Navitas SPAC Presentation Deck

Transaction Summary

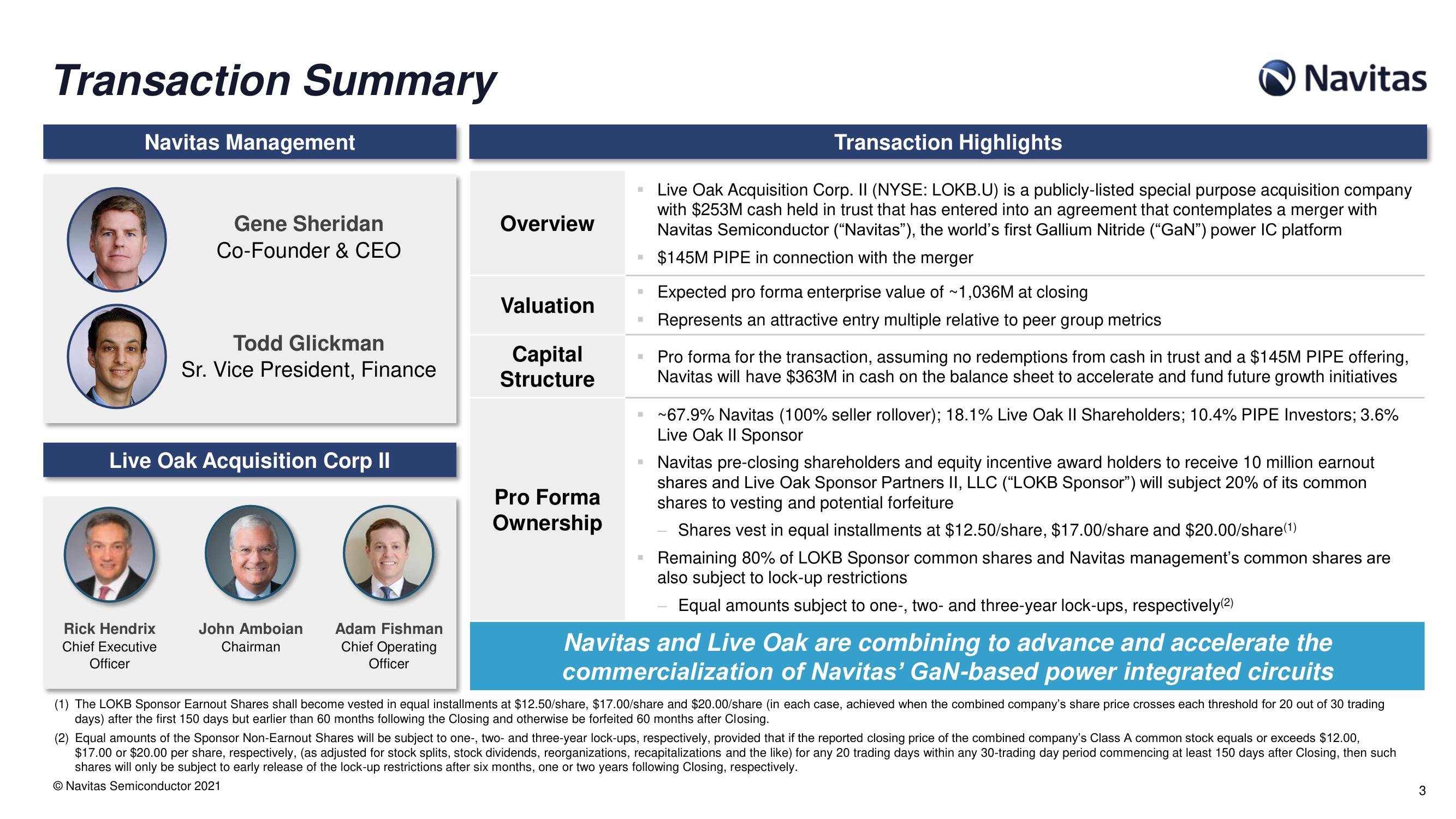

Navitas Management

Gene Sheridan

Co-Founder & CEO

Rick Hendrix

Chief Executive

Officer

Todd Glickman

Sr. Vice President, Finance

Live Oak Acquisition Corp II

John Amboian

Chairman

Adam Fishman

Chief Operating

Officer

Overview

Valuation

Capital

Structure

Pro Forma

Ownership

M

Navitas

Transaction Highlights

Live Oak Acquisition Corp. II (NYSE: LOKB.U) is a publicly-listed special purpose acquisition company

with $253M cash held in trust that has entered into an agreement that contemplates a merger with

Navitas Semiconductor ("Navitas"), the world's first Gallium Nitride ("GaN") power IC platform

$145M PIPE in connection with the merger

Expected pro forma enterprise value of ~1,036M at closing

Represents an attractive entry multiple relative to peer group metrics

Pro forma for the transaction, assuming no redemptions from cash in trust and a $145M PIPE offering,

Navitas will have $363M in cash on the balance sheet to accelerate and fund future growth initiatives

▪ ~67.9% Navitas (100% seller rollover); 18.1% Live Oak II Shareholders; 10.4% PIPE Investors; 3.6%

Live Oak II Sponsor

Navitas pre-closing shareholders and equity incentive award holders to receive 10 million earnout

shares and Live Oak Sponsor Partners II, LLC ("LOKB Sponsor") will subject 20% of its common

shares to vesting and potential forfeiture

Shares vest in equal installments at $12.50/share, $17.00/share and $20.00/share(1)

Remaining 80% of LOKB Sponsor common shares and Navitas management's common shares are

also subject to lock-up restrictions

Equal amounts subject to one-, two- and three-year lock-ups, respectively(2)

Navitas and Live Oak are combining to advance and accelerate the

commercialization of Navitas' GaN-based power integrated circuits

(1) The LOKB Sponsor Earnout Shares shall become vested in equal installments at $12.50/share, $17.00/share and $20.00/share (in each case, achieved when the combined company's share price crosses each threshold for 20 out of 30 trading

days) after the first 150 days but earlier than 60 months following the Closing and otherwise be forfeited 60 months after Closing.

(2) Equal amounts of the Sponsor Non-Earnout Shares will be subject to one-, two- and three-year lock-ups, respectively, provided that if the reported closing price of the combined company's Class A common stock equals or exceeds $12.00,

$17.00 or $20.00 per share, respectively, (as adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like) for any 20 trading days within any 30-trading day period commencing at least 150 days after Closing, then such

shares will only be subject to early release of the lock-up restrictions after six months, one or two years following Closing, respectively.

O Navitas Semiconductor 2021

3View entire presentation