Kering Investor Presentation Deck

10

2015

74

2016

2

MONT

GUCCI BLANC

Cartier

495

352

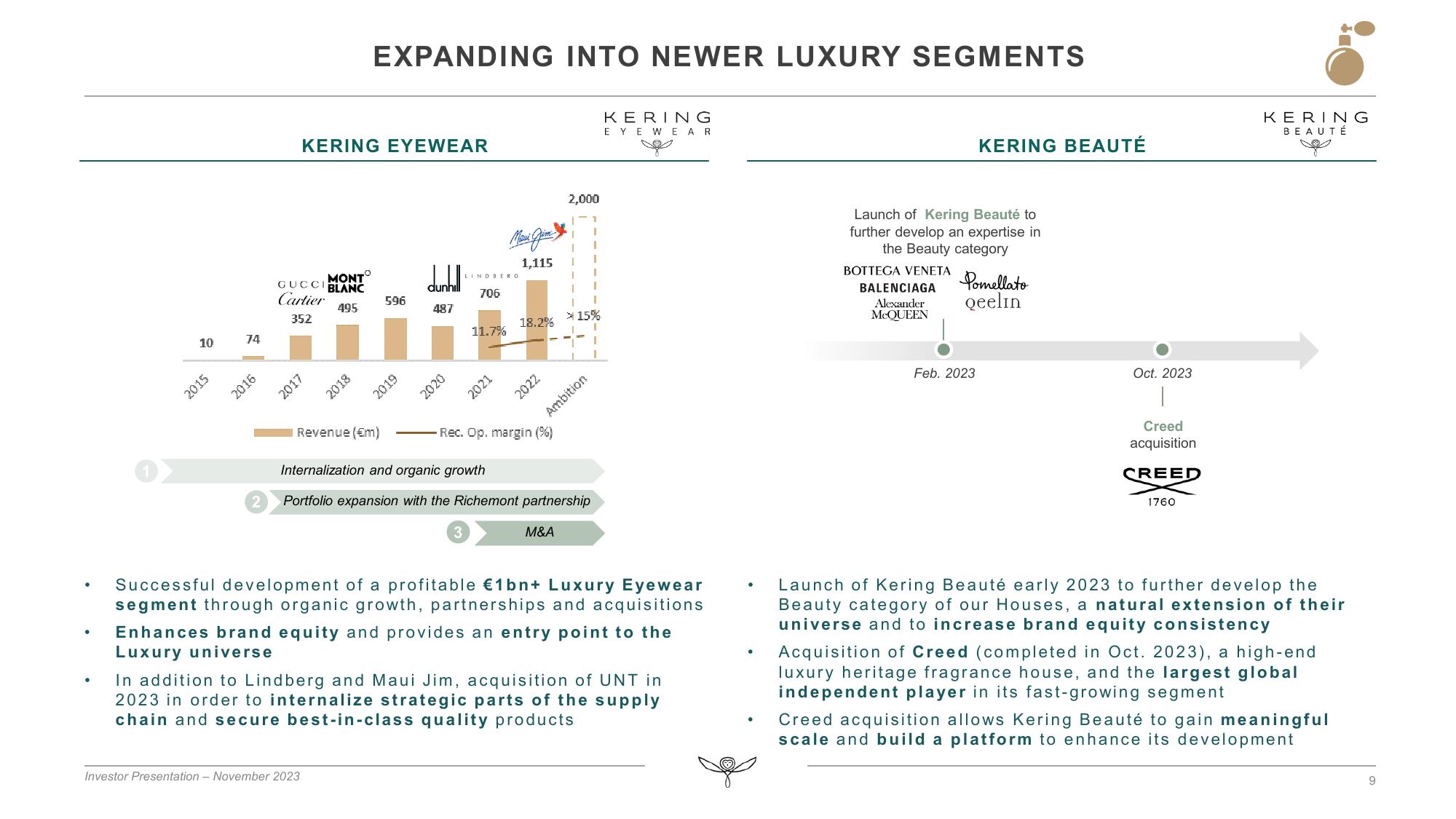

KERING EYEWEAR

2017

EXPANDING INTO NEWER LUXURY SEGMENTS

2018

Revenue (€m)

Investor Presentation - November 2023

596

2019

dunhill

487

2020

LINDBERO

706

11.7%

2021

1,115

18.2%

2022

Rec. Op. margin (%)

2,000

1

M&A

1

Internalization and organic growth

Portfolio expansion with the Richemont partnership

1

1

1

Ambition

I

I

I

15%

KERING

EYEWEAR

Successful development of a profitable €1bn+ Luxury Eyewear

segment through organic growth, partnerships and acquisitions

Enhances brand equity and provides an entry point to the

Luxury universe

In addition to Lindberg and Maui Jim, acquisition of UNT in

2023 in order to internalize strategic parts of the supply

chain and secure best-in-class quality products

Launch of Kering Beauté to

further develop an expertise in

the Beauty category

BOTTEGA VENETA

BALENCIAGA

Alexander

MCQUEEN

KERING BEAUTÉ

Pomellato

Qeelin

Feb. 2023

Oct. 2023

|

Creed

acquisition

CREED

1760

KERING

BEAUTÉ

Launch of Kering Beauté early 2023 to further develop the

Beauty category of our Houses, a natural extension of their

universe and to increase brand equity consistency

Acquisition of Creed (completed in Oct. 2023), a high-end

luxury heritage fragrance house, and the largest global

independent player in its fast-growing segment

Creed acquisition allows Kering Beauté to gain meaningful

scale and build a platform to enhance its development

9View entire presentation