Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

WACC

WACC

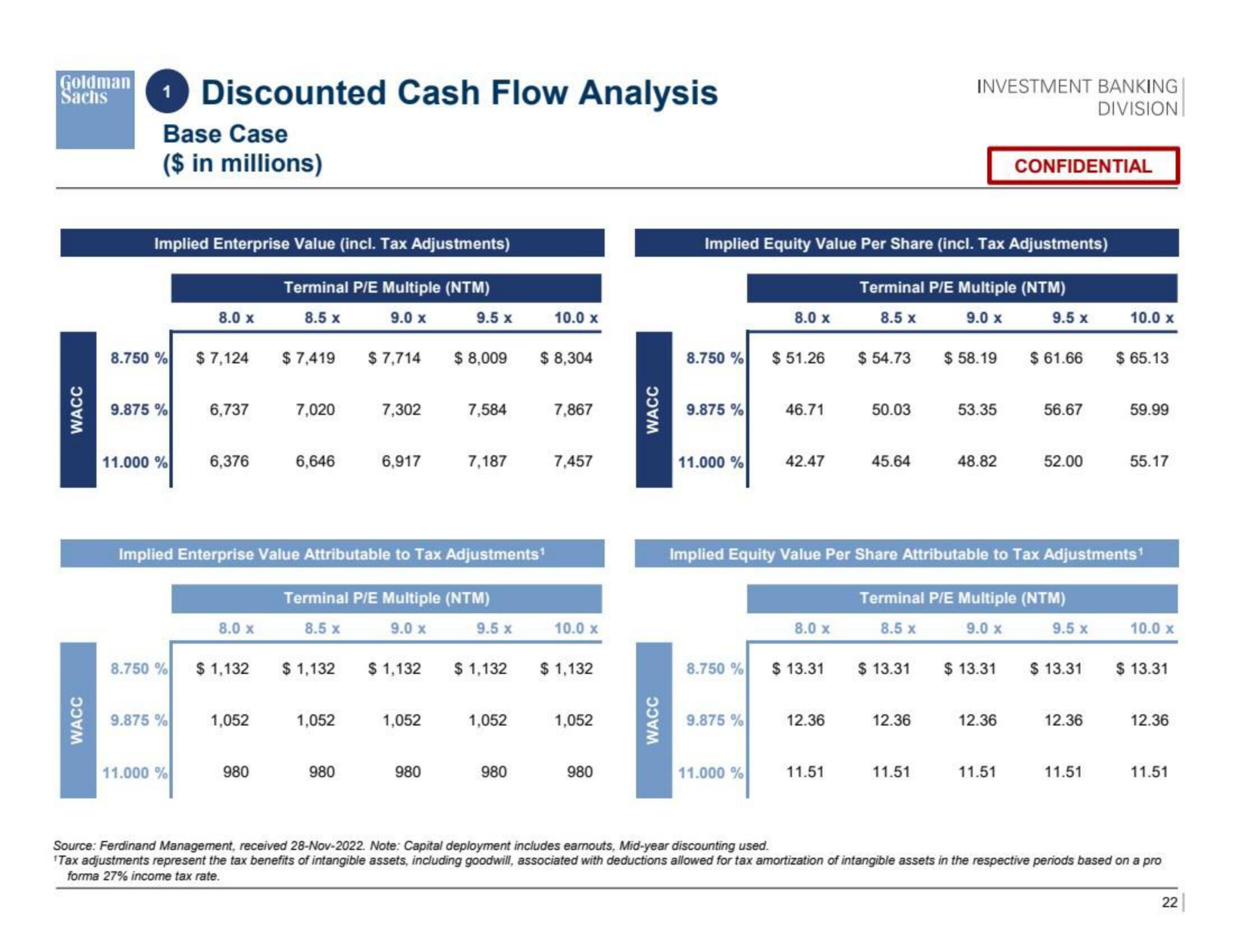

Discounted Cash Flow Analysis

Base Case

($ in millions)

Implied Enterprise Value (incl. Tax Adjustments)

Terminal P/E Multiple (NTM)

8.5 x

9.0 x

8.750 %

9.875%

11.000 %

8.750 %

9.875%

8.0 x

11.000 %

$ 7,124

6,737

6,376

8.0 x

$ 1,132

1,052

$ 7,419

980

7,020

6,646

Implied Enterprise Value Attributable to Tax Adjustments¹

Terminal P/E Multiple (NTM)

8.5 x

9.0 x

$ 1,132

1,052

$7,714

980

7,302

6,917

$ 1,132

1,052

9.5 x

980

$8,009

7,584

7,187

9.5 x

$ 1,132

1,052

980

10.0 X

$ 8,304

7,867

7,457

10.0 x

$ 1,132

1,052

980

WACC

WACC

8.750 %

Implied Equity Value Per Share (incl. Tax Adjustments)

Terminal P/E Multiple (NTM)

8.5 x

9.0 x

9.875%

11.000 %

8.750%

9.875%

8.0 x

11.000 %

$51.26

46.71

42.47

8.0 x

$ 13.31

12.36

$ 54.73

11.51

50.03

45.64

$ 13.31

INVESTMENT BANKING

DIVISION

12.36

11.51

$ 58.19

53.35

48.82

Implied Equity Value Per Share Attributable to Tax Adjustments¹

Terminal P/E Multiple (NTM)

8.5 x

9.0 x

$ 13.31

CONFIDENTIAL

12.36

11.51

9.5 x

$61.66

56.67

52.00

9.5 x

$ 13.31

12.36

10.0 x

11.51

$ 65.13

59.99

55.17

10.0 x

$ 13.31

12.36

11.51

Source: Ferdinand Management, received 28-Nov-2022. Note: Capital deployment includes earnouts, Mid-year discounting used.

Tax adjustments represent the tax benefits of intangible assets, including goodwill, associated with deductions allowed for tax amortization of intangible assets in the respective periods based on a pro

forma 27% income tax rate.

22View entire presentation