Oaktree Real Estate Opportunities Fund VII, L.P.

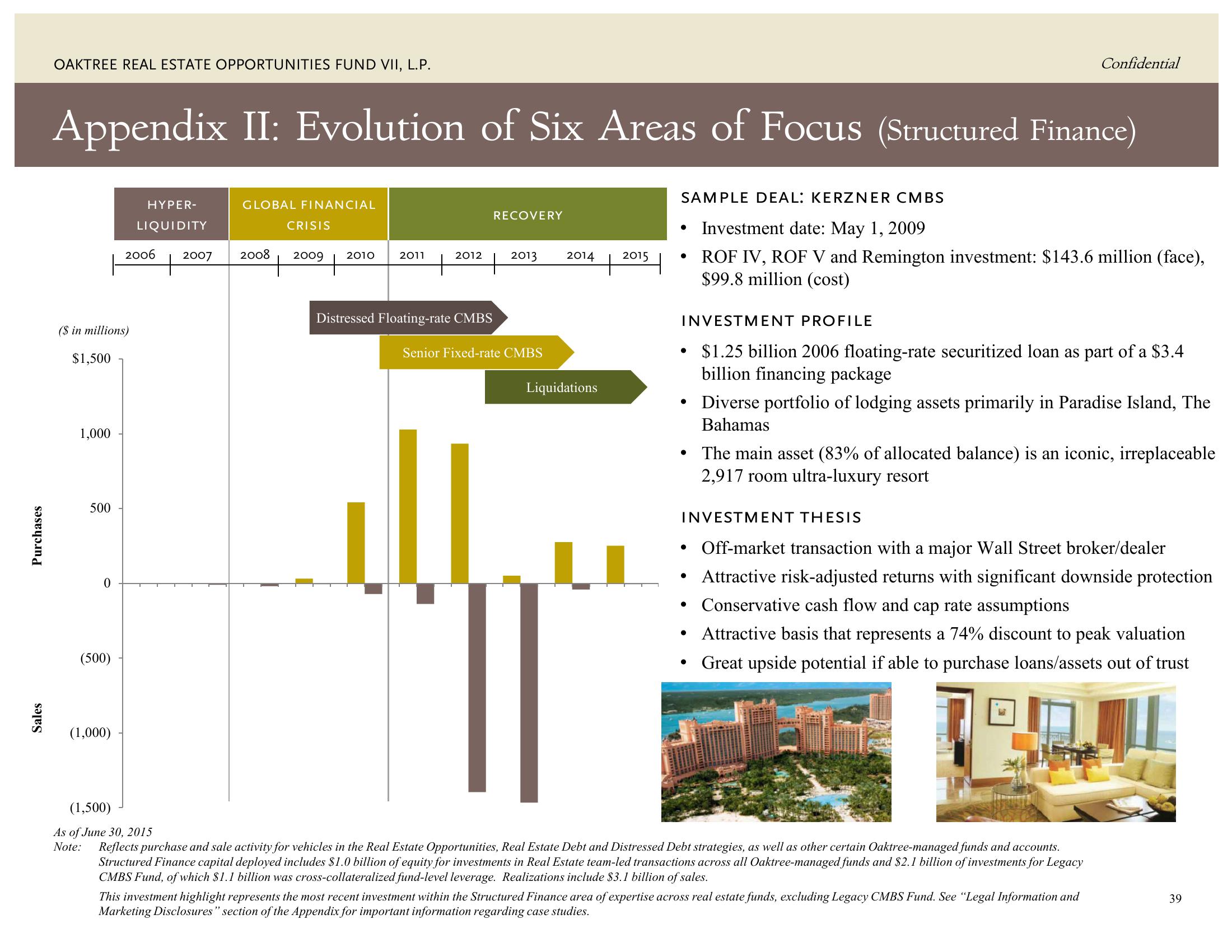

Purchases

Sales

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

Appendix II: Evolution of Six Areas of Focus (Structured Finance)

($ in millions)

$1,500

1,000

500

0

(500)

(1,000)

HYPER-

LIQUIDITY

2006 2007

GLOBAL FINANCIAL

CRISIS

2008 2009 2010

2011

2012

Distressed Floating-rate CMBS

RECOVERY

2013

Senior Fixed-rate CMBS

2014

Liquidations

+

2015

SAMPLE DEAL: KERZNER CMBS

• Investment date: May 1, 2009

ROF IV, ROF V and Remington investment: $143.6 million (face),

$99.8 million (cost)

INVESTMENT PROFILE

• $1.25 billion 2006 floating-rate securitized loan as part of a $3.4

billion financing package

Confidential

●

●

Diverse portfolio of lodging assets primarily in Paradise Island, The

Bahamas

INVESTMENT THESIS

• Off-market transaction with a major Wall Street broker/dealer

• Attractive risk-adjusted returns with significant downside protection

Conservative cash flow and cap rate assumptions

Attractive basis that represents a 74% discount to peak valuation

Great upside potential if able to purchase loans/assets out of trust

The main asset (83% of allocated balance) is an iconic, irreplaceable

2,917 room ultra-luxury resort

(1,500)

As of June 30, 2015

Note: Reflects purchase and sale activity for vehicles in the Real Estate Opportunities, Real Estate Debt and Distressed Debt strategies, as well as other certain Oaktree-managed funds and accounts.

Structured Finance capital deployed includes $1.0 billion of equity for investments in Real Estate team-led transactions across all Oaktree-managed funds and $2.1 billion of investments for Legacy

CMBS Fund, of which $1.1 billion was cross-collateralized fund-level leverage. Realizations include $3.1 billion of sales.

This investment highlight represents the most recent investment within the Structured Finance area of expertise across real estate funds, excluding Legacy CMBS Fund. See "Legal Information and

Marketing Disclosures" section of the Appendix for important information regarding case studies.

39View entire presentation