Wix Results Presentation Deck

2016 compared to 48% in 2015 and we continue to progress towards our

long-term target of 30%.

We are constantly optimizing our channel and geographic mix to drive faster

return on our marketing dollars. In Q3, we maintained our marketing efficiency

while still growing our investment 36% year over year, a significant

achievement. Our ability to increase our global marketing efforts while

remaining within our TROI target range is a testament to the increasing

efficiency of our direct response advertising, increased brand awareness and

the continued improvement in our product.

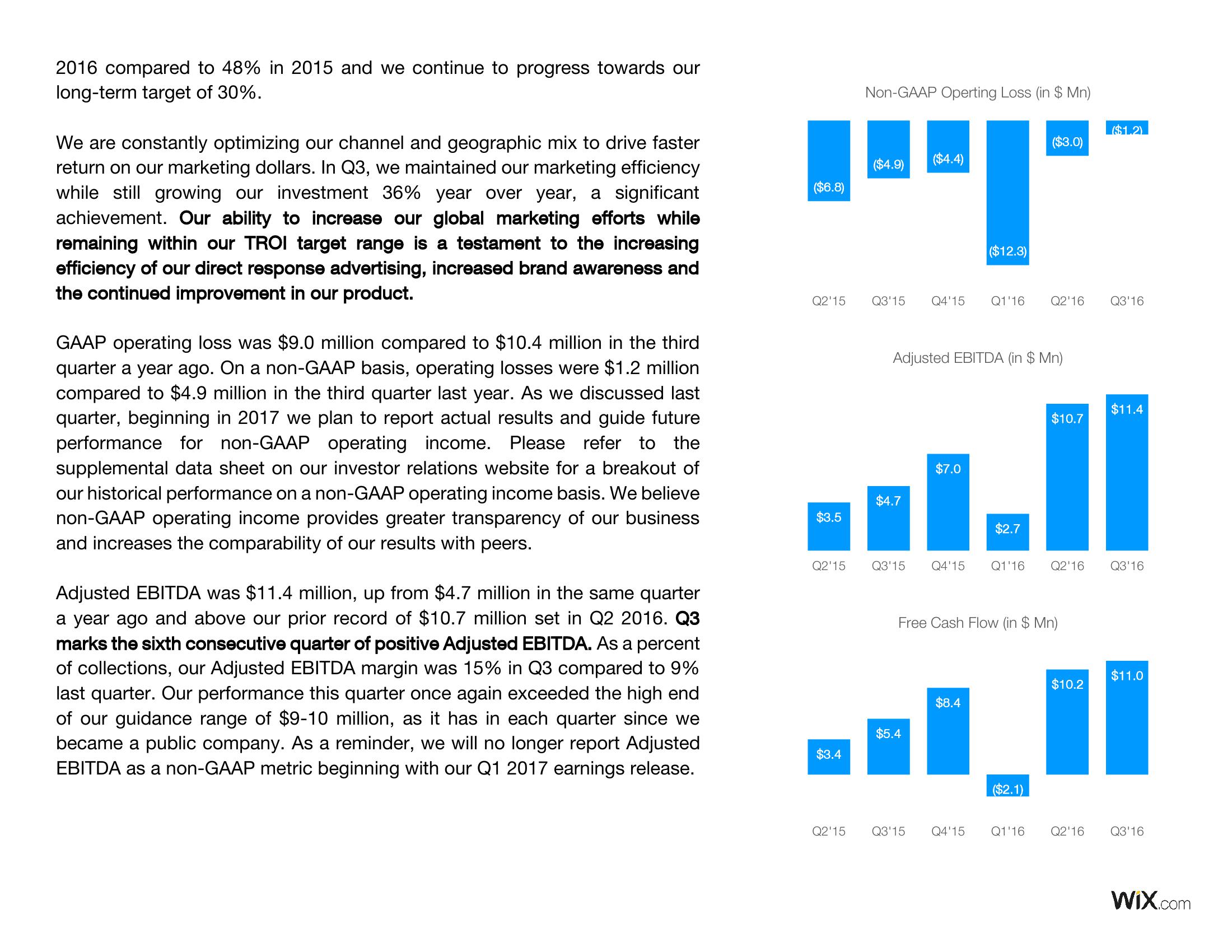

GAAP operating loss was $9.0 million compared to $10.4 million in the third

quarter a year ago. On a non-GAAP basis, operating losses were $1.2 million

compared to $4.9 million in the third quarter last year. As we discussed last

quarter, beginning in 2017 we plan to report actual results and guide future

performance for non-GAAP operating income. Please refer to the

supplemental data sheet on our investor relations website for a breakout of

our historical performance on a non-GAAP operating income basis. We believe

non-GAAP operating income provides greater transparency of our business

and increases the comparability of our results with peers.

Adjusted EBITDA was $11.4 million, up from $4.7 million in the same quarter

a year ago and above our prior record of $10.7 million set in Q2 2016. Q3

marks the sixth consecutive quarter of positive Adjusted EBITDA. As a percent

of collections, our Adjusted EBITDA margin was 15% in Q3 compared to 9%

last quarter. Our performance this quarter once again exceeded the high end

of our guidance range of $9-10 million, as it has in each quarter since we

became a public company. As a reminder, we will no longer report Adjusted

EBITDA as a non-GAAP metric beginning with our Q1 2017 earnings release.

($6.8)

$3.5

Non-GAAP Operting Loss (in $ Mn)

Q2'15

($4.9)

$3.4

Q2'15 Q3'15 Q4'15 Q1'16 Q2'16

($4.4)

($12.3)

Adjusted EBITDA (in $ Mn)

$7.0

..ll

$4.7

$2.7

Q3'15 Q4'15 Q1'16 Q2'16 Q3'16

$5.4

($3.0)

$8.4

Free Cash Flow (in $ Mn)

($2.1)

$10.7

$10.2

($1.2)

Q2'15 Q3'15 Q4'15 Q1'16 Q2'16

Q3'16

$11.4

$11.0

Q3'16

Wix.comView entire presentation