Maersk Investor Presentation Deck

Guidance

Guidance for 2020

A.P. Moller-Maersk expects earnings before interest, tax, depreciation and

amortisation (EBITDA) of around USD 5.5bn, before restructuring and

integration costs.

The organic volume growth in Ocean is expected to be in line with or

slightly lower than the average estimated market growth of 1-3% for

2020.

The accumulated guidance on gross capital expenditures excl. acquisitions

(CAPEX) for 2020-2021 is still expected to be USD 3.0-4.0bn. A high cash

conversion (cash flow from operations compared to EBITDA) is expected

for both years.

The outlook and guidance for 2020 is subject to significant uncertainties

and impacted by the current outbreak of the Coronavirus in China, which

has significantly lowered visibility on what to expect in 2020. As factories

in China are closed for longer than usual in connection with the Chinese

New Year and as a result of the Coronavirus, we expect a weak start to the

year.

The guidance for 2020 is also subject to uncertainties related to the

implementation of IMO 2020 and the impact on bunker fuel prices and

freight rates combined with the weaker macroeconomic conditions and

other external factors.

27

Annual Report 2019

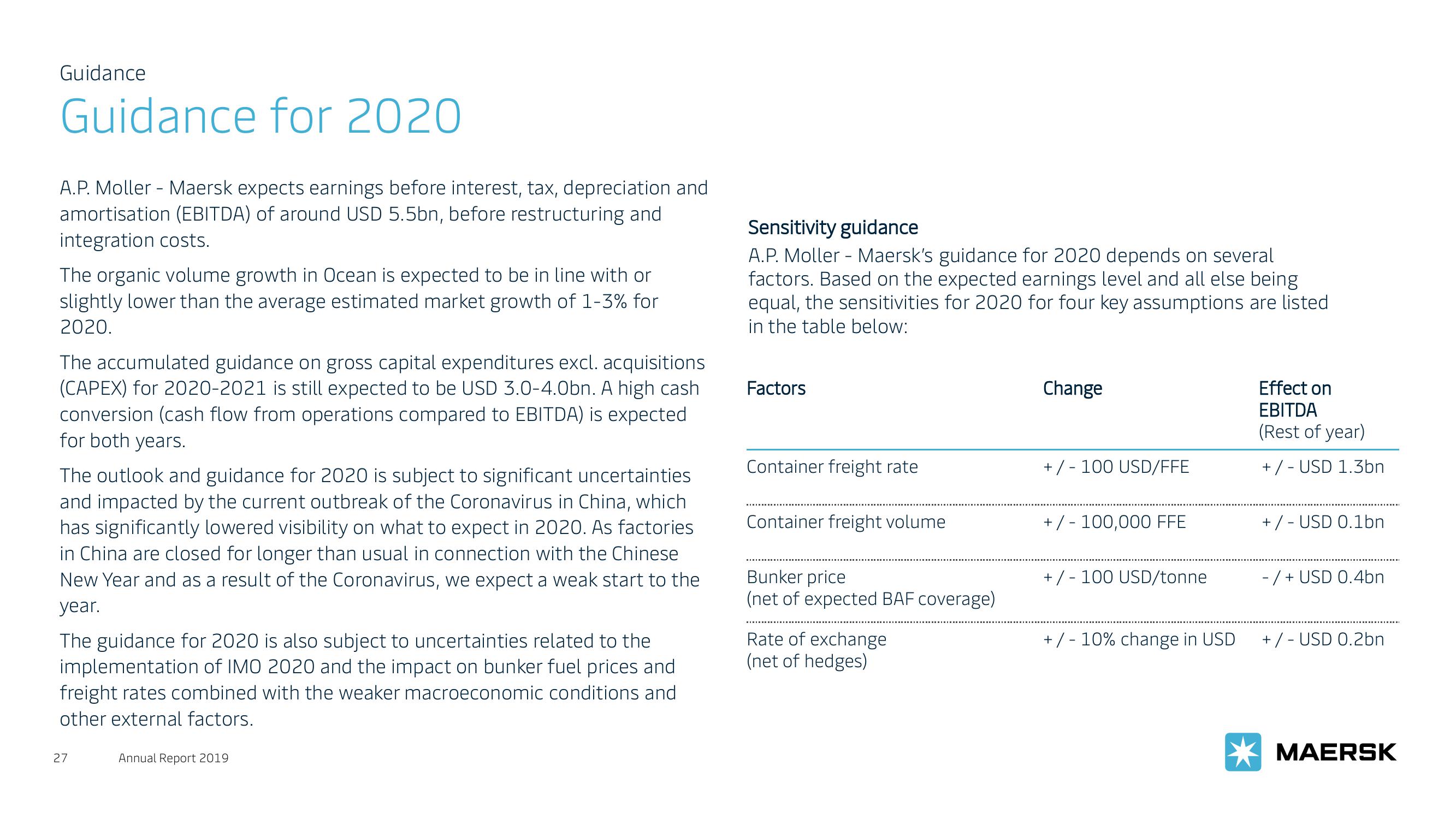

Sensitivity guidance

A.P. Moller - Maersk's guidance for 2020 depends on several

factors. Based on the expected earnings level and all else being

equal, the sensitivities for 2020 for four key assumptions are listed

in the table below:

Factors

Container freight rate

Container freight volume

Bunker price

(net of expected BAF coverage)

Rate of exchange

(net of hedges)

Change

+/- 100 USD/FFE

+/- 100,000 FFE

+/- 100 USD/tonne

+/- 10% change in USD

Effect on

EBITDA

(Rest of year)

+/- USD 1.3bn

+/- USD 0.1bn

-/+ USD 0.4bn

+/- USD 0.2bn

MAERSKView entire presentation