Selina SPAC

Selina Has a Highly Visible Path to Increased Profitability

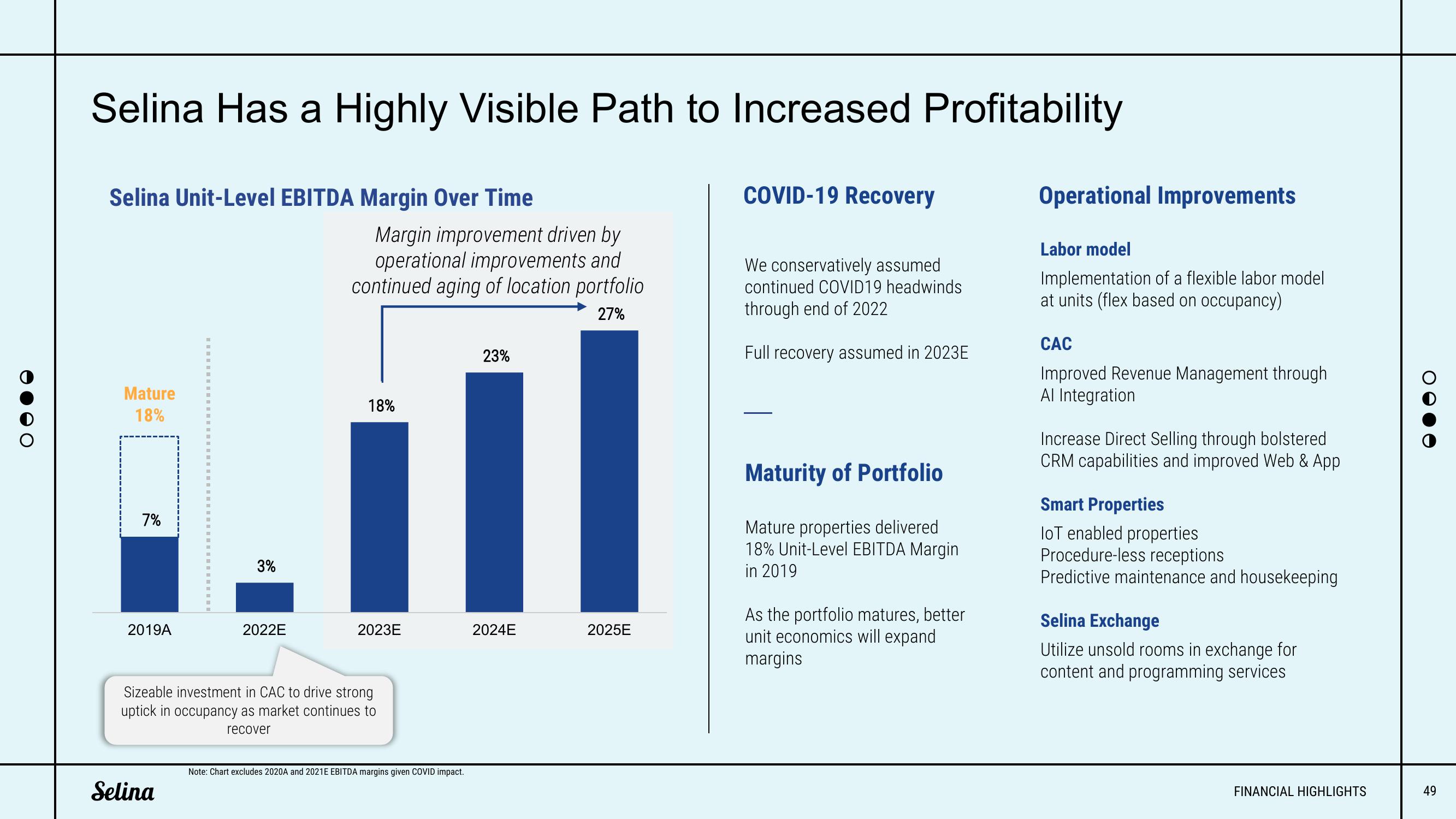

Selina Unit-Level EBITDA Margin Over Time

Mature

18%

7%

2019A

M

H

1

Selina

m

1

m

m

1

-

B

-

U

■

M

3%

2022E

Margin improvement driven by

operational improvements and

continued aging of location portfolio

27%

18%

2023E

Sizeable investment in CAC to drive strong

uptick in occupancy as market continues to

recover

Note: Chart excludes 2020A and 2021E EBITDA margins given COVID impact.

23%

2024E

2025E

COVID-19 Recovery

We conservatively assumed

continued COVID19 headwinds

through end of 2022

Full recovery assumed in 2023E

Maturity of Portfolio

Mature properties delivered

18% Unit-Level EBITDA Margin

in 2019

As the portfolio matures, better

unit economics will expand

margins

Operational Improvements

Labor model

Implementation of a flexible labor model

at units (flex based on occupancy)

CAC

Improved Revenue Management through

Al Integration

Increase Direct Selling through bolstered

CRM capabilities and improved Web & App

Smart Properties

loT enabled properties

Procedure-less receptions

Predictive maintenance and housekeeping

Selina Exchange

Utilize unsold rooms in exchange for

content and programming services

FINANCIAL HIGHLIGHTS

49View entire presentation