Maersk Investor Presentation Deck

Financial highlights Q1 2020

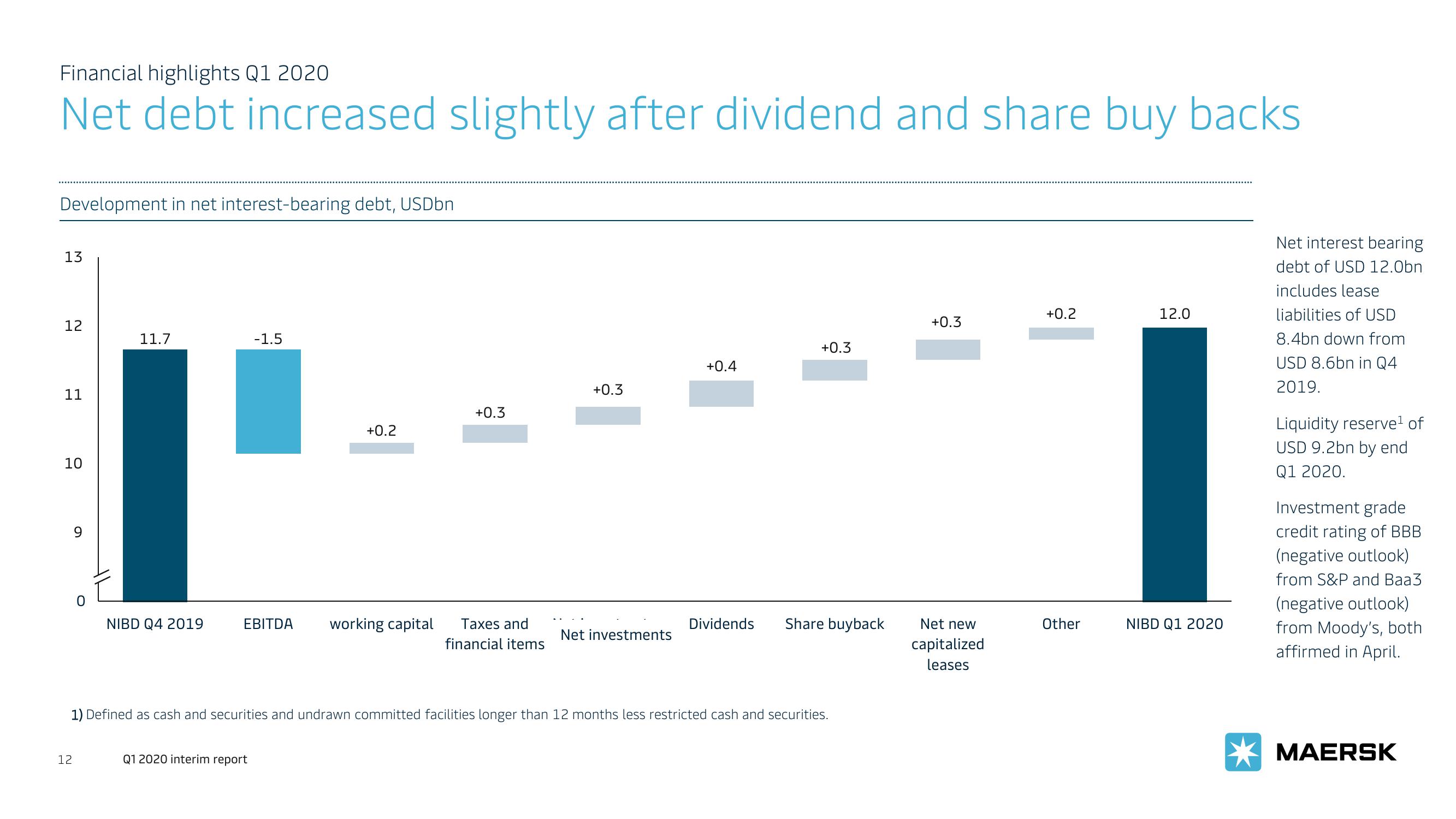

Net debt increased slightly after dividend and share buy backs

Development in net interest-bearing debt, USDbn

13

12

11

10

9

12

0

11.7

NIBD Q4 2019

-1.5

+0.2

EBITDA working capital

Q1 2020 interim report

+0.3

Taxes and

financial items

+0.3

Net investments

+0.4

+0.3

1) Defined as cash and securities and undrawn committed facilities longer than 12 months less restricted cash and securities.

Dividends Share buyback

+0.3

Net new

capitalized

leases

+0.2

Other

12.0

NIBD Q1 2020

Net interest bearing

debt of USD 12.0bn

includes lease

liabilities of USD

8.4bn down from

USD 8.6bn in Q4

2019.

Liquidity reserve¹ of

USD 9.2bn by end

Q1 2020.

Investment grade

credit rating of BBB

(negative outlook)

from S&P and Baa3

(negative outlook)

from Moody's, both

affirmed in April.

MAERSKView entire presentation