Pathward Financial Results Presentation Deck

Return of Capital

to Shareholders

HIGHLIGHTS

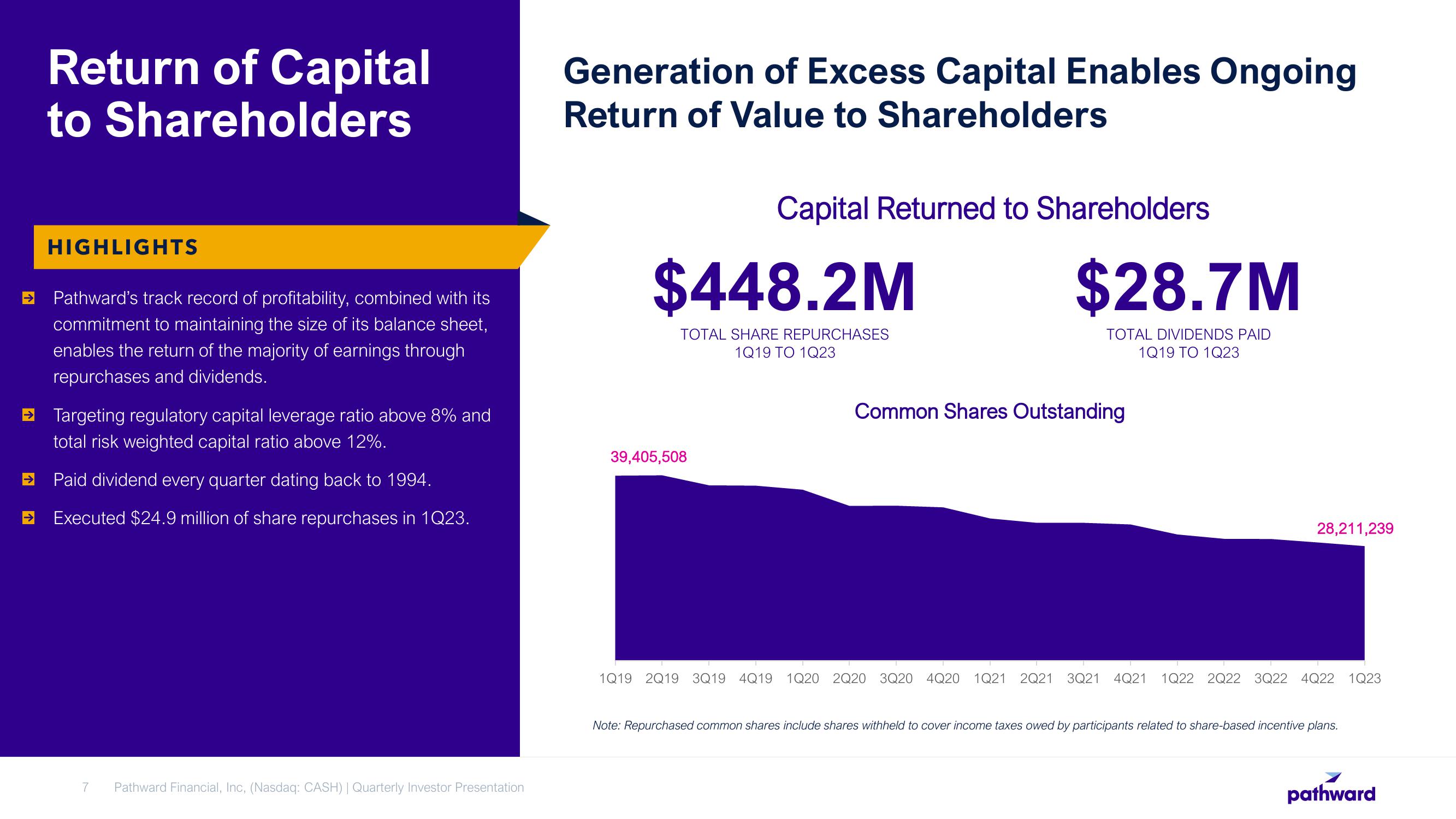

Pathward's track record of profitability, combined with its

commitment to maintaining the size of its balance sheet,

enables the return of the majority of earnings through

repurchases and dividends.

→ Targeting regulatory capital leverage ratio above 8% and

total risk weighted capital ratio above 12%.

Paid dividend every quarter dating back to 1994.

→ Executed $24.9 million of share repurchases in 1Q23.

7

Pathward Financial, Inc, (Nasdaq: CASH) | Quarterly Investor Presentation

Generation of Excess Capital Enables Ongoing

Return of Value to Shareholders

Capital Returned to Shareholders

$448.2M

TOTAL SHARE REPURCHASES

1Q19 TO 1Q23

39,405,508

$28.7M

TOTAL DIVIDENDS PAID

1Q19 TO 1Q23

Common Shares Outstanding

28,211,239

1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23

Note: Repurchased common shares include shares withheld to cover income taxes owed by participants related to share-based incentive plans.

pathwardView entire presentation