Blackwells Capital Activist Presentation Deck

■

■

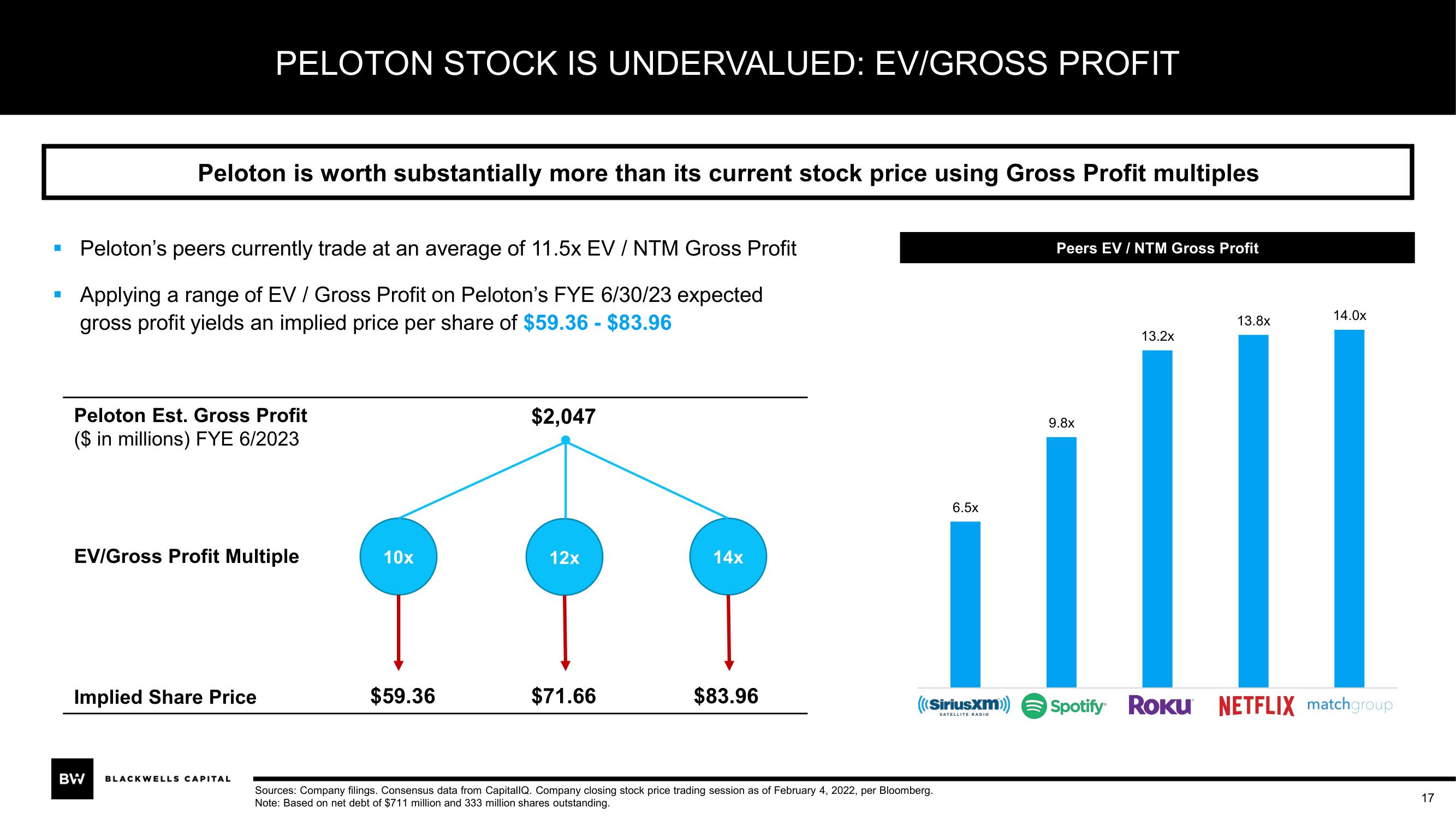

Peloton is worth substantially more than its current stock price using Gross Profit multiples

Peloton's peers currently trade at an average of 11.5x EV / NTM Gross Profit

Applying a range of EV / Gross Profit on Peloton's FYE 6/30/23 expected

gross profit yields an implied price per share of $59.36 - $83.96

PELOTON STOCK IS UNDERVALUED: EV/GROSS PROFIT

Peloton Est. Gross Profit

($ in millions) FYE 6/2023

EV/Gross Profit Multiple

Implied Share Price

BW

BLACKWELLS CAPITAL

10x

$59.36

$2,047

12x

$71.66

14x

$83.96

6.5x

(((Siriusxm)))

SATELLITE RADIO

Sources: Company filings. Consensus data from Capital IQ. Company closing stock price trading session as of February 4, 2022, per Bloomberg.

Note: Based on net debt of $711 million and 333 million shares outstanding.

Peers EV / NTM Gross Profit

13.8x

14.0x

13.2x

9.8x

||||

Spotify Roku NETFLIX matchgroup

17View entire presentation