Perfect SPAC Presentation Deck

PERFECT

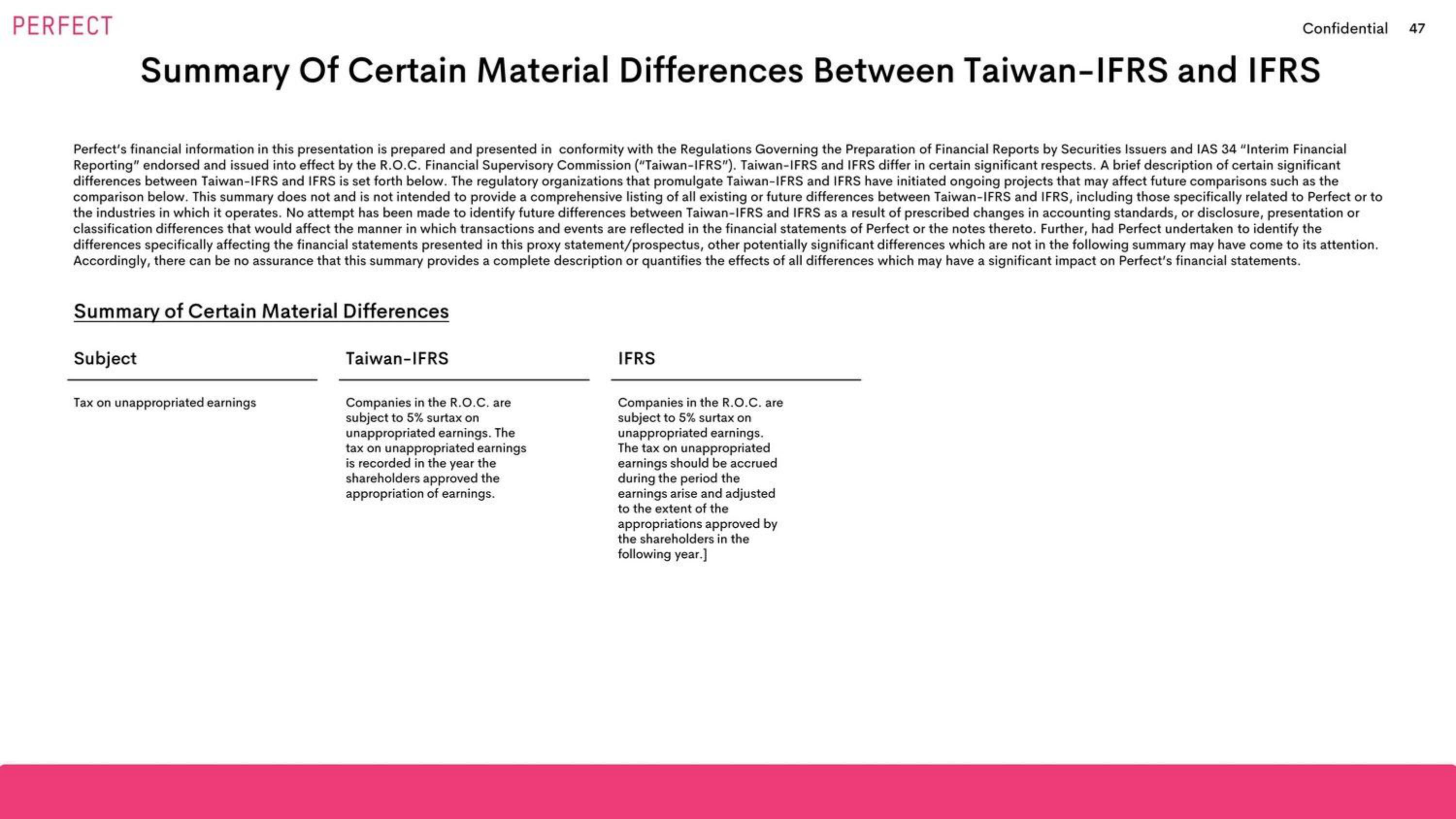

Summary Of Certain Material Differences Between Taiwan-IFRS and IFRS

Perfect's financial information in this presentation is prepared and presented in conformity with the Regulations Governing the Preparation of Financial Reports by Securities Issuers and IAS 34 "Interim Financial

Reporting" endorsed and issued into effect by the R.O.C. Financial Supervisory Commission ("Taiwan-IFRS"). Taiwan-IFRS and IFRS differ in certain significant respects. A brief description of certain significant

differences between Taiwan-IFRS and IFRS is set forth below. The regulatory organizations that promulgate Taiwan-IFRS and IFRS have initiated ongoing projects that may affect future comparisons such as the

comparison below. This summary does not and is not intended to provide a comprehensive listing of all existing or future differences between Taiwan-IFRS and IFRS, including those specifically related to Perfect or to

the industries in which it operates. No attempt has been made to identify future differences between Taiwan-IFRS and IFRS as a result of prescribed changes in accounting standards, or disclosure, presentation or

classification differences that would affect the manner in which transactions and events are reflected in the financial statements of Perfect or the notes thereto. Further, had Perfect undertaken to identify the

differences specifically affecting the financial statements presented in this proxy statement/prospectus, other potentially significant differences which are not in the following summary may have come to its attention.

Accordingly, there can be no assurance that this summary provides a complete description or quantifies the effects of all differences which may have a significant impact on Perfect's financial statements.

Summary of Certain Material Differences

Subject

Tax on unappropriated earnings

Taiwan-IFRS

Companies in the R.O.C. are

subject to 5% surtax on

unappropriated earnings. The

tax on unappropriated earnings

is recorded in the year the

shareholders approved the

appropriation of earnings.

IFRS

Confidential 47

Companies in the R.O.C. are

subject to 5% surtax on

unappropriated earnings.

The tax on unappropriated

earnings should be accrued

during the period the

earnings arise and adjusted

to the extent of the

appropriations approved by

the shareholders in the

following year.]View entire presentation