Company Overview

■

■

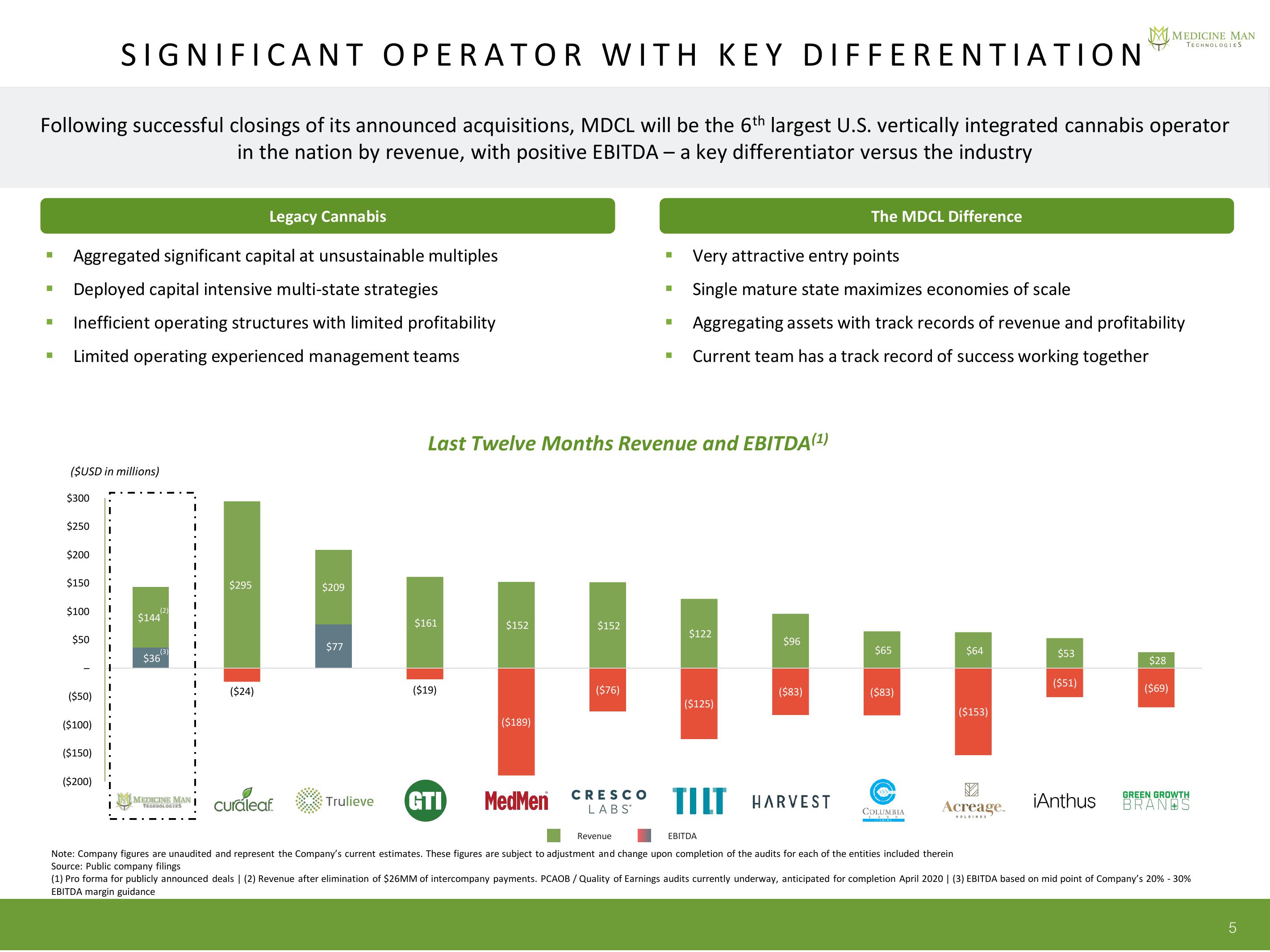

Following successful closings of its announced acquisitions, MDCL will be the 6th largest U.S. vertically integrated cannabis operator

in the nation by revenue, with positive EBITDA - a key differentiator versus the industry

■

Legacy Cannabis

Aggregated significant capital at unsustainable multiples

Deployed capital intensive multi-state strategies

Inefficient operating structures with limited profitability

Limited operating experienced management teams

($USD in millions)

$300

$250

$200

$150

SIGNIFICANT OPERATOR WITH KEY DIFFERENTIATION

$100

$50

($50)

($100)

($150)

($200)

$144

(3)

$36

MM MEDICINE MAN

TECHNOLOGIES

$295

($24)

curaleaf.

$209

$77

$161

($19)

Trulieve GTI

$152

($189)

Last Twelve Months Revenue and EBITDA (¹)

MedMen

$152

($76)

■

CRESCO

LABS

■

■

■

Very attractive entry points

Single mature state maximizes economies of scale

$122

Aggregating assets with track records of revenue and profitability

Current team has a track record of success working together

($125)

$96

EBITDA

The MDCL Difference

($83)

TILT HARVEST

$65

($83)

COLUMBIA

CABL

$64

($153)

Acreage.

HOLDINGS

$53

MMEDICINE MAN

($51)

¡Anthus

TECHNOLOGIES

$28

($69)

GREEN GROWTH

BRANDS

Revenue

Note: Company figures are unaudited and represent the Company's current estimates. These figures are subject to adjustment and change upon completion of the audits for each of the entities included therein

Source: Public company filings

(1) Pro forma for publicly announced deals | (2) Revenue after elimination of $26MM of intercompany payments. PCAOB / Quality of Earnings audits currently underway, anticipated for completion April 2020 | (3) EBITDA based on mid point of Company's 20% - 30%

EBITDA margin guidance

5View entire presentation