Azerion SPAC Presentation Deck

Transaction structure

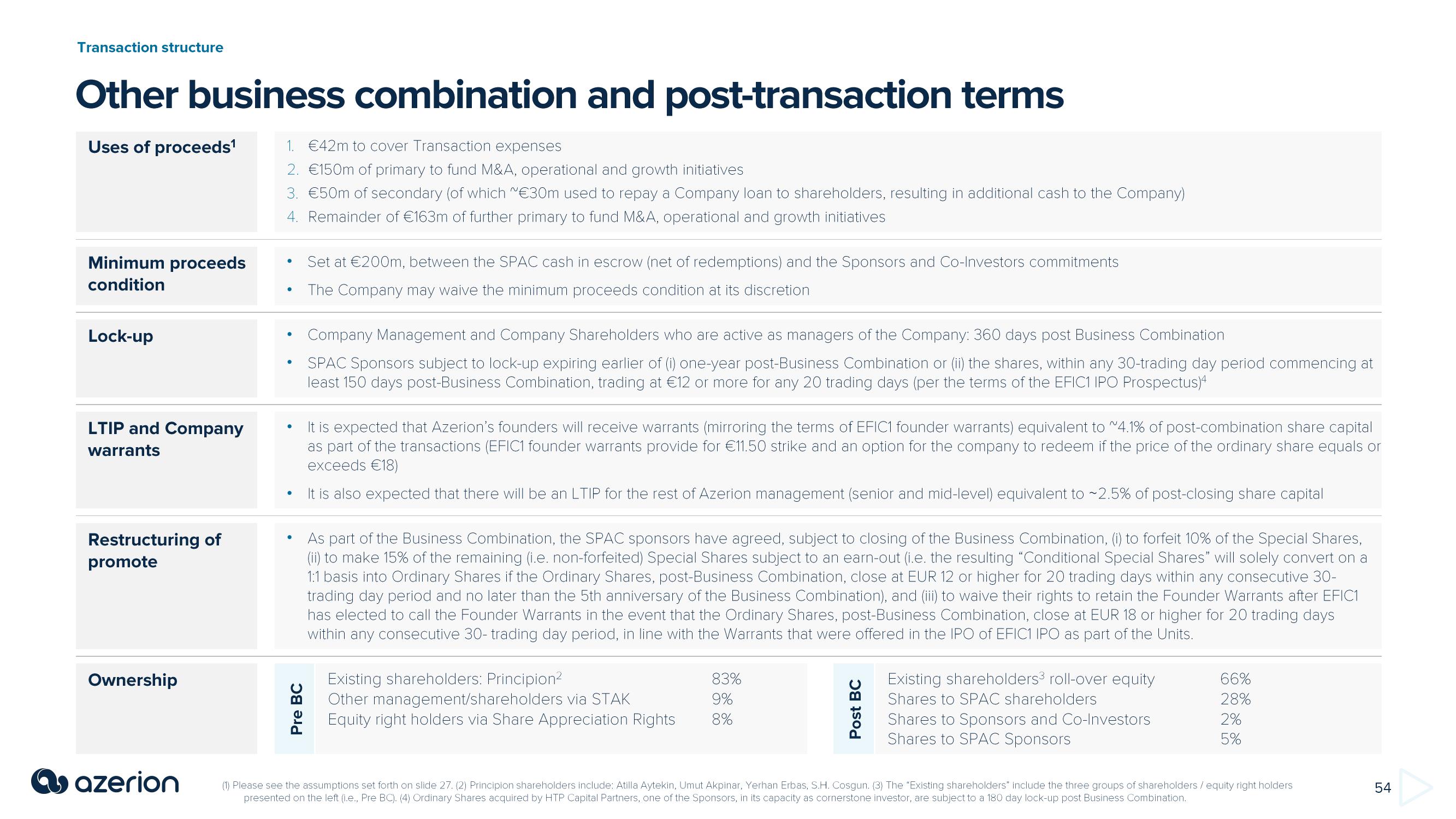

Other business combination and post-transaction terms

Uses of proceeds¹

Minimum proceeds

condition

Lock-up

LTIP and Company

warrants

Restructuring of

promote

Ownership

azerion

1. €42m to cover Transaction expenses

2. €150m of primary to fund M&A, operational and growth initiatives

3. €50m of secondary (of which ~€30m used to repay a Company loan to shareholders, resulting in additional cash to the Company)

4. Remainder of €163m of further primary to fund M&A, operational and growth initiatives

●

●

●

Pre BC

Set at €200m, between the SPAC cash in escrow (net of redemptions) and the Sponsors and Co-Investors commitments

The Company may waive the minimum proceeds condition at its discretion

Company Management and Company Shareholders who are active as managers of the Company: 360 days post Business Combination

SPAC Sponsors subject to lock-up expiring earlier of (i) one-year post-Business Combination or (ii) the shares, within any 30-trading day period commencing at

least 150 days post-Business Combination, trading at €12 or more for any 20 trading days (per the terms of the EFIC1 IPO Prospectus)4

It is expected that Azerion's founders will receive warrants (mirroring the terms of EFIC1 founder warrants) equivalent to ~4.1% of post-combination share capital

as part of the transactions (EFIC1 founder warrants provide for €11.50 strike and an option for the company to redeem if the price of the ordinary share equals or

exceeds €18)

It is also expected that there will be an LTIP for the rest of Azerion management (senior and mid-level) equivalent to ~2.5% of post-closing share capital

As part of the Business Combination, the SPAC sponsors have agreed, subject to closing of the Business Combination, (i) to forfeit 10% of the Special Shares,

(ii) to make 15% of the remaining (i.e. non-forfeited) Special Shares subject to an earn-out (i.e. the resulting "Conditional Special Shares" will solely convert on a

1:1 basis into Ordinary Shares if the Ordinary Shares, post-Business Combination, close at EUR 12 or higher for 20 trading days within any consecutive 30-

trading day period and no later than the 5th anniversary of the Business Combination), and (iii) to waive their rights to retain the Founder Warrants after EFIC1

has elected to call the Founder Warrants in the event that the Ordinary Shares, post-Business Combination, close at EUR 18 or higher for 20 trading days

within any consecutive 30- trading day period, in line with the Warrants that were offered in the IPO of EFIC1 IPO as part of the Units.

Existing shareholders: Principion²

Other management/shareholders via STAK

Equity right holders via Share Appreciation Rights

83%

9%

8%

Post BC

Existing shareholders³ roll-over equity

Shares to SPAC shareholders

Shares to Sponsors and Co-Investors

Shares to SPAC Sponsors

66%

28%

2%

5%

(1) Please see the assumptions set forth on slide 27. (2) Principion shareholders include: Atilla Aytekin, Umut Akpinar, Yerhan Erbas, S.H. Cosgun. (3) The "Existing shareholders" include the three groups of shareholders/ equity right holders

presented on the left (i.e., Pre BC). (4) Ordinary Shares acquired by HTP Capital Partners, one of the Sponsors, in its capacity as cornerstone investor, are subject to a 180 day lock-up post Business Combination.

54View entire presentation