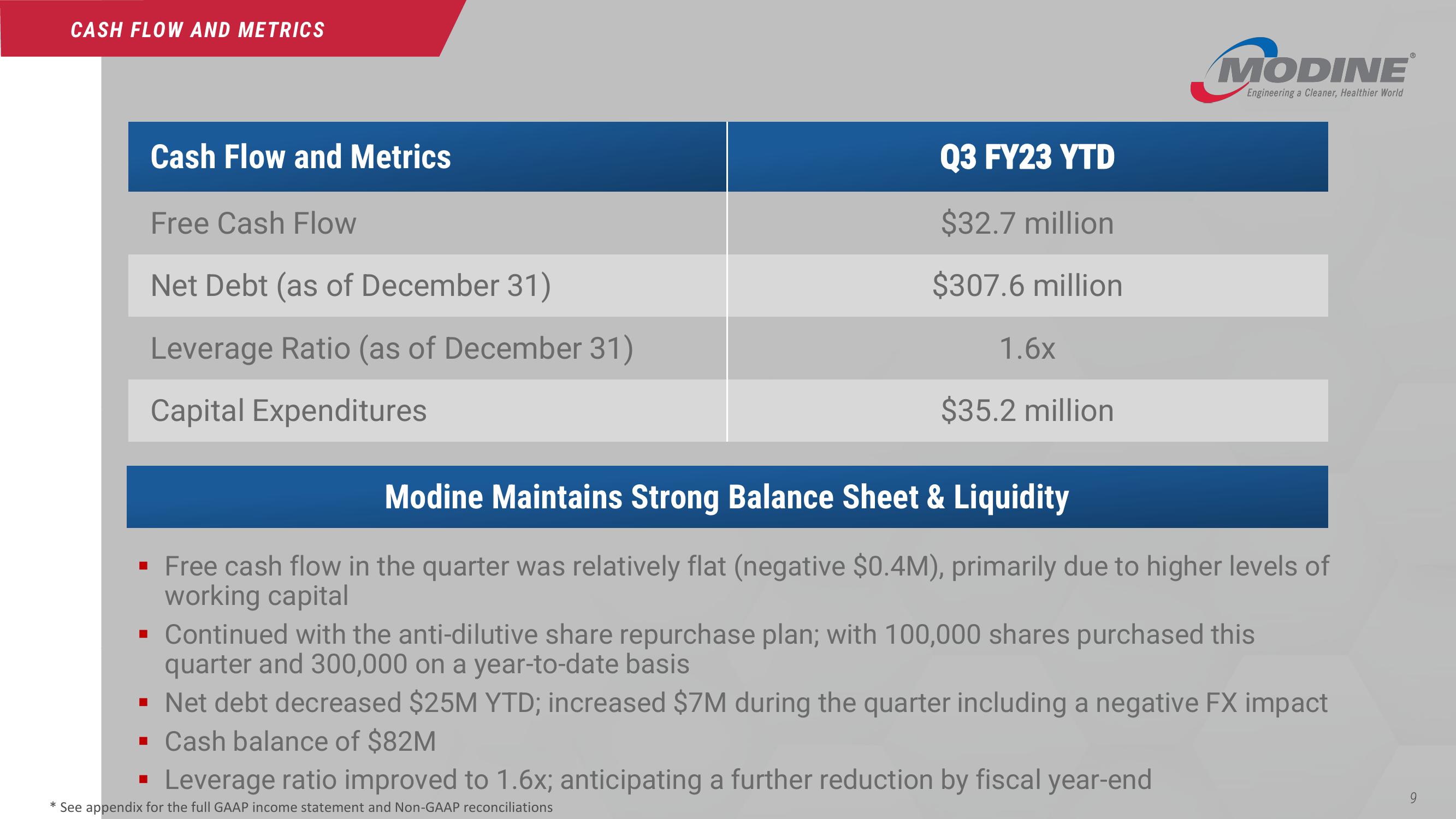

Cash Flow and Metrics

Free Cash Flow

Net Debt (as of December 31)

Leverage Ratio (as of December 31)

Capital Expenditures

Q3 FY23 YTD

$32.7 million

$307.6 million

1.6x

$35.2 million

Modine Maintains Strong Balance Sheet & Liquidity

▪ Free cash flow in the quarter was relatively flat (negative $0.4M), primarily due to higher levels of

working capital

* See appendix for the full GAAP income statement and Non-GAAP reconciliations

MODINE

Engineering a Cleaner, Healthier World

▪ Continued with the anti-dilutive share repurchase plan; with 100,000 shares purchased this

quarter and 300,000 on a year-to-date basis

▪ Net debt decreased $25M YTD; increased $7M during the quarter including a negative FX impact

▪ Cash balance of $82M

Leverage ratio improved to 1.6x; anticipating a further reduction by fiscal year-end

9View entire presentation