Tradeweb Investor Presentation Deck

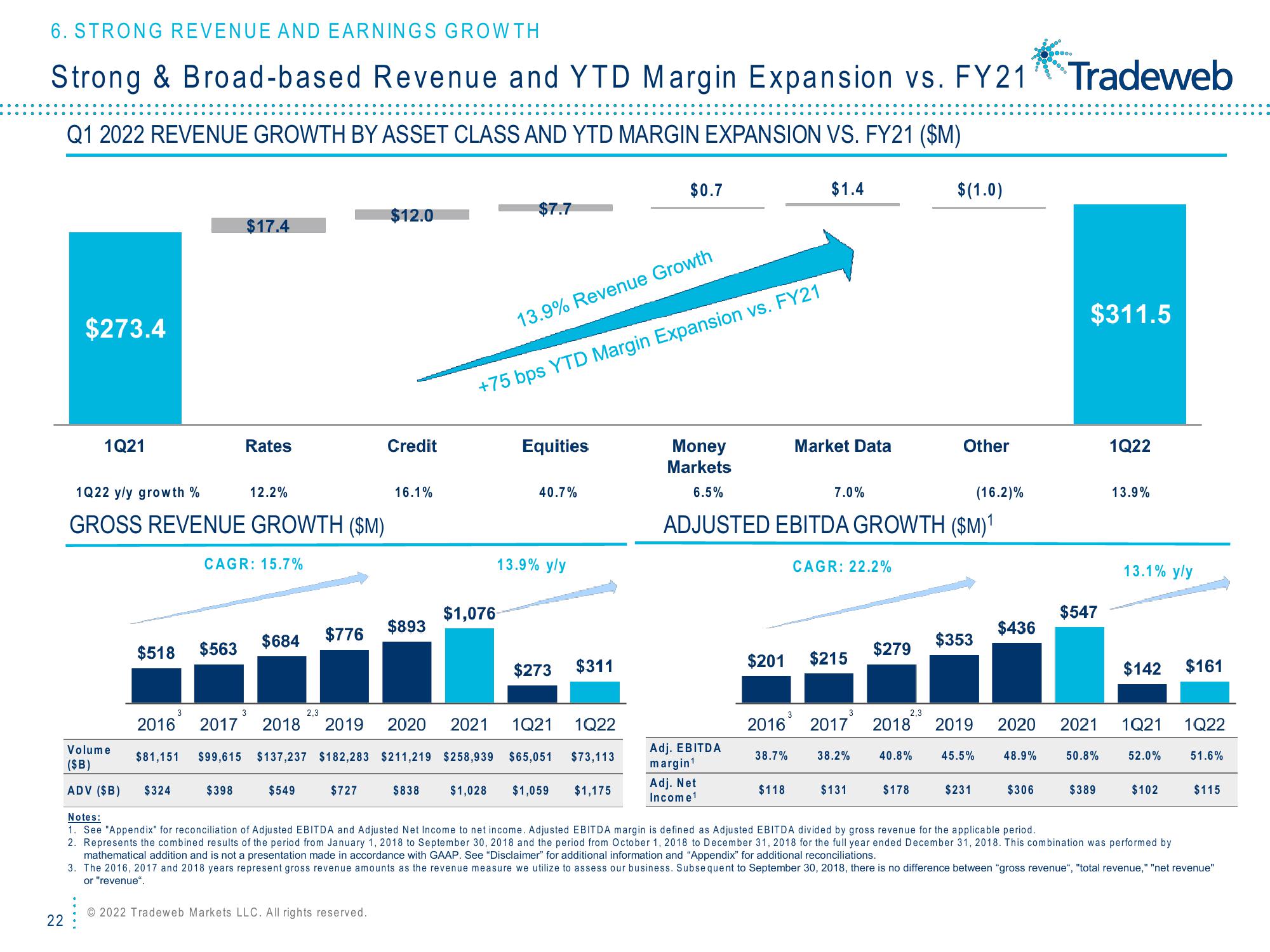

6. STRONG REVENUE AND EARNINGS GROWTH

Strong & Broad-based Revenue and YTD Margin Expansion vs. FY21 Tradeweb

Q1 2022 REVENUE GROWTH BY ASSET CLASS AND YTD MARGIN EXPANSION VS. FY21 ($M)

22

$273.4

1Q21

1Q22 y/y growth %

GROSS REVENUE GROWTH ($M)

$518 $563

2016

Volume

($B)

ADV ($B) $324

3

$81,151

$17.4

Rates

CAGR: 15.7%

$398

12.2%

3

$684 $776

$549

2.3

$12.0

$727

Credit

16.1%

$893

$7.7

$1,076

13.9% Revenue Growth

+75 bps YTD Margin Expansion vs. FY21

2017 2018 2019 2020 2021 1Q21

$99,615 $137,237 $182,283 $211,219 $258,939 $65,051

Equities

40.7%

13.9% y/y

$273 $311

1Q22

$0.7

$73,113

$838 $1,028 $1,059 $1,175

Adj. EBITDA

margin¹

Adj. Net

Income ¹

Money

Markets

6.5%

(16.2)%

ADJUSTED EBITDA GROWTH ($M)¹

$201

$1.4

38.7%

Market Data

$118

7.0%

CAGR: 22.2%

$215

38.2%

$279

$131

3

2,3

2016 2017 2018² 2019 2020

45.5%

48.9%

$(1.0)

40.8%

Other

$178

$353

$436

$231

$306

ooo..

$311.5

$547

50.8%

1Q22

$389

13.9%

13.1% y/y

2021 1Q21 1Q22

$142 $161

52.0%

$102

51.6%

$115

Notes:

1. See "Appendix" for reconciliation of Adjusted EBITDA and Adjusted Net Income to net income. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by gross revenue for the applicable period.

2. Represents the combined results of the period from January 1, 2018 to September 30, 2018 and the period from October 1, 2018 to December 31, 2018 for the full year ended December 31, 2018. This combination was performed by

mathematical addition and is not a presentation made in accordance with GAAP. See "Disclaimer" for additional information and "Appendix" for additional reconciliations.

3. The 2016, 2017 and 2018 years represent gross revenue amounts as the revenue measure we utilize to assess our business. Subsequent to September 30, 2018, there is no difference between "gross revenue", "total revenue," "net revenue"

or "revenue".

2022 Tradeweb Markets LLC. All rights reserved.View entire presentation