Sonos Investor Presentation Deck

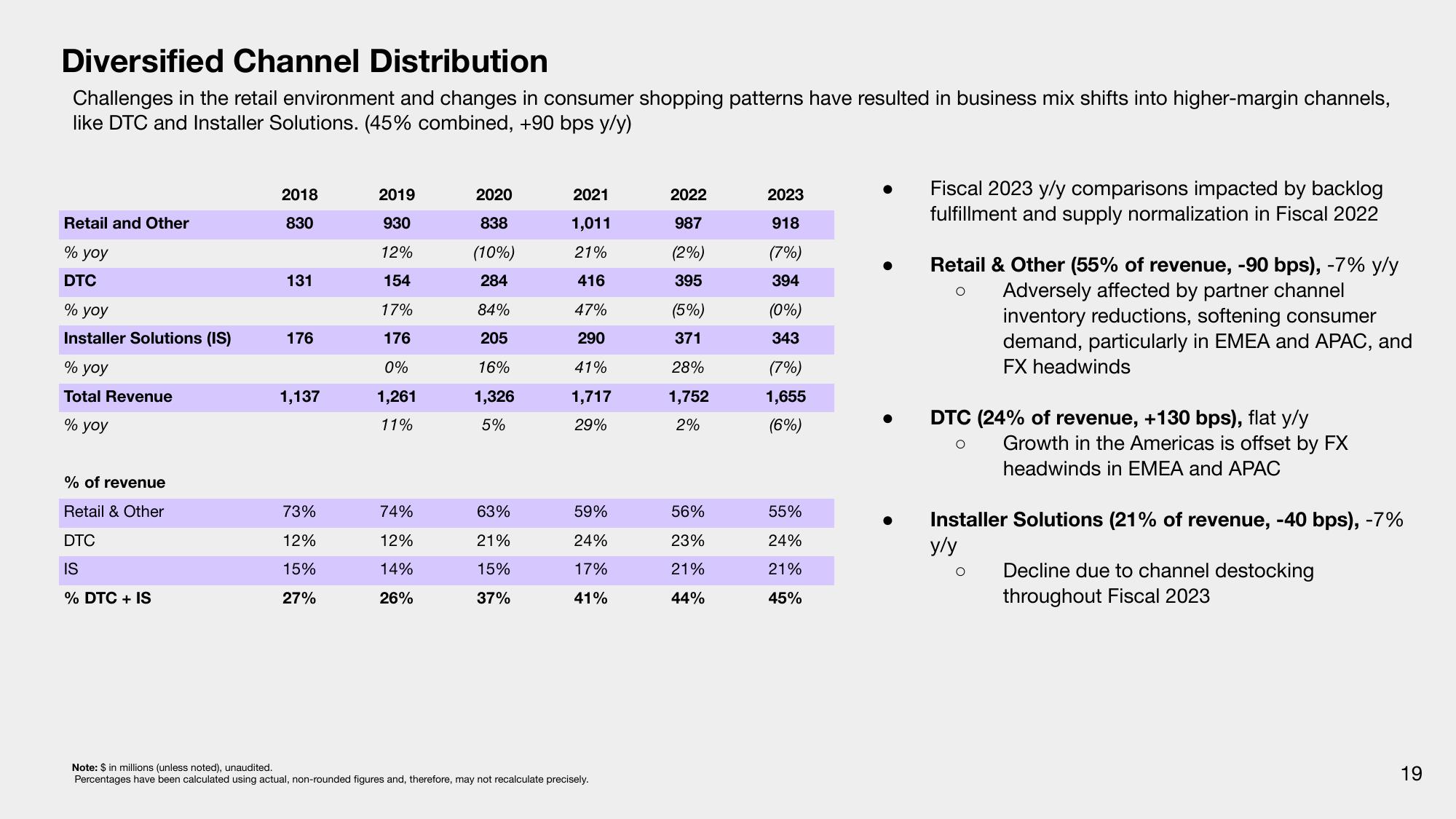

Diversified Channel Distribution

Challenges in the retail environment and changes in consumer shopping patterns have resulted in business mix shifts into higher-margin channels,

like DTC and Installer Solutions. (45% combined, +90 bps y/y)

Retail and Other

% yoy

DTC

% yoy

Installer Solutions (IS)

% yoy

Total Revenue

% yoy

% of revenue

Retail & Other

DTC

IS

% DTC + IS

2018

830

131

176

1,137

73%

12%

15%

27%

2019

930

12%

154

17%

176

0%

1,261

11%

74%

12%

14%

26%

2020

838

(10%)

284

84%

205

16%

1,326

5%

63%

21%

15%

37%

2021

1,011

21%

416

47%

290

41%

1,717

29%

59%

24%

17%

41%

Note: $ in millions (unless noted), unaudited.

Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

2022

987

(2%)

395

(5%)

371

28%

1,752

2%

56%

23%

21%

44%

2023

918

(7%)

394

(0%)

343

(7%)

1,655

(6%)

55%

24%

21%

45%

Fiscal 2023 y/y comparisons impacted by backlog

fulfillment and supply normalization in Fiscal 2022

Retail & Other (55% of revenue, -90 bps), -7% y/y

Adversely affected by partner channel

O

inventory reductions, softening consumer

demand, particularly in EMEA and APAC, and

FX headwinds

DTC (24% of revenue, +130 bps), flat y/y

O

Growth in the Americas is offset by FX

headwinds in EMEA and APAC

Installer Solutions (21% of revenue, -40 bps), -7%

y/y

O

Decline due to channel destocking

throughout Fiscal 2023

19View entire presentation