Azerion SPAC Presentation Deck

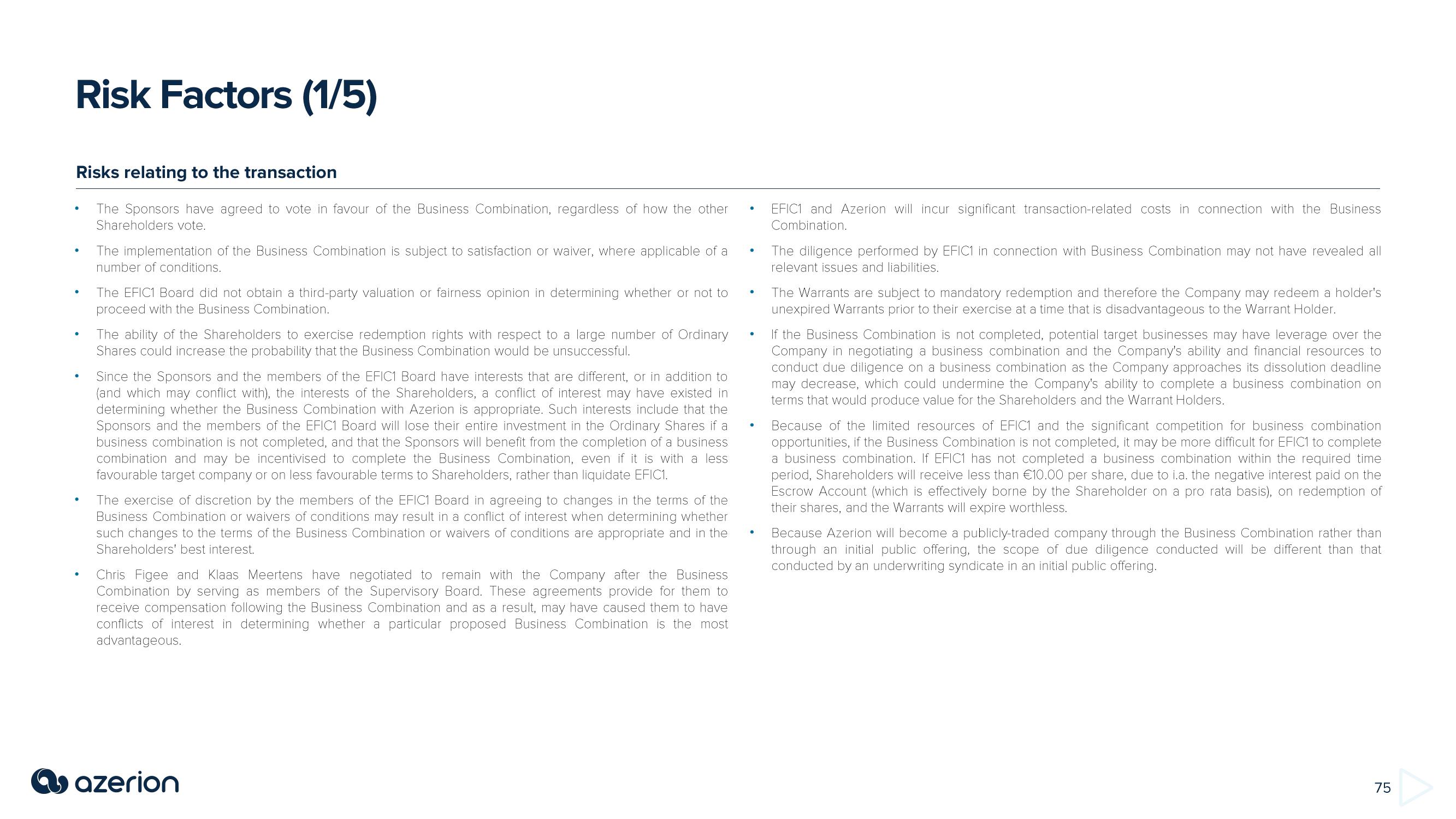

Risk Factors (1/5)

Risks relating to the transaction

The Sponsors have agreed to vote in favour of the Business Combination, regardless of how the other

Shareholders vote.

●

●

●

The implementation of the Business Combination is subject to satisfaction or waiver, where applicable of a

number of conditions.

The EFIC1 Board did not obtain a third-party valuation or fairness opinion in determining whether or not to

proceed with the Business Combination.

The ability of the Shareholders to exercise redemption rights with respect to a large number of Ordinary

Shares could increase the probability that the Business Combination would be unsuccessful.

Since the Sponsors and the members of the EFIC1 Board have interests that are different, or in addition to

(and which may conflict with), the interests of the Shareholders, a conflict of interest may have existed in

determining whether the Business Combination with Azerion is appropriate. Such interests include that the

Sponsors and the members of the EFIC1 Board will lose their entire investment in the Ordinary Shares if a

business combination is not completed, and that the Sponsors will benefit from the completion of a business

combination and may be incentivised to complete the Business Combination, even if it is with a less

favourable target company or on less favourable terms to Shareholders, rather than liquidate EFIC1.

The exercise of discretion by the members of the EFIC1 Board in agreeing to changes in the terms of the

Business Combination or waivers of conditions may result in a conflict of interest when determining whether

such changes to the terms of the Business Combination or waivers of conditions are appropriate and in the

Shareholders' best interest.

Chris Figee and Klaas Meertens have negotiated to remain with the Company after the Business

Combination by serving as members of the Supervisory Board. These agreements provide for them to

receive compensation following the Business Combination and as a result, may have caused them to have

conflicts of interest in determining whether a particular proposed Business Combination is the most

advantageous.

azerion

●

●

●

EFIC1 and Azerion will incur significant transaction-related costs in connection with the Business

Combination.

The diligence performed by EFIC1 in connection with Business Combination may not have revealed all

relevant issues and liabilities.

The Warrants are subject to mandatory redemption and therefore the Company may redeem a holder's

unexpired Warrants prior to their exercise at a time that is disadvantageous to the Warrant Holder.

If the Business Combination is not completed, potential target businesses may have leverage over the

Company in negotiating a business combination and the Company's ability and financial resources to

conduct due diligence on a business combination as the Company approaches its dissolution deadline

may decrease, which could undermine the Company's ability to complete a business combination on

terms that would produce value for the Shareholders and the Warrant Holders.

Because of the limited resources of EFIC1 and the significant competition for business combination

opportunities, if the Business Combination is not completed, it may be more difficult for EFIC1 to complete

a business combination. If EFIC1 has not completed a business combination within the required time

period, Shareholders will receive less than €10.00 per share, due to i.a. the negative interest paid on the

Escrow Account (which is effectively borne by the Shareholder on a pro rata basis), on redemption of

their shares, and the Warrants will expire worthless.

Because Azerion will become a publicly-traded company through the Business Combination rather than

through an initial public offering, the scope of due diligence conducted will be different than that

conducted by an underwriting syndicate in an initial public offering.

75View entire presentation