Talkspace SPAC Presentation Deck

Pro forma capitalization and ownership

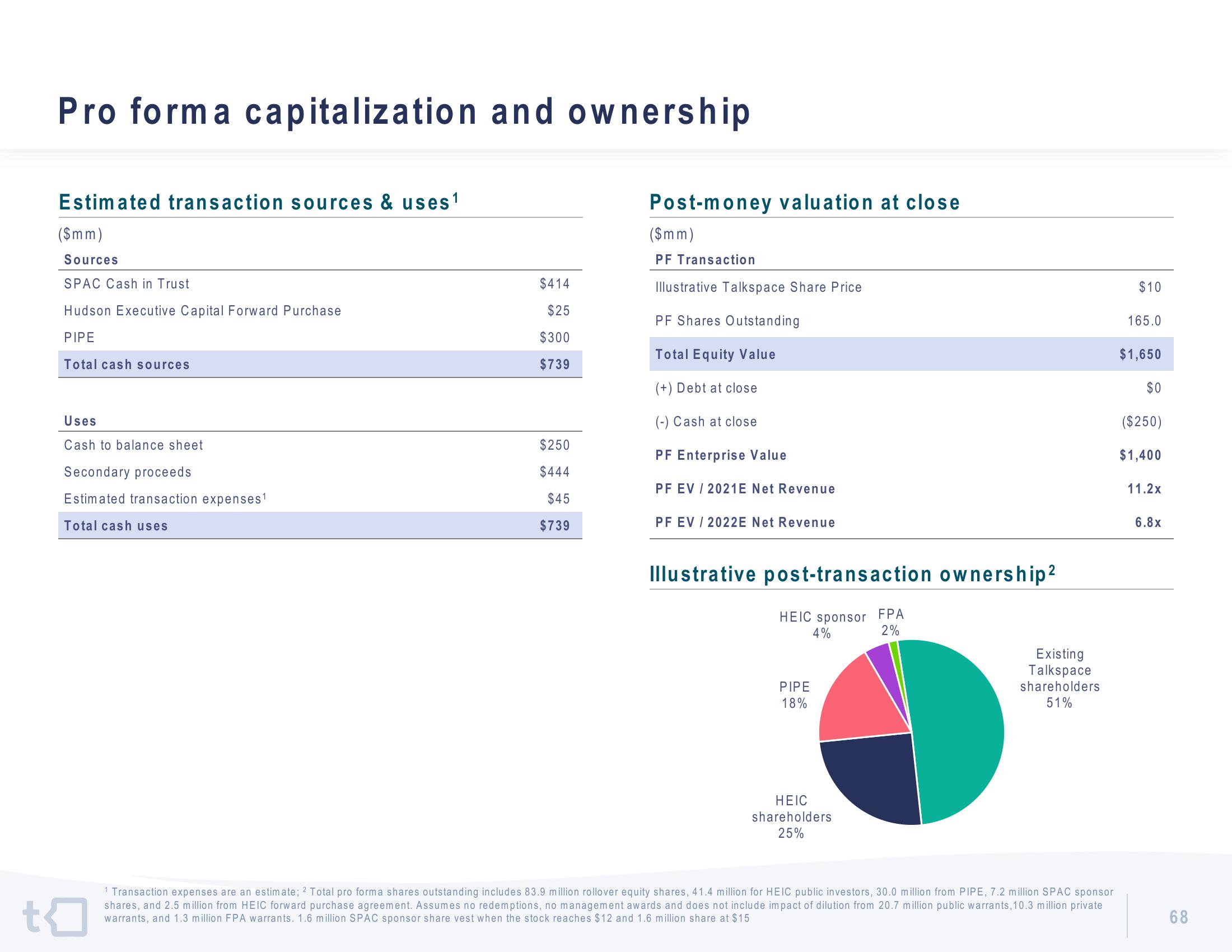

Estimated transaction sources & uses¹

($mm)

Sources

SPAC Cash in Trust

Hudson Executive Capital Forward Purchase

PIPE

Total cash sources

Uses

Cash to balance sheet

Secondary proceeds

Estimated transaction expenses ¹

Total cash uses

$414

$25

$300

$739

$250

$444

$45

$739

Post-money valuation at close

($mm)

PF Transaction

Illustrative Talkspace Share Price

PF Shares Outstanding

Total Equity Value

(+) Debt at close

(-) Cash at close

PF Enterprise Value

PF EV / 2021E Net Revenue

PF EV / 2022E Net Revenue

Illustrative post-transaction ownership2

HEIC sponsor FPA

4%

2%

PIPE

18%

HEIC

shareholders

25%

Existing

Talkspace

shareholders

51%

t

1 Transaction expenses are an estimate; 2 Total pro forma shares outstanding includes 83.9 million rollover equity shares, 41.4 million for HEIC public investors, 30.0 million from PIPE, 7.2 million SPAC sponsor

shares, and 2.5 million from HEIC forward purchase agreement. Assumes no redemptions, no management awards and does not include impact of dilution from 20.7 million public warrants, 10.3 million private

warrants, and 1.3 million FPA warrants. 1.6 million SPAC sponsor share vest when the stock reaches $12 and 1.6 million share at $15

$10

165.0

$1,650

$0

($250)

$1,400

11.2x

6.8x

68View entire presentation