Repay SPAC

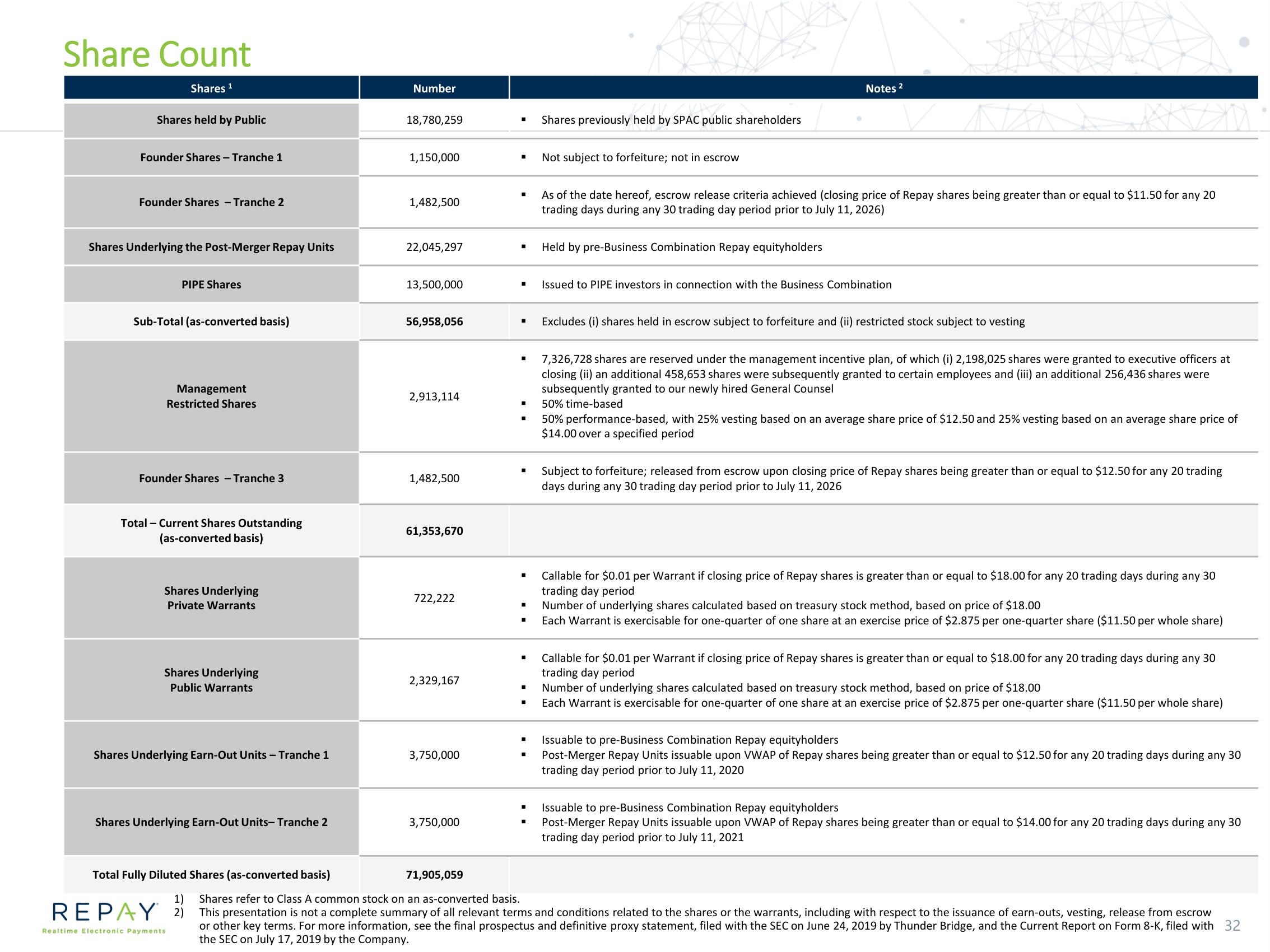

Share Count

Shares ¹

Shares held by Public

Founder Shares - Tranche 1

Founder Shares - Tranche 2

Shares Underlying the Post-Merger Repay Units

PIPE Shares

Sub-Total (as-converted basis)

Management

Restricted Shares

Founder Shares - Tranche 3

Total Current Shares Outstanding

(as-converted basis)

Shares Underlying

Private Warrants

Shares Underlying

Public Warrants

Shares Underlying Earn-Out Units - Tranche 1

Shares Underlying Earn-Out Units- Tranche 2

Total Fully Diluted Shares (as-converted basis)

1)

REPAY 2)

Realtime Electronic Payments

Number

18,780,259

1,150,000

1,482,500

22,045,297

13,500,000

56,958,056

2,913,114

1,482,500

61,353,670

722,222

2,329,167

3,750,000

3,750,000

71,905,059

■

I

I

I

I

I

■ Issued to PIPE investors in connection with the Business Combination

I

■

■

I

I

I 50% time-based

50% performance-based, with 25% vesting based on an average share price of $12.50 and 25% vesting based on an average share price of

$14.00 over a specified period

■

Shares previously held by SPAC public shareholders

·

Not subject to forfeiture; not in escrow

■

Notes ²

Held by pre-Business Combination Repay equityholders

As of the date hereof, escrow release criteria achieved (closing price of Repay shares being greater than or equal to $11.50 for any 20

trading days during any 30 trading day period prior to July 11, 2026)

NA

Excludes (i) shares held in escrow subject to forfeiture and (ii) restricted stock subject to vesting

7,326,728 shares are reserved under the management incentive plan, of which (i) 2,198,025 shares were granted to executive officers at

closing (ii) an additional 458,653 shares were subsequently granted to certain employees and (iii) an additional 256,436 shares were

subsequently granted to our newly hired General Counsel

Subject to forfeiture; released from escrow upon closing price of Repay shares being greater than or equal to $12.50 for any 20 trading

days during any 30 trading day period prior to July 11, 2026

Callable for $0.01 per Warrant if closing price of Repay shares is greater than or equal to $18.00 for any 20 trading days during any 30

trading day period

Number of underlying shares calculated based on treasury stock method, based on price of $18.00

Each Warrant is exercisable for one-quarter of one share at an exercise price of $2.875 per one-quarter share ($11.50 per whole share)

Callable for $0.01 per Warrant if closing price of Repay shares is greater than or equal to $18.00 for any 20 trading days during any 30

trading day period

Number of underlying shares calculated based on treasury stock method, based on price of $18.00

Each Warrant is exercisable for one-quarter of one share at an exercise price of $2.875 per one-quarter share ($11.50 per whole share)

Issuable to pre-Business Combination Repay equityholders

Post-Merger Repay Units issuable upon VWAP of Repay shares being greater than or equal to $12.50 for any 20 trading days during any 30

trading day period prior to July 11, 2020

Issuable to pre-Business Combination Repay equityholders

Post-Merger Repay Units issuable upon VWAP of Repay shares being greater than or equal to $14.00 for any 20 trading days during any 30

trading day period prior to July 11, 2021

Shares refer to Class A common stock on an as-converted basis.

This presentation is not a complete summary of all relevant terms and conditions related to the shares or the warrants, including with respect to the issuance of earn-outs, vesting, release from escrow

or other key terms. For more information, see the final prospectus and definitive proxy statement, filed with the SEC on June 24, 2019 by Thunder Bridge, and the Current Report on Form 8-K, filed with 32

the SEC on July 17, 2019 by the Company.View entire presentation