KKR Real Estate Finance Trust Investor Presentation Deck

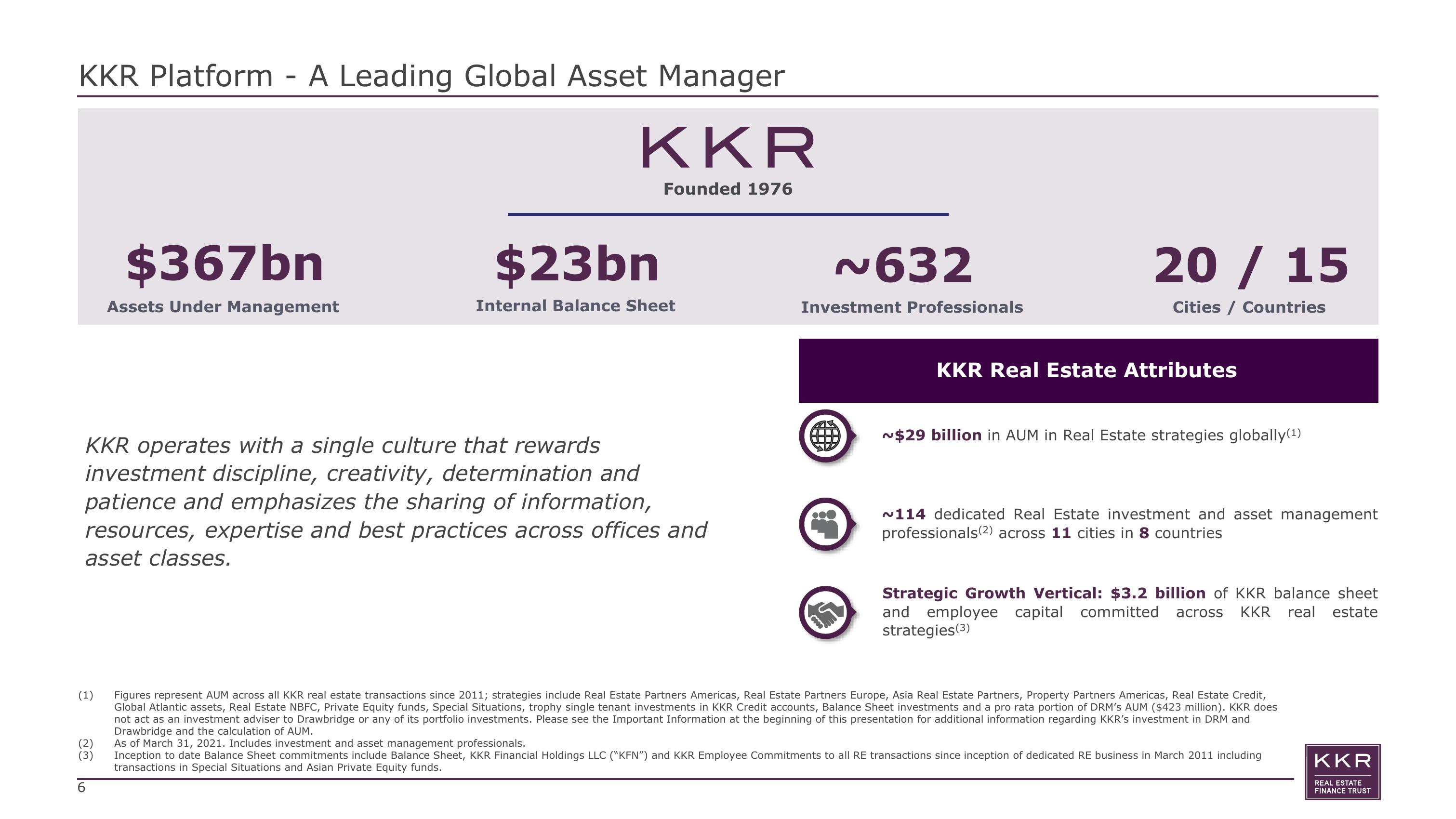

KKR Platform - A Leading Global Asset Manager

KKR

Founded 1976

(1)

KKR operates with a single culture that rewards

investment discipline, creativity, determination and

patience and emphasizes the sharing of information,

resources, expertise and best practices across offices and

asset classes.

(2)

(3)

$367bn

Assets Under Management

6

$23bn

Internal Balance Sheet

~632

Investment Professionals

0000

20 / 15

Cities / Countries

KKR Real Estate Attributes

~$29 billion in AUM in Real Estate strategies globally(¹)

~114 dedicated Real Estate investment and asset management

professionals (2) across 11 cities in 8 countries

Strategic Growth Vertical: $3.2 billion of KKR balance sheet

and employee capital committed across KKR real estate

strategies (3)

Figures represent AUM across all KKR real estate transactions since 2011; strategies include Real Estate Partners Americas, Real Estate Partners Europe, Asia Real Estate Partners, Property Partners Americas, Real Estate Credit,

Global Atlantic assets, Real Estate NBFC, Private Equity funds, Special Situations, trophy single tenant investments in KKR Credit accounts, Balance Sheet investments and a pro rata portion of DRM's AUM ($423 million). KKR does

not act as an investment adviser to Drawbridge or any of its portfolio investments. Please see the Important Information at the beginning of this presentation for additional information regarding KKR's investment in DRM and

Drawbridge and the calculation of AUM.

As of March 31, 2021. Includes investment and asset management professionals.

Inception to date Balance Sheet commitments include Balance Sheet, KKR Financial Holdings LLC ("KFN") and KKR Employee Commitments to all RE transactions since inception of dedicated RE business in March 2011 including

transactions in Special Situations and Asian Private Equity funds.

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation