WeWork Investor Presentation Deck

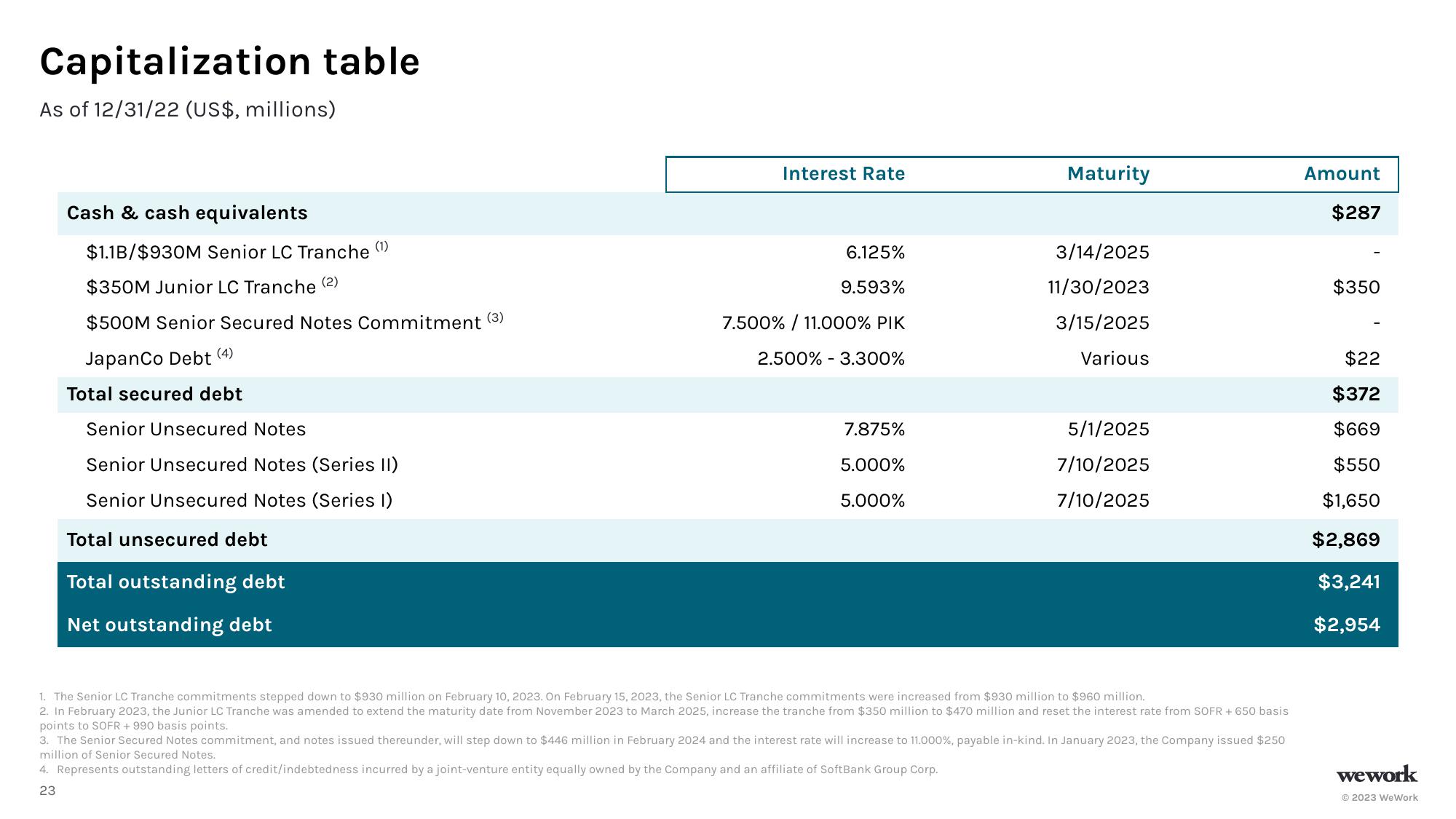

Capitalization table

As of 12/31/22 (US$, millions)

Cash & cash equivalents

$1.1B/$930M Senior LC Tranche (1)

$350M Junior LC Tranche (2)

$500M Senior Secured Notes Commitment (³)

JapanCo Debt

(4)

Total secured debt

Senior Unsecured Notes

Senior Unsecured Notes (Series II)

Senior Unsecured Notes (Series 1)

Total unsecured debt

Total outstanding debt

Net outstanding debt

Interest Rate

6.125%

9.593%

7.500% / 11.000% PIK

2.500% - 3.300%

7.875%

5.000%

5.000%

Maturity

3/14/2025

11/30/2023

3/15/2025

Various

5/1/2025

7/10/2025

7/10/2025

1. The Senior LC Tranche commitments stepped down to $930 million on February 10, 2023. On February 15, 2023, the Senior LC Tranche commitments were increased from $930 million to $960 million.

2. In February 2023, the Junior LC Tranche was amended to extend the maturity date from November 2023 to March 2025, increase the tranche from $350 million to $470 million and reset the interest rate from SOFR + 650 basis

points to SOFR +990 basis points.

3. The Senior Secured Notes commitment, and notes issued thereunder, will step down to $446 million in February 2024 and the interest rate will increase to 11.000%, payable in-kind. In January 2023, the Company issued $250

million of Senior Secured Notes.

4. Represents outstanding letters of credit/indebtedness incurred by a joint-venture entity equally owned by the Company and an affiliate of SoftBank Group Corp.

23

Amount

$287

$350

$22

$372

$669

$550

$1,650

$2,869

$3,241

$2,954

wework

© 2023 WeWorkView entire presentation