Synchrony Financial Results Presentation Deck

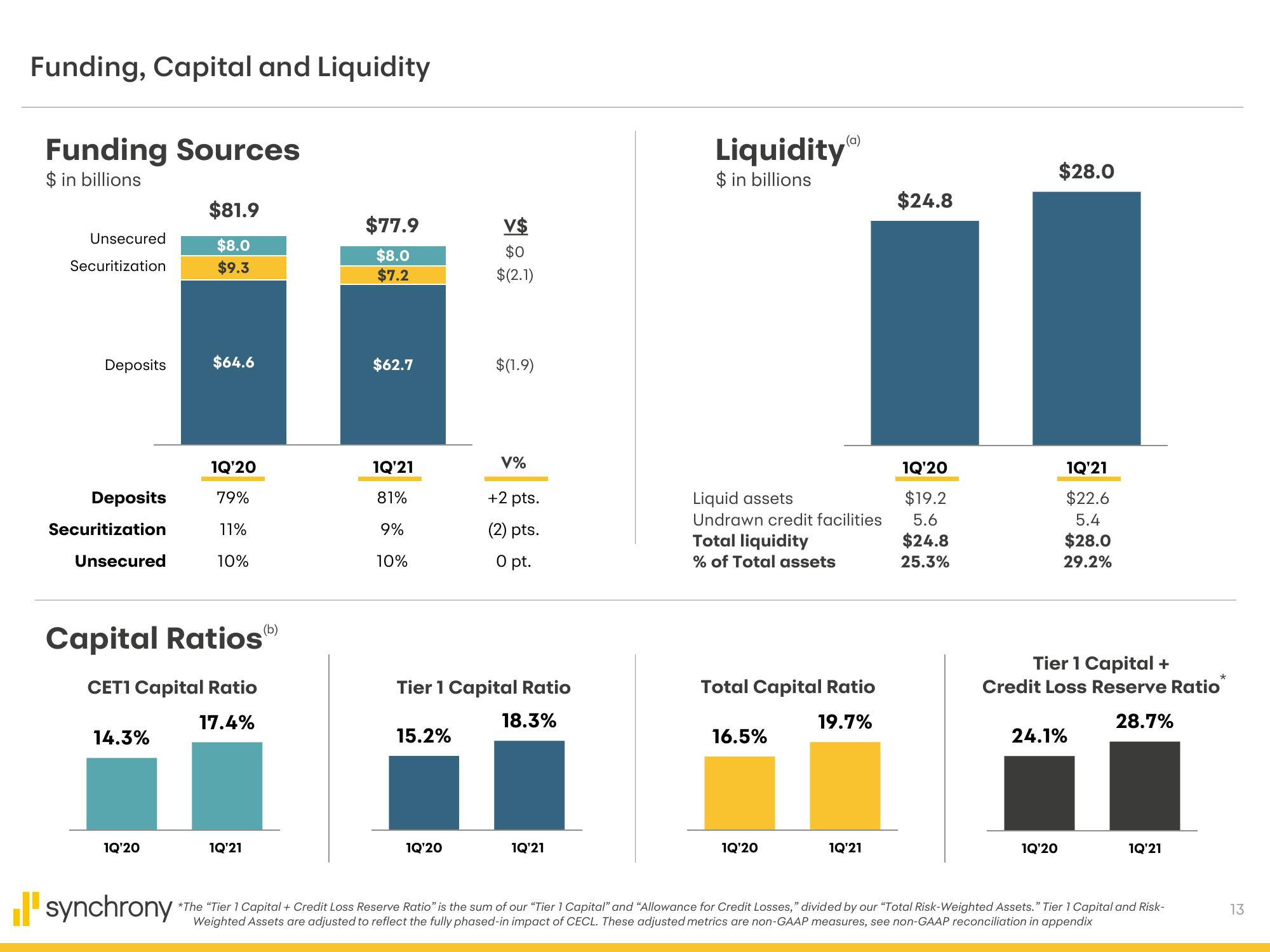

Funding, Capital and Liquidity

Funding Sources

$ in billions

Unsecured

Securitization

Deposits

Deposits

Securitization

Unsecured

14.3%

1Q'20

$81.9

$8.0

$9.3

Capital Ratios

CET1 Capital Ratio

17.4%

synchrony

$64.6

1Q'20

79%

11%

10%

1Q'21

$77.9

$8.0

$7.2

$62.7

1Q'21

81%

9%

10%

15.2%

V$

$0

$(2.1)

1Q'20

$(1.9)

V%

Tier 1 Capital Ratio

18.3%

+2 pts.

(2) pts.

0 pt.

1Q'21

Liquidity)

$ in billions

Liquid assets

Undrawn credit facilities

Total liquidity

% of Total assets

Total Capital Ratio

19.7%

16.5%

1Q'20

1Q'21

$24.8

1Q'20

$19.2

5.6

$24.8

25.3%

$28.0

1Q'21

$22.6

5.4

$28.0

29.2%

Tier 1 Capital +

Credit Loss Reserve Ratio

28.7%

1Q'20

24.1%

1Q'21

*The "Tier 1 Capital + Credit Loss Reserve Ratio" is the sum of our "Tier 1 Capital" and "Allowance for Credit Losses," divided by our "Total Risk-Weighted Assets." Tier 1 Capital and Risk-

Weighted Assets are adjusted to reflect the fully phased-in impact of CECL. These adjusted metrics are non-GAAP measures, see non-GAAP reconciliation in appendix

*

13View entire presentation