Long Duration Energy Storage Systems for a Cleaner Future

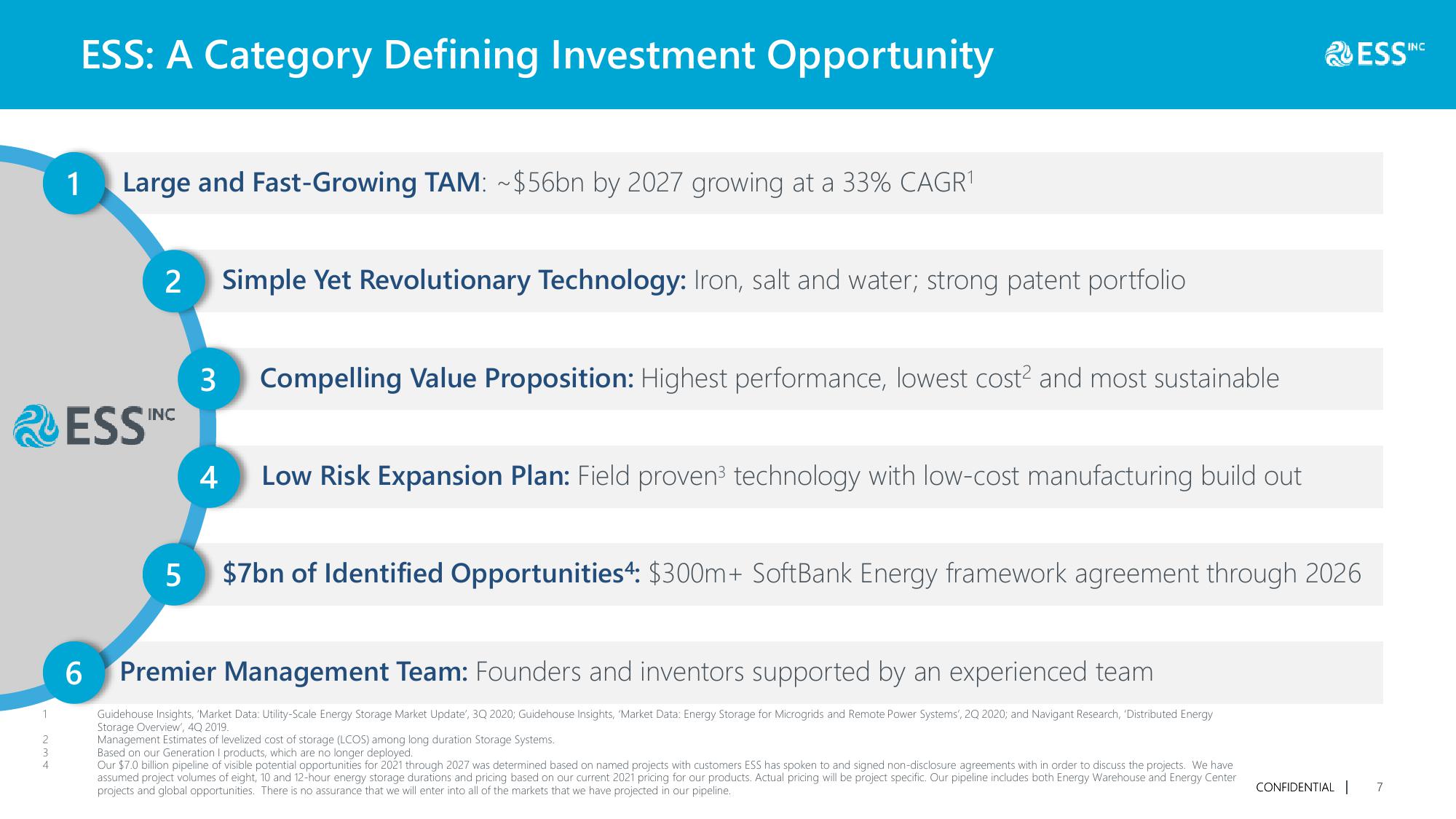

ESS: A Category Defining Investment Opportunity

1

Large and Fast-Growing TAM: ~$56bn by 2027 growing at a 33% CAGR¹

2

Simple Yet Revolutionary Technology: Iron, salt and water; strong patent portfolio

ESS INC

3 Compelling Value Proposition: Highest performance, lowest cost² and most sustainable

4 Low Risk Expansion Plan: Field proven³ technology with low-cost manufacturing build out

5

INC

RESSI

$7bn of Identified Opportunities: $300m+ SoftBank Energy framework agreement through 2026

1

234

6

Premier Management Team: Founders and inventors supported by an experienced team

Guidehouse Insights, 'Market Data: Utility-Scale Energy Storage Market Update', 3Q 2020; Guidehouse Insights, 'Market Data: Energy Storage for Microgrids and Remote Power Systems', 2Q 2020; and Navigant Research, 'Distributed Energy

Storage Overview', 4Q 2019.

Management Estimates of levelized cost of storage (LCOS) among long duration Storage Systems.

Based on our Generation I products, which are no longer deployed.

Our $7.0 billion pipeline of visible potential opportunities for 2021 through 2027 was determined based on named projects with customers ESS has spoken to and signed non-disclosure agreements with in order to discuss the projects. We have

assumed project volumes of eight, 10 and 12-hour energy storage durations and pricing based on our current 2021 pricing for our products. Actual pricing will be project specific. Our pipeline includes both Energy Warehouse and Energy Center

projects and global opportunities. There is no assurance that we will enter into all of the markets that we have projected in our pipeline.

CONFIDENTIAL|

7View entire presentation